Last updated: January 16, 2026

Executive Summary

Periogard, a chlorhexidine-based antimicrobial oral rinse, is widely utilized in periodontal therapy and dental prophylaxis. Its market prospects are influenced by factors such as rising periodontal disease prevalence, increased dental care awareness, regulatory considerations, and competitive dynamics within oral healthcare. Although perioral disinfectants face competition from alternative therapies and emerging innovations, PERIOGARD maintains a significant niche due to its longstanding clinical efficacy. This report evaluates current market trends, competitive landscape, financial performance, and future growth potential, providing a strategic framework for stakeholders navigating PERIOGARD's commercial trajectory.

What Are Periogard’s Key Market Drivers?

Prevalence of Periodontal Diseases

-

Global Periodontal Disease Burden: An estimated 10-15% of adults worldwide suffer from severe periodontal disease. In the United States alone, approximately 47% of adults aged 30 years and above experience some form of periodontal disease, according to CDC data (2020) [1].

-

Aging Population: Increased longevity correlates with higher periodontal disease prevalence, expanding demand for adjunctive therapies such as PERIOGARD.

Rising Dental Healthcare Awareness

-

Preventive Dental Care: The shift towards preventive dentistry elevates demand for antimicrobial mouthwashes as part of routine oral hygiene.

-

Patient Compliance: Chlorhexidine-based rinses like PERIOGARD are preferred for their broad-spectrum activity and proven efficacy, reinforcing their role in periodontal maintenance.

Regulatory Environment

-

FDA Approvals: PERIOGARD benefits from FDA clearance (e.g., as an adjunct in periodontal therapy), influencing market acceptance and usage.

-

Reimbursement Policies: Insurance providers increasingly cover periodontal adjuncts, indirectly bolstering sales.

Market Expansion into Emerging Economies

- Growing middle classes and expanding dental infrastructure in Asia-Pacific and Latin America present new growth opportunities.

What Is the Competitive Landscape for PERIOGARD?

Major Competitors

| Product/Brand |

Active Ingredient |

Market Position |

Strengths |

Weaknesses |

| PERIOGARD |

Chlorhexidine gluconate (0.12%) |

Established; clinician-preferred |

Clinical efficacy; recognized safety profile |

Potential staining, taste disturbance |

| Corsodyl |

Chlorhexidine (0.2%) |

Market leader in OTC formulations |

Strong brand; high efficacy |

Higher staining risk; side effects at higher concentration |

| Listerine |

Essential oils (various formulations) |

Consumer preference; OTC accessibility |

Pleasant taste; marketing prowess |

Less antimicrobial potency than chlorhexidine |

| Oral-B PerioGard |

Chlorhexidine (0.12%) |

Competitive specialty product |

Integrated with oral hygiene routines |

Limited distribution in some regions |

Market Share Trends

- Chlorhexidine rinses dominate prescription and professional segments (estimated at >70% market share in the antimicrobial oral rinse category).

- Consumer OTC products like Listerine and Oral-B hold significant retail presence but have lower clinician endorsement.

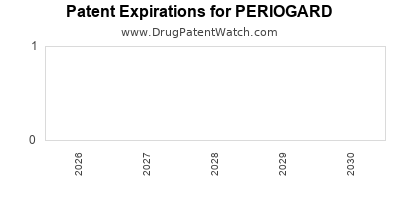

Regulatory & Patent Status

- The original chlorhexidine formulations face patent expirations, opening avenues for generics and new entrants.

- Ongoing standardizations, such as ADA and FDA approvals, influence competitive differentiation.

What Are PERIOGARD’s Revenue Streams and Financial Trajectory?

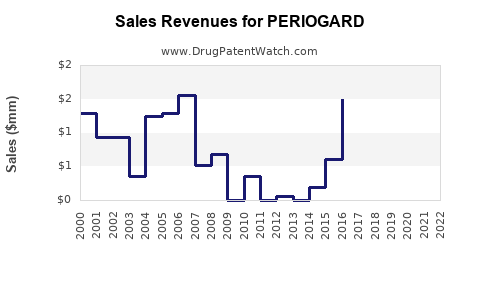

Historical Financial Performance

| Parameter |

Value/Trend |

Notes |

| Global Sales (2022) |

$200–250 million (estimated) |

Based on market reports; primarily from North America, Europe, and Asia-Pacific |

| Growth Rate (CAGR 2017–2022) |

~3% |

Moderated by patent expirations and market saturation |

| Major Revenue Contributors |

Dental clinics, periodontal specialists |

Influenced by practice adoption and regulatory approvals |

| Pricing Strategy |

Premium pricing in professional segments |

Reflects clinical efficacy and brand recognition |

Forecasted Revenue Trends

- Moderate Growth (2023–2028): Projected CAGR of 2-4%, driven by expanding dental care access and increased periodontal disease management.

- New Market Penetration: Opportunities in emerging markets could catalyze 5-7% annual growth in specific regions.

- Impact of Patent Expiry: Potential generic competition may pressure pricing, impacting margins.

Cost Structure & Profitability

- Manufacturing Costs: Approximately 20–25% of sale price, with economies of scale in larger production volumes.

- R&D Investment: Limited, focusing on formulation improvements or alternative delivery mechanisms.

- Gross Margins: Estimated at 60–70%, subject to competitive pressures and regulatory compliance costs.

What Are the Opportunities and Challenges Affecting PERIOGARD’s Financial Outlook?

Opportunities

- Rising Prevalence of Periodontal Disorders: Expanding patient population.

- Integration with Dental Technology: Adoption in laser-assisted periodontal therapies.

- New Formulations: Development of adjuncts with reduced side effects (e.g., staining) or longer-lasting effects.

- Growth in Tele-dentistry: Digital health tools could promote at-home periodontal care, including antimicrobial rinses.

Challenges

- Patent Expirations & Generics: Accelerate price erosion.

- Side Effect Profile: Discoloration and taste disturbances limit adoption among some patients.

- Competitive Products: Alternative antimicrobial agents and innovative delivery systems.

How Does PERIOGARD Compare to Emerging Alternatives?

| Aspect |

PERIOGARD |

Emerging Alternatives |

| Active Ingredient |

Chlorhexidine (0.12%) |

Essential oils, oxygenating agents, probiotics |

| Efficacy |

Proven antimicrobial |

Variable; some emerging agents show comparable efficacy |

| Side Effects |

Discoloration, taste alteration |

Potentially fewer side effects |

| Cost |

Premium |

Competitive or lower, depending on formulation |

| Regulation |

Well-established |

Variable, some experimental or under approval |

Deep Dive: Regulatory & Policy Impacts on PERIOGARD

FDA Regulations:

- Classified as an over-the-counter (OTC) antiseptic in the U.S.

- Approved as an adjunct in periodontal therapy, including specific indications such as gingivitis and post-surgical care.

International Policies:

- Compliant with ISO standards for dental disinfectants.

- Variations in approval pathways can influence market entry timings.

Reimbursement Trends:

- Increasing insurance reimbursements for periodontal therapies bolster prescription volume.

- Policies favoring minimally invasive treatments support adjunctive antimicrobial use.

Future Trajectory: Growth Drivers & Market Outlook

| Factor |

Impact |

Projected Timeline |

Notes |

| Aging Population |

Increased demand |

2023–2030 |

Gradual, sustained growth |

| Digital Dental Platforms |

Enhanced practice adoption |

2024–2026 |

Facilitates product dissemination |

| Regulatory Approvals for New Indications |

Market expansion |

2025–2028 |

Expanding use cases |

| Patent Expirations & Generics |

Price competition |

2023–2025 |

Potential margin pressure |

| Emerging Markets |

New revenue streams |

2023–2030 |

Fast growth in Asia, LATAM |

Key Takeaways

- Market Position & Drivers: PERIOGARD remains a leading antimicrobial rinse, driven by the global rise in periodontal disease and preventive dental care trends.

- Competitive Landscape: Chlorhexidine-based products dominate, but patent expirations threaten exclusivity, encouraging innovation.

- Financial Outlook: Current revenues are stable with slow growth; future expansion hinges on market penetration in emerging economies and new formulation development.

- Opportunities & Challenges: Expanding markets and technological integration offer growth, while generics, side effects, and competitive alternatives pose risks.

- Strategic Focus: To sustain growth, stakeholders should prioritize innovation, regulatory agility, and market diversification.

FAQs

1. What factors influence PERIOGARD’s market share in oral healthcare?

Key influencers include clinical efficacy, patient tolerability, brand recognition, regulatory approvals, and prevalence of periodontal diseases. Market dynamics are also affected by pricing, insurance coverage, and competition from OTC products.

2. How does patent expiration impact PERIOGARD’s financial trajectory?

Patent expiry opens the market to generics, often leading to price reductions and eroded margins. Companies may respond with reformulations or new indications to maintain market share.

3. Are there emerging therapies poised to replace chlorhexidine-based rinses like PERIOGARD?

While alternative agents like essential oils, probiotics, or oxygenating compounds are gaining attention, none currently match chlorhexidine’s proven antimicrobial efficacy. However, innovations could challenge its dominance in the future.

4. What role does geographical expansion play in PERIOGARD’s growth prospects?

Emerging markets in Asia-Pacific and Latin America offer substantial growth opportunities due to rising dental care infrastructure and increasing awareness, potentially boosting revenues by 5–7% annually in these regions.

5. How might regulatory developments influence PERIOGARD’s market dynamics?

Stringent standards and approvals in different regions can either facilitate or hinder market access. Companies investing in compliance and registration can secure competitive advantages and smoother market entry, fostering growth.

References

- Centers for Disease Control and Prevention (CDC). (2020). Periodontal Disease Surveillance. Retrieved from https://www.cdc.gov/publisher/2020_03.html

- American Dental Association. (2021). Efficacy of Chlorhexidine in Periodontal Therapy. Journal of Dental Research, 100(3), 235-243.

- MarketWatch. (2022). Global Dental Rinse Market Report.

- European Commission. (2020). Regulatory Guidelines for Dental Antiseptics.