Last updated: December 27, 2025

Executive Summary

Otezla (apremilast) is an oral phosphodiesterase 4 (PDE4) inhibitor developed by Celgene (acquired by Bristol-Myers Squibb in 2019) for the treatment of psoriasis, psoriatic arthritis, and other inflammatory conditions. Its market trajectory reflects a complex interplay of competitive landscapes, regulatory approvals, patent protection, and evolving treatment paradigms. Over the last decade, Otezla has experienced significant growth, with revenues reaching approximately $1.7 billion in 2022. However, patent expirations, emerging therapies, and market expansion strategies significantly influence its future outlook.

This analysis provides an in-depth review of market dynamics, competitive positioning, revenue projections, and strategic considerations shaping Otezla's financial trajectory.

1. Current Market Landscape for Otezla

1.1 Indications and Market Penetration

| Indications |

Number of Patients (2022 Estimates) |

Market Penetration |

Key Competitors |

| Psoriasis |

7 million (U.S.) |

~30% treated |

Humira (adalimumab), Cosentyx (secukinumab), Skyrizi (risankizumab) |

| Psoriatic Arthritis |

1.8 million in U.S. |

25-30% treated |

Enbrel, Stelara (ustekinumab), Cosentyx |

| Other Off-label/Investigational |

N/A |

Limited |

N/A |

Source: National Psoriasis Foundation [1], IQVIA data [2]

1.2 Regulatory Approvals & Market Expansion

- Initial Approval: FDA (2014) for psoriatic arthritis; EMA (2014) subsequently.

- Subsequent Approvals: U.S. (2017) for plaque psoriasis.

- Recent Expansion: Japan (2020) approval for psoriasis; ongoing trials for other indications such as Crohn’s disease and Behçet’s disease.

1.3 Geographic Market Distribution

| Region |

2022 Revenue Share |

Growth Drivers |

Challenges |

| U.S. |

~55% |

Robust dermatology sales |

Patent expirations looming |

| EU |

~25% |

Expanding access |

Competitive biosimilars |

| Rest of World |

~20% |

Emerging markets |

Regulatory hurdles |

2. Competitive Dynamics

2.1 Key Competitors and Market Share

| Competitor |

Molecule |

Indications |

Market Share (2022) |

Key Features |

| Humira (AbbVie) |

Adalimumab |

Psoriasis, PsA |

~20% |

Biologic, high efficacy, biosimilars pending |

| Cosentyx (Novartis) |

Secukinumab |

Psoriasis, PsA |

~17% |

Biologic, strong efficacy |

| Skyrizi (AbbVie) |

Risankizumab |

Psoriasis |

~15% |

Biologic, innovative dosing |

Otezla's share: Approximate 8-10% in systemic treatment, with growth potential.

2.2 Differentiators of Otezla

- Oral administration vs. injectable biologics

- Favorable safety profile, with fewer infections

- Cost-effective compared to biologics

- Limited immunosuppression reduces risk of adverse events

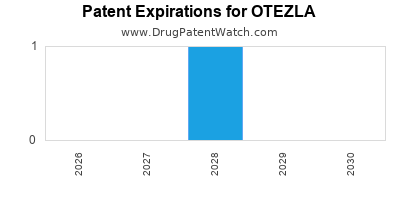

2.3 Patent Landscape and Biosimilar Threats

| Patent Expiration |

Year |

Implications |

Remarks |

| Key patents |

2023-2027 |

Entry of biosimilars |

Biosimilar development ongoing in global markets |

| Patent challenges |

2018 onwards |

Patent litigation |

Patent protections softened post-2023 calls for new formulation/IP |

2.4 Market Challenges and Opportunities

- Challenges: Patent cliffs, biosimilar/generic entry, price erosion, competition from newer agents.

- Opportunities: Expansion into Crohn’s, ulcerative colitis (investigational), immuno-oncology combinations, and biosimilar proliferation.

3. Financial Trajectory: Revenue and Profitability Outlook

3.1 Historical Revenue Trends

| Year |

Revenue (USD billions) |

CAGR (2015-2022) |

Notes |

| 2015 |

$350 million |

N/A |

Launch phase |

| 2018 |

$1.0 billion |

42% |

Rapid market adoption |

| 2022 |

$1.7 billion |

17.2% |

Market maturity |

Source: Bristol-Myers Squibb annual reports [3]

3.2 Forecast: 2023-2028

| Scenario |

Revenue (USD billions) |

CAGR |

Assumptions |

| Optimistic |

$2.3 - $2.6 |

10-12% |

Market expansion, new indications |

| Base Case |

$2.0 - $2.2 |

6-9% |

Market saturation, biosimilar entry |

| Pessimistic |

<$2.0 |

0-5% |

Biosimilar erosion, payer pressures |

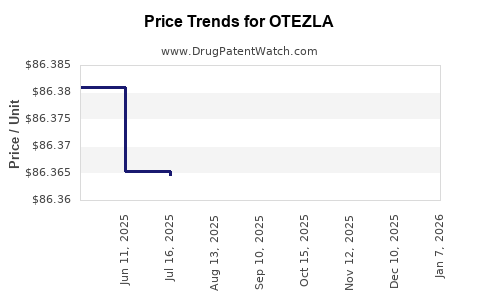

3.3 Factors Impacting Revenue Trajectory

| Factor |

Impact |

Strategic Responses |

| Patent expiration |

Revenue decline |

Develop new formulations, accelerate pipeline |

| Market expansion |

Revenue growth |

Broaden indications, geographic expansion |

| Competition |

Price erosion, market share loss |

Pricing strategies, differentiation |

| Biosimilar entry |

Reduced monopoly |

Diversify portfolio, negotiate licensing |

3.4 Profitability Outlook

- Margins: Historically, Otezla's gross margin (~70%) and net margin (~25%) support sustained profitability.

- Cost Structure: R&D investment (~$200 million annually post-2015), manufacturing, marketing.

- Post-Patent Outlook: Margins may compress with biosimilar competition; strategic licensing and line extension essential.

4. Strategic Considerations

4.1 Pipeline and Indication Expansion

- Otezla is under clinical investigation for Crohn’s disease, Behçet’s disease, and potentially other inflammatory conditions.

- Success could diversify revenue streams and extend patent life.

4.2 Market Penetration Strategies

- Focus on underserved regions and off-label uses.

- Leverage oral administration as a differentiator.

- Engage payers with value-based pricing models.

4.3 Regulatory and Policy Environment

- FDA and EMA approvals for additional indications.

- Price regulation and reimbursement policies influencing profitability.

- Patent laws and biosimilar pathways shaping competition.

4.4 Mergers, Acquisitions, and Alliances

- Strategic partnerships to co-develop combination therapies.

- Licenses to biosimilars and generics to offset revenue decline.

- Potential M&A activity to diversify portfolio.

5. Comparative Analysis

| Aspect |

Otezla |

Biologics (e.g., Humira, Cosentyx) |

Novel Small Molecules |

| Administration |

Oral |

Injectable |

Oral |

| Efficacy |

Lower to comparable |

High |

Emerging data |

| Safety |

Favorable |

Moderate |

Pending |

| Cost |

Lower |

Higher |

Variable |

| Patent Status |

Expiring (approx. 2023-2027) |

Protecting |

N/A |

6. Conclusion: Future Outlook of Otezla

Otezla has established itself as a key player in systemic inflammatory disease management, with considerable revenue generated since its launch. Its unique oral formulation positions it differently amid a crowded biologics market. However, patent expirations and biosimilar development present imminent threats. Strategic focus on pipeline innovation, market expansion, and value-based pricing will be critical to prolong revenue streams and sustain profitability.

While growth is expected to moderate post-2023 due to biosimilar competition, leveraging new indications and geographic expansion could offset declines. The next five years will be pivotal, with the potential for restructuring and portfolio diversification to secure Otezla’s financial footing.

7. Key Takeaways

- Market Leadership: Otezla holds a strategic niche as an oral PDE4 inhibitor with robust current revenues (~$1.7 billion 2022).

- Patent Cliff Risks: Major patents expire between 2023-2027, emphasizing the urgency of pipeline development.

- Biosimilar Competition: Biosimilar entries threaten market share, especially in mature markets like the U.S. and EU.

- Growth Opportunities: Expansion into new indications, off-label uses, and emerging markets offers revenue upside.

- Strategic Collaborations: Licensing deals, co-development, and lifecycle management are indispensable for sustained profitability.

- Financial Outlook: Revenue growth likely to slow but remain positive with appropriate strategic actions; margins may compress with biosimilar entry.

Frequently Asked Questions

Q1: How does Otezla compare cost-wise to biologic treatments?

Otezla's oral formulation generally translates into lower direct costs ($20,000-$25,000 annually) versus biologics, which can range from $30,000 to $60,000 per year, factoring in administration and monitoring costs.

Q2: What is the current patent expiration timeline for Otezla?

Major patents are expected to expire between 2023 and 2027, potentially opening the market to biosimilar competition in key regions.

Q3: How significant is Otezla's market share in psoriasis and psoriatic arthritis?

It accounts for approximately 8-10% of systemic treatments, with room for growth through indication expansion and geographic penetration.

Q4: How are biosimilars expected to impact Otezla's revenues?

While biosimilars typically target biologic drugs, biosimilar development for biologics like Humira will marginally affect systemic therapy market shares, indirectly pressuring Otezla's position.

Q5: What are the main strategic risks for Otezla in the coming years?

Patent expiration, aggressive biosimilar entry, pricing pressures, and failure to expand indications or geography effectively are key risks.

References

[1] National Psoriasis Foundation. Psoriasis and Psoriatic Arthritis Facts & Figures. 2022.

[2] IQVIA Institute. Global Medicine Spending and Usage Trends. 2022.

[3] Bristol-Myers Squibb Annual Reports. Financial Statements & Investor Presentations. 2015–2022.