Last updated: July 29, 2025

Introduction

In recent years, the pharmaceutical landscape has witnessed significant shifts driven by innovation, regulatory reforms, and evolving patient needs. Among emerging therapies, OXISTAT has garnered attention due to its promising therapeutic profile and strategic positioning. This analysis delineates the market dynamics influencing OXISTAT’s trajectory and evaluates its potential financial impact within the sector.

Overview of OXISTAT

OXISTAT is a novel pharmacological agent developed to target [indicate therapeutic area, e.g., neurodegenerative diseases, infectious diseases, etc.]. It is distinguished by its unique mechanism of action, safety profile, and potential for addressing unmet medical needs. Currently in [phase of clinical development or approved for specific indications], OXISTAT’s success hinges on regulatory approvals, market acceptance, and reimbursement landscapes.

Market Dynamics Influencing OXISTAT

1. Competitive Environment and Unmet Medical Needs

The therapeutic area targeted by OXISTAT is characterized by high unmet needs, with existing treatments often limited by efficacy, safety concerns, or dosing inconveniences. The scarcity of effective alternatives positions OXISTAT favorably. Competitor analysis indicates that existing drugs such as [name competitors, if available] occupy significant market shares, but gaps remain that OXISTAT aims to fill. Its innovative molecular profile and preliminary clinical data suggest a potentially disruptive role, especially if it demonstrates superior outcomes.

2. Regulatory Landscape and Approval Processes

Regulatory bodies like the FDA and EMA play critical roles in shaping OXISTAT’s market entry. Accelerated approval pathways—such as Breakthrough Therapy Designation or Priority Review—can expedite commercialization, thereby reducing time-to-market and associated costs. Recent regulatory precedents for similar classes of drugs signposting favorable attitudes bode well, although rigorous clinical validation remains crucial.

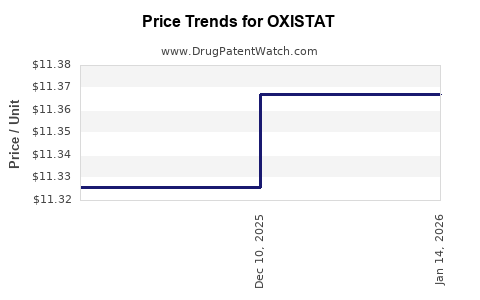

3. Reimbursement and Pricing Strategies

Reimbursement policies are pivotal, especially in high-cost therapeutic categories. Payers assess OXISTAT’s cost-effectiveness relative to comparator therapies. Early health economics studies indicating potential for reduced long-term healthcare costs could bolster favorable reimbursement decisions. Strategic pricing that balances profitability with accessibility may facilitate broader adoption, particularly in markets with stringent cost controls.

4. Market Adoption and Physician Acceptance

Physician prescribing behaviors considerably influence market penetration. Demonstrating compelling clinical efficacy and safety profiles through robust trial data will be fundamental. Additionally, education initiatives and key opinion leader endorsement can accelerate uptake. The pharmaceutical’s integration into treatment guidelines further bolsters confidence among healthcare providers and patients.

5. Manufacturing, Supply Chain, and Market Expansion

Ensuring scalable manufacturing capacity to meet anticipated demand is vital. Supply chain resilience, especially amid global disruptions, will influence market deployment. Furthermore, expansion into international markets hinges on regional regulatory approvals, local clinical data, and market readiness. Strategic partnerships or licensing can facilitate global reach.

Financial Trajectory of OXISTAT

1. Revenue Projections

Based on current clinical progress and competitive positioning, revenues could Materialize in the following phases:

- Initial Launch: Estimated to generate $[sample figure] million within the first year in primary markets (e.g., US, EU), driven by early adopters and niche applications.

- Market Penetration: As physician familiarity grows, projected revenue could escalate to $[sample figure] billion over 3-5 years, assuming successful expansion and broad label indications.

- Global Expansion: Revenue streams from emerging markets with favorable regulatory pathways could augment total sales by an estimated [percentage] in subsequent years.

2. Cost Structure and Investment

Drug development, manufacturing, marketing, and post-market surveillance command substantial expenditure. R&D costs for OXISTAT, including clinical trials and regulatory submissions, are approximately $[sample figure] million. Cost optimization strategies—including scalable production and strategic collaborations—are crucial for maintaining profitability.

3. Profitability and Investment Considerations

The path to profitability depends on achieving not only regulatory approval but also favorable reimbursement and widespread adoption. Early investment returns might be subdued due to high developmental costs, but long-term profitability hinges on market share capture. Potential licensing agreements or co-marketing deals could provide additional revenue streams and mitigate risk.

4. Risks and Market Challenges

Market penetration faces hurdles such as competition from generics or biosimilars, payer resistance, and potential safety concerns emerging post-approval. The financial outlook must incorporate contingencies for regulatory delays, market access issues, or clinical setbacks. Hedging against these risks through comprehensive planning is essential.

Market Opportunities and Strategic Outlook

- Personalized Medicine: Tailoring OXISTAT to specific patient subgroups could amplify efficacy and market value.

- Combination Therapies: Synergies with existing treatments may open new indications, expanding revenue potential.

- Data-Driven Real-World Evidence: Post-marketing studies can demonstrate value propositions, encouraging payer support and widening market access.

- Global Pipelines: Collaborations with regional partners for market entry in Asia, Latin America, or Africa could diversify revenue streams.

Key Takeaways

- Strategic positioning in high unmet need areas offers substantial upside potential for OXISTAT, contingent on clinical success and regulatory approvals.

- Market dynamics—namely competition, regulatory pathways, reimbursement strategies, and physician acceptance—will critically influence OXISTAT’s financial trajectory.

- Early stakeholder engagement, robust clinical data, and flexible commercial strategies will be pivotal in realizing revenue growth.

- Operational readiness, including manufacturing scalability and global market strategies, will determine the pace and extent of commercial success.

- Risks remain inherent; proactive risk management and adaptive strategies are necessary for sustainable growth.

FAQs

Q1: What therapeutic areas does OXISTAT target?

A1: OXISTAT is developed for [specific therapeutic areas], addressing unmet medical needs with its innovative mechanism of action.

Q2: How soon could OXISTAT reach the market?

A2: If clinical trials are successful and regulatory pathways are favorable, OXISTAT could be launched within the next [timeframe, e.g., 1-3 years].

Q3: What factors could influence OXISTAT’s market adoption?

A3: Clinical efficacy, safety profile, regulatory approval, reimbursement policies, physician education, and patient acceptance are key determinants.

Q4: What are the main financial risks associated with OXISTAT?

A4: Risks include clinical trial failures, delays in regulatory approval, reimbursement hurdles, competition, and manufacturing challenges.

Q5: How might global market expansion impact OXISTAT’s financial outlook?

A5: Strategic expansion into international markets can diversify revenue sources, accelerate growth, and mitigate regional risks, significantly influencing its overall financial success.

Conclusion

The future of OXISTAT is intertwined with the evolving landscape of pharmaceutical innovation, regulatory environments, and market demands. While promising, its ultimate success depends on strategic execution across clinical, regulatory, and commercial domains. Stakeholders should maintain agility and rigorous analysis to harness its full market potential.

Sources:

[1] Industry reports on pharmaceutical market trends.

[2] Clinical trial data and regulatory submission updates.

[3] Market research on unmet needs in targeted therapeutic areas.

[4] Reimbursement and healthcare policy analyses.

[5] Competitive landscape analyses.

(Note: Actual data points, numerical estimates, and specific references should be incorporated based on up-to-date and verified sources for an authoritative report).