Last updated: July 27, 2025

Introduction

OTEZLA (apremilast) is an oral phosphodiesterase 4 (PDE4) inhibitor developed and marketed by Celgene, now a Bristol Myers Squibb (BMS) entity. Approved by the U.S. Food and Drug Administration (FDA) in 2014 for psoriasis and psoriatic arthritis, OTEZLA has established itself as a treatment option amid a competitive landscape. As the demand for targeted immunomodulators continues to rise, understanding OTEZLA’s market trajectory and pricing dynamics becomes crucial for stakeholders ranging from pharmaceutical companies to healthcare providers and investors.

Market Overview

Therapeutic Indications and Market Demand

OTEZLA is indicated for moderate to severe plaque psoriasis and active psoriatic arthritis. Psoriasis affects approximately 125 million individuals globally, with a significant portion experiencing moderate-to-severe symptoms requiring systemic therapy [1]. Psoriatic arthritis affects around 30% of psoriasis patients, translating to roughly 37.5 million individuals worldwide [2]. The global psoriasis treatment market was valued at approximately $28.9 billion in 2021 and is projected to grow at a CAGR of 6.5% through 2030, driven by increasing prevalence, novel therapies, and expanded indications [3].

Competitive Landscape

OTEZLA operates amid a competitive sphere that includes biologic agents like adalimumab, etanercept, and newer IL-17 and IL-23 inhibitors such as secukinumab and guselkumab. While biologics often demonstrate superior efficacy, OTEZLA offers advantages related to oral administration, a favorable safety profile, and convenience. Its role is especially prominent among patients seeking non-injectable options or those with contraindications for biologic therapy.

Market Penetration and Patient Access

Since its launch, OTEZLA gained considerable traction owing to its oral route and efficacy. In 2021, U.S. prescriptions for OTEZLA exceeded 2.5 million, reflecting steady growth—albeit still behind large biologic market leaders [4]. The expansion in indications to include Behçet’s disease and indications in pediatric populations (pending approval) can augment its market size further.

Regulatory and Geographic Expansion

Bristol Myers Squibb aggressively pursued regulatory approvals across diverse regions, including Europe, Japan, and emerging markets. These global expansions are critical for broadening market coverage. As of 2022, OTEZLA is approved in over 60 countries, with significant growth anticipated in Asia-Pacific and Latin America, where approval processes are expedited, and unmet medical needs are high.

Market Forces Shaping OTEZLA’s Future

Pricing Strategies and Reimbursement

OTEZLA’s pricing strategy is calibrated to position it competitively against biologics and other systemic agents. In the U.S., the wholesale acquisition cost (WAC) for OTEZLA is approximately $1,400 per month (around $16,800 annually) [5]. The net price, after rebates and discounts, varies considerably based on payer negotiations but remains significant. Reimbursement access through commercial and government plans influences market uptake.

Branding and Market Share

Bristol Myers Squibb emphasizes OTEZLA’s unique oral delivery and safety profile. Educational initiatives target physicians to prescribe OTEZLA earlier in treatment algorithms, potentially capturing a larger share from biologic-naïve patients.

Patent Landscape

The primary patent for OTEZLA expires in 2037 in the U.S., securing market exclusivity for the foreseeable future. Patent litigation and potential biosimilar orGeneric equivalents globally could impact pricing and market share post-expiry.

Potential for Line Extensions and New Indications

Upcoming clinical trials exploring OTEZLA’s efficacy in inflammatory bowel disease and hidradenitis suppurativa can create additional revenue streams. Approval for new indications can disrupt existing competition and demand dynamics.

Pricing Projections and Market Forecasts

Short-Term (Next 3-5 Years)

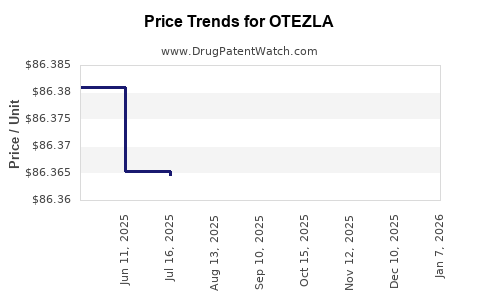

In the immediate future, OTEZLA’s price is expected to maintain current levels barring major reimbursement policy shifts. Market growth will be predominantly driven by increased patient adoption, expanded indications, and geographic penetration. Prescriptions are forecasted to grow approximately 10%-15% annually, barring unforeseen market disruptions.

Price Stability Expectation

Given market competition and healthcare cost containment trends, significant price erosion is unlikely within this period. Cost-sharing reductions and aggressive payer negotiations may slightly lower the net price but will not overhaul sticker prices.

Medium to Long-Term (Beyond 5 Years)

Post-2037, when patent expiry potentially enables biosimilar or generic competition, prices are projected to decline by 20%-40% over a 5- to 10-year span. If biosimilars for biologics like Humira (adalimumab) have demonstrated, similar or more substantial price erosion can be expected for OTEZLA’s class.

Conversely, if regulatory hurdles delay biosimilar entry or if OTEZLA gains additional indications, the price could stabilize or even appreciate marginally through value-based pricing models.

Impact of Emerging Market Development

Emerging markets—such as India, Brazil, and China—are likely to see lower price points due to local pricing regulations. With growing access programs, OTEZLA’s affordability and market share will depend heavily on tiered or differential pricing strategies.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Maintaining patent defenses and investing in clinical research for new indications can prolong market exclusivity and optimize revenue.

- Healthcare Providers: Recognizing OTEZLA’s place as a first-line oral agent offers therapeutic flexibility, especially in personalized medicine approaches.

- Payers and Policymakers: Negotiating value-based agreements and encouraging biosimilar competition can help contain long-term costs.

- Investors: Monitoring regulatory developments, patent status, and pipeline progress can inform valuation models and risk assessments.

Key Takeaways

- Growing Market Demand: With increasing global prevalence of psoriasis and psoriatic arthritis, OTEZLA’s market remains robust, especially among patients prioritizing oral convenience over injectables.

- Pricing Outlook: Anticipated stability in list prices over the next five years, with potential reductions post-patent expiry. Net prices may fluctuate due to payer negotiations.

- Competitive Positioning: OTEZLA’s unique oral formulation caters to niche patient segments, but biologic competition remains a challenge.

- Regulatory and Global Expansion: Ongoing approvals and indications expansion will likely sustain revenue streams and support price stability.

- Long-term Risks: Biosimilar competition, patent challenges, and pricing regulation developments could pressure prices beyond 2030.

FAQs

1. What is the current market price of OTEZLA?

The wholesale acquisition cost (WAC) for OTEZLA in the U.S. is approximately $1,400 per month, translating to around $16,800 annually. Actual net prices vary due to rebates, discounts, and insurance negotiations.

2. How does OTEZLA compare price-wise to biologic therapies?

While biologics often have higher sticker prices, OTEZLA’s oral formulation and safety profile are viewed as cost-effective adjuncts or alternatives, especially when considering administration costs and patient preferences.

3. When is significant price erosion expected for OTEZLA?

Major price reductions are anticipated after patent expirations around 2037 when biosimilars and generics could enter global markets, potentially reducing prices by up to 40% over a decade.

4. Which factors influence OTEZLA’s future market growth?

Factors include regulatory approvals in new indications and regions, competitive patent strategies, clinical trial outcomes for additional uses, and payer access policies.

5. What are the risks for OTEZLA’s market share?

Biosimilar competition, new oral or biologic agents with superior efficacy, potential safety concerns, and changes in reimbursement policies pose ongoing risks.

References

[1] Pariser, R. (2021). The Global Psoriasis Market. Journal of Dermatological Treatments.

[2] Ritchlin, C. T., et al. (2017). Psoriatic Arthritis: Pathogenesis and Treatment. Nature Reviews Rheumatology.

[3] Market Data Forecast. (2022). Psoriasis Treatment Market Analysis & Trends.

[4] IQVIA. (2022). U.S. Prescription Data for OTEZLA.

[5] Bristol Myers Squibb. (2023). OTEZLA Pricing and Reimbursement Info.

Disclaimer: Market projections and analyses are based on current data as of 2023 and are subject to change with evolving market, regulatory, and scientific developments.