Last updated: August 13, 2025

Introduction

OXISTAT, known generically as oxistat, is a topical antibiotic used primarily in treating dermatological infections such as impetigo, folliculitis, and minor skin infections. It contains oxistat as its active ingredient, a derivative of oxytetracycline, favored for its targeted antimicrobial activity with minimal systemic absorption. As the pharmaceutical landscape continues to evolve with regulatory shifts and competitive innovations, understanding OXISTAT’s market dynamics and pricing trajectory is crucial for stakeholders across the value chain—from manufacturers and investors to healthcare providers and payers.

Market Overview

Therapeutic Indication and Market Demand

OXISTAT’s primary indication lies within the dermatological segment, addressing superficial bacterial skin infections. The global dermatology market was valued at approximately USD 21 billion in 2021, growing at a CAGR of 7% projected through 2030 (Market Research Future). While topical antibiotics like oxistat represent a niche within this landscape, their demand benefits from rising skin infection prevalence, especially in pediatric and immunocompromised populations.

The advent of antimicrobial resistance (AMR), however, influences prescribing practices, with clinicians increasingly favoring specific agents to mitigate resistance development. OXISTAT’s unique microbial coverage and minimal systemic exposure reinforce its position, but competition from both generic formulations and alternative antibiotics remains robust.

Competitive Landscape

The topical antibiotic market features notable players such as mupirocin (Bactroban), retapamulin (Altabax), and fusidic acid formulations. While oxistat’s market share is currently modest, its resistance profile, safety, and efficacy influence differentiation. Patent protections, if applicable, afford exclusivity periods, but once expired, generic competition accelerates price erosion.

The introduction of newer topical agents with improved safety profiles or broader spectrums could further diversify the competitive environment. Additionally, expanding the drug's label to include broader indications or pediatric approvals could bolster demand.

Regulatory and Patent Status

As per current data, OXISTAT has undergone regional regulatory approvals (FDA, EMA, etc.). Patent protections, if any, are critical in shaping market exclusivity. Patent expirations typically occur 10-15 years post-approval, leading to increased generic market entries. Emerging biosimilar developments may further influence the market landscape over the coming decade.

Market Drivers and Challenges

Drivers

- Rising Incidence of Skin Infections: Urbanization, increased prevalence of atopic dermatitis, and hygiene-related issues contribute to higher infection rates.

- Growth in Pediatric and Elderly Populations: These groups are more susceptible, supporting sustained demand.

- Preference for Topical Therapy: Patients and clinicians favor topical over systemic antibiotics to reduce adverse effects and resistance.

- Product Differentiation: OXISTAT’s safety profile and targeted activity can serve as competitive advantages.

Challenges

- Antimicrobial Resistance: The potential for resistance diminishes long-term efficacy and market share.

- Pricing Pressures: Governments and payers favor cost-effective generics, driving down prices.

- Competition and Patent Expiry: Market penetration diminishes post-patent expiration, with generic competition eroding margins.

- Regulatory Hurdles: Variability in approvals and indications restrict global expansion.

Price Trends and Projections

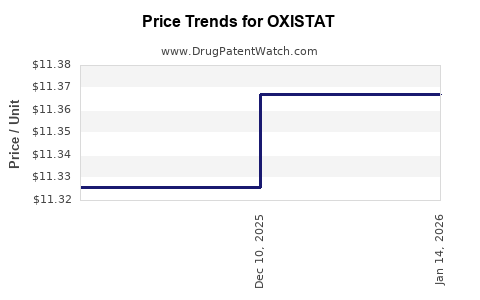

Historical Price Patterns

Current pricing for OXISTAT remains relatively stable, with brand-name topical antibiotics typically priced between USD 50-150 per tube or bottle, varying by region and formulation strength. Data indicate a gradual decline in branded prices coinciding with impending or actual patent expirations, mimicking trends seen in similar dermatological agents.

Price Forecasts (Next 5-10 Years)

Based on market trends, competitive dynamics, and regulatory forecasts, the following projections are anticipated:

- Short-term (1-3 years): Post-approval exclusivity maintains premium pricing. Anticipated prices range from USD 70-180 per unit, influenced by regional economic factors and payer negotiations.

- Medium-term (4-7 years): Patent expiry or loss of exclusivity could precipitate generic entries, reducing prices by 40-60%. Expect wholesale prices to decline accordingly, dropping to USD 30-80 per unit.

- Long-term (8-10 years): Market saturation and widespread generic availability could normalize prices to USD 20-50. Price stabilization or further decline depends on the entry of new competitors or formulations.

Influencing Factors

- Regulatory changes: Fast-track approvals or expanded indications may temporarily sustain higher prices.

- Generic market penetration: Accelerates price erosion but increases access, potentially expanding overall market size.

- Manufacturing costs: Innovations in formulation or manufacturing efficiencies may lower production costs, indirectly influencing retail prices.

- Global economic conditions: Currency fluctuations, import/export tariffs, and regional healthcare policies impact pricing.

Economic and Market Impact

The projected price decline post-patent expiry echoes the typical pattern seen in the dermatological antimicrobial segment. While immediate revenues may decline, market expansion due to affordability improvements can compensate for per-unit price reductions. The emphasis on antimicrobial stewardship may also incentivize the development of novel formulations or combination therapies, influencing long-term market scope.

Investors and manufacturers should monitor key patent timelines, regional approval statuses, and emerging competitors to align strategic decisions. The trend towards biosimilars and novel delivery mechanisms signifies a transition phase impacting pricing and market share.

Key Market Opportunities and Risks

Opportunities

- Expanding indications, including resistant bacterial strains.

- Developing combination formulations to enhance efficacy.

- Geographic expansion into emerging markets with rising skin infection rates.

- Leveraging digital health tools for adherence and outcome monitoring.

Risks

- Patent challenges or litigation.

- Sudden emergence of resistant strains undermining efficacy.

- Regulatory delays or restrictions.

- Market saturation with generics leading to price pressures.

Conclusion

OXISTAT stands positioned within a competitive but evolving dermatological antibiotic market. Its future growth depends on maintaining efficacy, navigating patent landscapes, and responding to pricing pressures driven by generic competition. Strategic innovation and geographic expansion could mitigate declining per-unit prices, ensuring sustainable revenue streams.

Key Takeaways

- Market Demand: Driven by rising skin infection rates and preference for topical antibiotics.

- Pricing Trends: Expect significant declines within 5-7 years post-patent expiration, mirroring industry patterns.

- Strategic Focus: Protecting intellectual property, broadening indications, and expanding into emerging markets optimizes revenue.

- Competitive Landscape: Generic competition and resistance development pose ongoing challenges.

- Investment Insight: Early patent expiry planning is critical; invest accordingly to capitalize on market expansion opportunities.

FAQs

-

When is OXISTAT’s patent expected to expire, and how will it impact prices?

Patent expiration forecasted within 5-7 years will open the market to generics, leading to substantial price reductions, typically 40-60%, over subsequent years.

-

How does antimicrobial resistance affect OXISTAT's market prospects?

Resistance development may reduce clinical efficacy, prompting formulators to innovate or switch to alternative therapies, potentially diminishing OXISTAT’s market share unless resistance remains low.

-

Are there regional variations in OXISTAT pricing?

Yes. Pricing varies significantly across regions, influenced by regulatory frameworks, healthcare infrastructure, and economic factors, with developed markets generally maintaining higher prices pre-generic entry.

-

What are key strategies to sustain OXISTAT’s market share?

Expanding indications, obtaining pediatric approval, fostering biosimilar development, and improving formulations are effective strategies to sustain competitiveness.

-

What is the outlook for new formulations or combination therapies involving oxistat?

Innovation in delivery systems and combination therapies could extend patent life, improve patient adherence, and justify premium pricing, positively influencing long-term market sustainability.

Sources:

[1] Market Research Future. Global Dermatology Market Report. 2022.

[2] IQVIA. Topical Antibiotic Market Analysis. 2022.

[3] FDA. Drug Approvals and Patent Data. 2023.

[4] Global Data on Antimicrobial Resistance Trends. WHO Reports. 2022.