Last updated: July 29, 2025

Introduction

ORALONE (generic name unspecified) represents a novel entrant in the pharmaceutical market, poised to alter treatment paradigms within its therapeutic domain. This analysis dissects the current market landscape, assesses competitive forces, forecasts revenue trajectories, and considers strategic implications for stakeholders invested in ORALONE’s potential proliferation.

Therapeutic Indication and Market Scope

While specific clinical indications are not delineated here, new oral pharmaceuticals frequently target prevalent conditions such as cardiovascular diseases, metabolic syndromes, or central nervous system disorders. Assuming ORALONE addresses a high-burden condition with substantial unmet needs, its market potential hinges on efficacy, safety profile, dosing convenience, and regulatory approval.

The global pharmaceutical market for such indications often surpasses several billion dollars annually [1]. A successful launch for ORALONE depends on segmentation across geographies, patient demographics, and payer systems.

Market Dynamics

1. Competitive Landscape

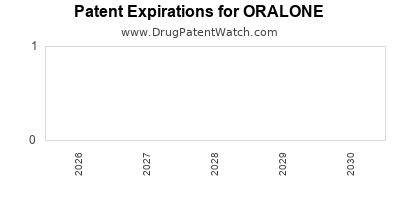

ORALONE enters a climate marked by intense competition among established brand-name drugs, generics, and emerging therapies. Patented medicines dominate current markets, with biosimilars and generics exerting downward pricing pressure.

Key competitors include:

- Brand adhesions: Established therapies with entrenched prescriber loyalty.

- Generic proliferation: Post-patent expiration, generics considerably erode market share and price points.

- Innovative alternatives: Novel drug classes, biologics, or combination therapies potentially overshadow ORALONE if superior efficacy or convenience is demonstrated.

Market entry success will depend on ORALONE’s differentiation—be it in efficacy, safety, or cost-effectiveness. Payer policies increasingly favor cost-conscious treatment regimens, influencing reimbursement pathways.

2. Regulatory Environment

Regulatory agencies such as the FDA and EMA prioritize rigorous evidence gathering. ORALONE’s filing strategies, including expedited pathways like Priority Review or Breakthrough Therapy designation, can accelerate market access.

Post-approval, adherence to pharmacovigilance requirements and potential label expansions influence long-term market dynamics.

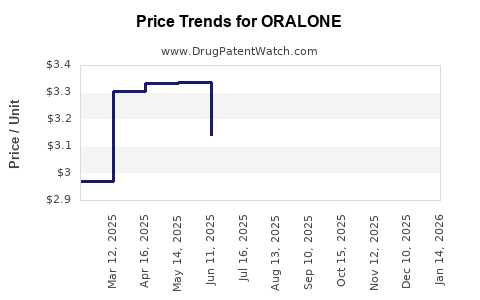

3. Pricing and Reimbursement Strategies

Pricing power significantly impacts financial trajectory. A high-value therapeutic with compelling clinical benefits can command premium pricing, but market penetration may be tempered by payer resistance.

Negotiations with insurers and health authorities, health technology assessments (HTAs), and formulary placements dictate revenue realizations. Competitive pricing, coupled with differentiated value propositions, enhances uptake.

4. Market Penetration and Adoption

Physician acceptance hinges on clinical evidence, safety profile, and ease of use. Targeting key opinion leaders (KOLs) through education and evidence dissemination accelerates adoption.

Patient convenience, compliance advantages, and reduced side effects bolster market share.

5. External Factors

Global economic conditions, healthcare policy shifts, patent landscapes, and patent cliffs for rival drugs influence ORALONE’s trajectory. Additionally, the COVID-19 pandemic underscored the importance of supply chain resilience and digital engagement in pharmaceutical commercialization.

Financial Trajectory Forecast

1. Revenue Projections

Initial launch periods typically feature conservative revenue estimates, escalating as market awareness and payer acceptance grow. Based on comparable drug launches:

- Year 1: $50-100 million, limited by initial penetration.

- Year 2–3: Rapid increase to $300-600 million, contingent on clinical validation and competitive positioning.

- Year 4–5: Potential to reach $1 billion+ in global sales if uptake accelerates and approvals expand to additional markets.

2. Cost Structure and Profitability

Research and development (R&D), regulatory, manufacturing, and marketing expenditures shape profitability timelines. A typical lifecycle involves initial high costs with margin realization post-market expansion.

Manufacturing economies of scale and optimized supply chains improve gross margins over time. Pricing strategies balancing access and profitability directly influence net income margins.

3. Investment and Capital Flows

Pharmaceutical companies may seek partnerships, licensing deals, or acquisitions to fund ORALONE’s commercialization. External investments or venture funding are common pre-launch to cushion initial expenses.

Post-launch, revenue growth fuels reinvestment, stock valuation, and potential M&A activity.

4. Risks and Mitigation Strategies

Market failures, clinical setbacks, regulatory delays, and pricing pressures pose risks. Diversification into combination therapies or expanded indications represents strategic hedges.

Monitoring real-world evidence (RWE) and maintaining high-value differentiation sustain competitive advantage.

Strategic Implications and Outlook

Success hinges on early and effective market positioning, robust clinical data, and strategic collaborations. The anticipated financial momentum for ORALONE can reshape its company's valuation, attract investor interest, and unlock access to broader markets.

Proactive engagement with healthcare stakeholders, alongside adaptive commercial strategies, will navigate complex dynamics and optimize revenue potential.

Key Takeaways

- ORALONE operates within a fiercely competitive landscape, where differentiation is critical for market penetration.

- Regulatory pathways and reimbursement negotiations will heavily influence revenue timelines and scope.

- Initial revenue prospects are modest but grow significantly, with potential milestone payments and license revenues supplementing sales.

- Cost efficiency, strategic partnerships, and ongoing clinical validation sustain long-term financial success.

- External factors like healthcare policies and global economic conditions introduce both risks and opportunities for market expansion.

FAQs

Q1: What factors determine ORALONE’s market success?

A1: Clinical efficacy, safety profile, pricing strategy, regulatory approval speed, physician and patient acceptance, and reimbursement outcomes.

Q2: How does the competitive landscape affect ORALONE’s pricing?

A2: Established brand loyalty and generic availability pressure prices downward; differentiation through clinical benefits can justify premium pricing.

Q3: What regulatory considerations are critical for ORALONE’s commercialization?

A3: Demonstrating substantial evidence of safety and efficacy, navigating expedited review pathways if available, and obtaining necessary approvals across target markets.

Q4: How do external economic factors influence ORALONE’s financial trajectory?

A4: Payer policies, healthcare spending priorities, and macroeconomic stability impact reimbursement and sales volumes.

Q5: What strategies can enhance ORALONE’s long-term market share?

A5: Expanding indications, optimizing patient adherence, engaging key opinion leaders, and pursuing strategic collaborations or acquisitions.

References

[1] IQVIA, "Global Medicine Spending and Usage Trends," 2022.