Last updated: July 28, 2025

Introduction

Perforomist (formoterol fumarate inhalation solution) is a bronchodilator indicated for the maintenance treatment of patients with Chronic Obstructive Pulmonary Disease (COPD). Approved by the FDA in 2009, Perforomist belongs to the long-acting beta-agonist (LABA) class, a critical component in COPD management. Its market trajectory is shaped by evolving regulatory landscapes, competing therapies, unmet medical needs, and technological advancements. This report analyzes the current market dynamics influencing Perforomist’s commercial performance and projects its financial trajectory in a competitive pharmaceutical environment.

Market Overview

COPD remains a significant global health burden, with an estimated 200 million affected individuals worldwide [1]. The disease's progressive nature necessitates chronic management, positioning long-acting bronchodilators as cornerstone therapies. The COPD drug market is characterized by a competitive landscape with established multi-drug regimens, inhaler device innovations, and rapid adoption of new molecular entities.

Perforomist addresses a niche within this landscape, primarily used in patients requiring nebulized therapy, especially those with severe symptoms or who have difficulty with inhaler use. Its role complements other long-acting bronchodilators, including tiotropium, glycopyrrolate, umeclidinium, and combination inhalers like Fluticasone/Salmeterol.

Market Dynamics Impacting Perforomist

Regulatory Environment

Regulatory pathways for COPD therapies are well-established, yet recent trends favor fixed-dose combination inhalers due to improved adherence and convenience. While Perforomist maintains a stable approval status, competition from combination inhalers approved for similar indications pressures its market share [2].

FDA’s focus on demonstrating improved safety profiles and device innovation influences product differentiation strategies. The continued absence of a fixed-dose combination formulation for Perforomist limits its appeal amidst the shift toward simplified treatment regimens.

Competitive Landscape

Perforomist faces intense competition from both nebulized and inhaler-based therapies:

- Inhaler-based Long-Acting Muscarinic Antagonist/Long-Acting Beta-Agonist (LAMA/LABA) combinations — e.g., Umeclidinium/Vilanterol, Glycopyrrolate/Indacaterol (Yupelri).

- Fixed-dose inhalers — e.g., Fluticasone/Salmeterol, Umeclidinium/Vilanterol.

- Other nebulized therapies — Tiotropium bromide via Respimat, which enjoys higher market penetration owing to its established efficacy and convenience.

Perforomist’s niche remains largely in patients needing nebulized therapy, often in older, more severe COPD cases or institutional settings, limiting broader market penetration.

Technological and Formulation Advances

The shift toward combination therapies and novel device technologies influences Perforomist’s adoption. Innovative inhaler devices offering enhanced compliance are favored over nebulized solutions. Additionally, the emergence of triple therapy regimens (LABA/LAMA/ICS) further constrains Perforomist’s growth prospects unless integrated into combination forms or new delivery systems.

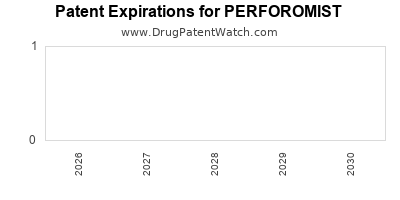

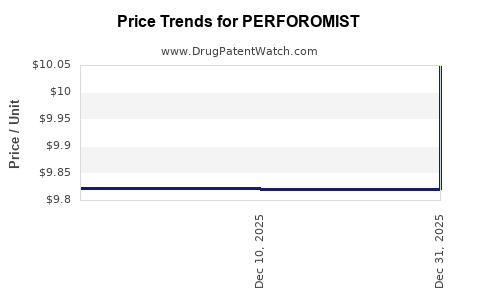

Pricing and Reimbursement

Pricing strategies significantly influence market access. Perforomist’s pricing remains competitive within nebulized therapies but faces pressure from generic inhaler formulations and insurance reimbursement frameworks favoring easier-to-administer devices with proven adherence benefits. Reimbursement policies favor inhalers, which threaten Perforomist’s adoption, especially in outpatient and home settings [3].

Patient Demographics and Disease Burden

The aging COPD patient population sustains demand for nebulized therapies, especially among those with mobility or coordination limitations. Hospitals, long-term care units, and home healthcare services are primary channels for Perforomist, insuring a steady, albeit niche, demand stream.

Financial Trajectory Projections

Historical Sales Performance

Since its approval, Perforomist’s sales have seen modest growth, primarily driven by institutional pulmonary markets. Reports indicate annual sales in the range of USD 50-70 million globally (e.g., 2021 figures), reflecting its limited but stable market position [4].

Forecasting Factors

- Market Penetration: Limited by competitive inhalers and the trend toward simplified, multi-drug inhaler therapies.

- Growth Opportunities: Comprised mainly of enhancing reach within institutional healthcare settings and expanding indications, such as in asthma or acute bronchospasm under future approvals.

- Pipeline and Innovation: Lack of current pipeline products or reformulations limits upside potential. Strategic development could alter trajectory if reformulated for combination inhalation or device innovation.

- Pricing and Reimbursement Trends: Increasing pressure for cost-effective treatments favors inhalers, likely capping sales growth.

- Geographic Expansion: Emerging markets with less penetrated COPD treatment regimens could present growth opportunities, though regulatory and pricing hurdles exist.

Projected Revenue Outlook

Based on current market conditions, annual sales of Perforomist are projected to grow modestly, at a CAGR of approximately 3-5% over the next five years, reaching USD 80-100 million by 2028. This conservative estimate accounts for market saturation in Western markets and emerging opportunities in underserved regions.

Potential catalysts for growth include:

- Introduction of next-generation nebulizers with improved device compatibility and patient compliance.

- Incorporation into combination regimens pending regulatory approval.

- Adoption in COPD management guidelines emphasizing nebulized bronchodilators for specific patient populations.

Conversely, aggressive device advancements and approval of newer fixed-dose inhalers pose headwinds that may limit further expansion.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Emphasize innovation in nebulizer technology and explore combination formulations to extend market relevance.

- Payers and Providers: Recognize the niche use cases where nebulized therapy remains preferable, ensuring reimbursement models support patient-centered care.

- Investors: Expect steady but limited revenue growth; prioritize companies with pipeline enhancements or broader COPD portfolios.

Key Takeaways

- Perforomist’s current market is niche-focused, largely constrained by competition from inhalers and evolving treatment paradigms.

- Regulatory trends favor combination therapies, which limits Perforomist's growth unless reformulated.

- Sales are projected to grow modestly, driven primarily by institutional use and segment-specific needs.

- Technological innovation, strategic repositioning, and geographic expansion could refine its financial trajectory.

- Stakeholders should monitor regulatory developments, device innovations, and market shifts toward simplified administration for optimal positioning.

FAQs

1. What are the primary factors limiting Perforomist’s market growth?

The shift toward fixed-dose inhalers, lack of combination formulations, and technological advancements in inhaler devices limit its broader adoption. Additionally, reimbursement and pricing pressures favor more convenient delivery methods.

2. How does Perforomist compare with other COPD therapies?

Perforomist offers nebulized delivery suitable for severe or certain patient populations, but inhaler-based long-acting bronchodilators generally provide superior convenience and adherence, leading to higher market prevalence.

3. Are there upcoming regulatory changes that could impact Perforomist?

While no immediate changes are anticipated, regulators continue to promote combination therapies and device innovations, which could influence future approval pathways and market strategies.

4. What growth strategies could enhance Perforomist’s financial trajectory?

Innovating with combination formulations, improving nebulizer technology, expanding into emerging markets, and integrating into triple therapy regimens represent potential growth avenues.

5. What is the outlook for Perforomist in the context of COPD treatment evolution?

Its niche positioning is likely to remain stable in the short term, with potential growth if technological or formulation innovations align with evolving treatment standards focused on patient adherence and simplified regimens.

References

[1] Global Initiative for Chronic Obstructive Lung Disease (GOLD). 2023 Report. https://goldcopd.org

[2] US FDA Drug Approvals. 2009, FDA.gov.

[3] MarketWatch. COPD drug market analysis report, 2022.

[4] IQVIA Sales Data. 2022.