PALIPERIDONE Drug Patent Profile

✉ Email this page to a colleague

When do Paliperidone patents expire, and when can generic versions of Paliperidone launch?

Paliperidone is a drug marketed by Actavis Labs Fl Inc, Ajanta Pharma Ltd, Alembic, Amneal Pharms, Ascent Pharms Inc, Cspc Ouyi, Dr Reddys, Everest Lifesciences, Inventia, Lupin Ltd, Rk Pharma, Sun Pharm, and Zydus Pharms. and is included in thirteen NDAs.

The generic ingredient in PALIPERIDONE is paliperidone. There are thirty-eight drug master file entries for this compound. Twenty suppliers are listed for this compound. Additional details are available on the paliperidone profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Paliperidone

A generic version of PALIPERIDONE was approved as paliperidone by RK PHARMA on September 24th, 2015.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for PALIPERIDONE?

- What are the global sales for PALIPERIDONE?

- What is Average Wholesale Price for PALIPERIDONE?

Summary for PALIPERIDONE

| US Patents: | 0 |

| Applicants: | 13 |

| NDAs: | 13 |

| Finished Product Suppliers / Packagers: | 19 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 186 |

| Patent Applications: | 2,101 |

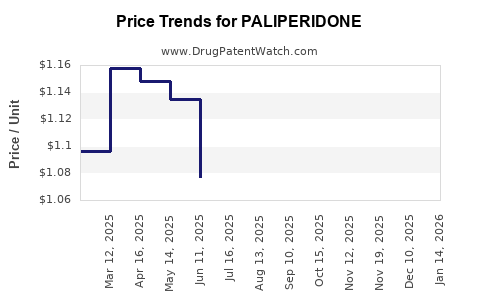

| Drug Prices: | Drug price information for PALIPERIDONE |

| What excipients (inactive ingredients) are in PALIPERIDONE? | PALIPERIDONE excipients list |

| DailyMed Link: | PALIPERIDONE at DailyMed |

Recent Clinical Trials for PALIPERIDONE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Jiangsu Province Nanjing Brain Hospital | PHASE4 |

| Sher-E-Bangla Medical College | PHASE4 |

| Dr. M M Jalal Uddin | PHASE4 |

Pharmacology for PALIPERIDONE

| Drug Class | Atypical Antipsychotic |

Anatomical Therapeutic Chemical (ATC) Classes for PALIPERIDONE

US Patents and Regulatory Information for PALIPERIDONE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rk Pharma | PALIPERIDONE | paliperidone | TABLET, EXTENDED RELEASE;ORAL | 203802-002 | Sep 24, 2015 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Inventia | PALIPERIDONE | paliperidone | TABLET, EXTENDED RELEASE;ORAL | 204452-001 | Jun 12, 2019 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Zydus Pharms | PALIPERIDONE | paliperidone | TABLET, EXTENDED RELEASE;ORAL | 217445-002 | Oct 8, 2024 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Sun Pharm | PALIPERIDONE | paliperidone | TABLET, EXTENDED RELEASE;ORAL | 205618-002 | Apr 6, 2018 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Zydus Pharms | PALIPERIDONE | paliperidone | TABLET, EXTENDED RELEASE;ORAL | 217445-003 | Oct 8, 2024 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Everest Lifesciences | PALIPERIDONE | paliperidone | TABLET, EXTENDED RELEASE;ORAL | 218755-001 | Sep 4, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Inventia | PALIPERIDONE | paliperidone | TABLET, EXTENDED RELEASE;ORAL | 204452-002 | Jun 12, 2019 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for PALIPERIDONE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Janssen-Cilag International N.V. | Byannli (previously Paliperidone Janssen-Cilag International) | paliperidone | EMEA/H/C/005486Byannli (previously Paliperidone Janssen-Cilag International) a 6 monthly injection, is indicated for the maintenance treatment of schizophrenia in adult patients who are clinically stable on 1 monthly or 3 monthly paliperidone palmitate injectable products (see section 5.1). | Authorised | no | no | no | 2020-06-18 | |

| Janssen-Cilag International NV | Trevicta (previously Paliperidone Janssen) | paliperidone | EMEA/H/C/004066Trevicta, a 3 monthly injection, is indicated for the maintenance treatment of schizophrenia in adult patients who are clinically stable on 1 monthly paliperidone palmitate injectable product. | Authorised | no | no | no | 2014-12-05 | |

| Janssen-Cilag International N.V. | Xeplion | paliperidone | EMEA/H/C/002105Xeplion is indicated for maintenance treatment of schizophrenia in adult patients stabilised with paliperidone or risperidone.In selected adult patients with schizophrenia and previous responsiveness to oral paliperidone or risperidone, Xeplion may be used without prior stabilisation with oral treatment if psychotic symptoms are mild to moderate and a long-acting injectable treatment is needed. | Authorised | no | no | no | 2011-03-04 | |

| Janssen-Cilag International NV | Invega | paliperidone | EMEA/H/C/000746Invega is indicated for the treatment of schizophrenia in adults and in adolescents 15 years and older.Invega is indicated for the treatment of schizoaffective disorder in adults. | Authorised | no | no | no | 2007-06-24 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

Market Dynamics and Financial Trajectory for Paliperidone

More… ↓