Share This Page

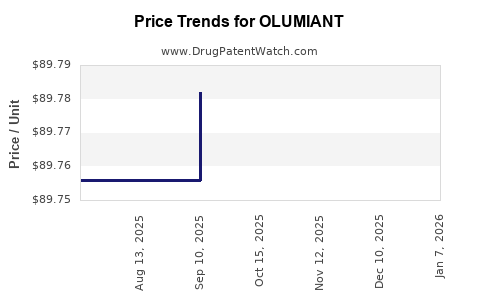

Drug Price Trends for OLUMIANT

✉ Email this page to a colleague

Average Pharmacy Cost for OLUMIANT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OLUMIANT 4 MG TABLET | 00002-4479-30 | 179.28381 | EACH | 2025-12-17 |

| OLUMIANT 2 MG TABLET | 00002-4182-30 | 89.60540 | EACH | 2025-12-17 |

| OLUMIANT 2 MG TABLET | 00002-4182-30 | 89.56818 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Olumiant (Baricitinib)

Introduction

OlumIANT (baricitinib) is a Janus kinase (JAK) inhibitor approved by the FDA for the treatment of rheumatoid arthritis and has garnered recent attention for its emergency use authorization for COVID-19. Its unique mechanism of action targeting inflammatory cytokine pathways positions it as a competitive therapeutic in inflammatory and autoimmune diseases. This report offers a comprehensive market analysis, examines current pricing strategies, explores future price projections, and discusses strategic implications for stakeholders.

Pharmacological Profile and Therapeutic Indications

Baricitinib, branded as OlumIANT by Eli Lilly, is classified as a selective JAK1/JAK2 inhibitor. It modulates immune response pathways implicated in rheumatoid arthritis and other autoimmune conditions. Based on recent clinical trials, its efficacy extends to COVID-19 management, specifically for hospitalized patients requiring supplemental oxygen, as authorized under Emergency Use Authorization (EUA) (FDA, 2021).

The drug’s approval timeline has positioned it within a competitive landscape of biologic and small-molecule therapies targeting inflammatory pathways. The expansion into COVID-19 treatment has further diversified its revenue streams, although initial adoption rates vary.

Market Size and Dynamics

1. Rheumatoid Arthritis (RA) Segment

The global RA therapeutics market was valued at approximately USD 28 billion in 2022, with anticipated growth driven by increasing prevalence, early diagnosis, and novel treatment options (Grand View Research, 2022). JAK inhibitors like OlumIANT represent a significant segment, capturing market share primarily from biologics due to shorter administration schedules and oral route preference among patients.

2. COVID-19 Therapeutic Market

The emergency authorization of baricitinib for COVID-19 expanded its usage beyond chronic autoimmune management. The COVID-19 therapeutic market is projected to reach USD 74 billion by 2027, with anti-inflammatory agents like JAK inhibitors contributing an estimated USD 4–6 billion annually by that time (Frost & Sullivan, 2022). However, the dynamic nature of the pandemic and evolving treatment protocols influence actual market penetration.

3. Competitive Landscape

OlumIANT competes with other JAK inhibitors such as tofacitinib (Xeljanz), upadacitinib (Rinvoq), and pacritinib. The competition intensifies with biologic DMARDs (Disease-Modifying Antirheumatic Drugs), including adalimumab and etanercept, which have established market footholds. Price sensitivity and patient preference for oral medications favor JAK inhibitors, but safety profiles influence competitive positioning.

Market Penetration and Adoption Trends

1. Rheumatology

In 2022, the adoption rate for OlumIANT in RA treatment remains steady but faces challenges from more established biologics and biosimilars. The oral administration benefits economic considerations, especially as biosimilars for biologics continue to decrease in price. However, safety concerns over adverse events, including infections and thromboembolic risks, constrain widespread uptake.

2. COVID-19 Treatment

The initial surge in baricitinib use for COVID-19 was driven by EUA approvals, with uptake varying across regions. As EUA adminsistrations expire or evolve, the future market depends on confirmatory trial outcomes and regulatory decisions. The integration of baricitinib into standard COVID-19 protocols depends on ongoing studies demonstrating benefit over existing therapies.

Pricing Strategies and Current Market Pricing

1. Rheumatoid Arthritis Indication

Eli Lilly’s pricing for OlumIANT in the US is approximately USD 2,500 per month per patient (GoodRx, 2023). This aligns with the typical range for JAK inhibitors, which often cost USD 2,000–3,000 monthly. Price discounts and rebates are common, especially in managed care plans, that influence net revenue.

2. COVID-19 Indications

During the emergency phase, government programs and institutional purchasing agreements resulted in lower prices or subsidized access. The prices for COVID-19 treatments vary significantly by region, often subsidized or negotiated for bulk procurement (WHO, 2021).

Future Price Projections

1. Factors Influencing Price Trajectory

- Patent life and biosimilar entry: OlumIANT’s exclusivity is expected to last until 2028-2030, after which generic competition will pressure prices downward.

- Market penetration: Increased adoption in RA could support sustained pricing, but biosimilar competition will inevitably lead to price erosion.

- Regulatory decisions: Positive results from ongoing trials for additional indications (e.g., alopecia, alopecia areata) could expand the market, potentially stabilizing or increasing prices in niche markets.

- Pandemic landscape: The COVID-19 market will diminish as newer treatments emerge, likely reducing revenues and exerting downward pressure on prices.

2. Projected Pricing Trends (2023-2030)

- Short-term (2023-2025): Prices are expected to remain stable at approximately USD 2,500/month, with rebates and patient assistance programs capably mitigating list price impact.

- Medium-term (2025-2028): Patent expiry could cause list prices to decline by 20–40%, aligning more with generic drug price benchmarks.

- Long-term (2028+): Entry of biosimilars will likely reduce prices by up to 70%, with list prices diminishing accordingly.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Maintaining competitive pricing while investing in new indications can safeguard market share amidst biosimilar competition.

- Healthcare Providers: Cost management strategies, including prior authorization and patient assistance programs, are essential for optimizing access.

- Payers and Insurers: Cost-effectiveness analyses will govern formulary placement; negotiated rebates could influence overall spend.

- Investors: Revenue growth hinges on market penetration, indication expansion, and the pace of biosimilar entry.

Key Takeaways

- OlumIANT's market prospects are robust within the autoimmune and emerging infectious disease sectors, yet competition, safety profiles, and patent life significantly influence future pricing.

- Current US retail prices for OlumIANT hover around USD 2,500/month; expect these to decline progressively post-patent expiry.

- The COVID-19 treatment market's volatility and eventual decline will shape short- to medium-term revenues, with long-term focus shifting to autoimmune indications.

- Expansion into additional indications and positive clinical trial outcomes could sustain or enhance pricing power.

- Strategic considerations include lifecycle management, biosimilar preparedness, and cost-effectiveness positioning in an increasingly competitive landscape.

FAQs

1. How does OlumIANT’s pricing compare to other JAK inhibitors?

OlumIANT’s USD 2,500/month fee is comparable to tofacitinib and upadacitinib, though pricing varies based on region, insurance negotiations, and patient assistance programs.

2. What factors could accelerate price declines for OlumIANT?

Introduction of biosimilars post-patent expiry and increased competition from alternative therapies are key drivers. Additionally, safety concerns may limit market share, pressuring prices.

3. Will COVID-19 treatment revenues sustain OlumIANT’s market?

Given the pandemic’s dynamic nature, revenue from COVID-19 indications is expected to decline as newer agents and vaccines take precedence.

4. Are there pricing differences internationally?

Yes. Many countries implement price controls, subsidies, or negotiated discounts, resulting in variable prices globally compared to the US.

5. What is the outlook for OlumIANT’s expansion into new indications?

Successful clinical trials for conditions like alopecia could broaden its market window, potentially supporting premium pricing in niche sectors.

References

- FDA. (2021). FDA Approves Baricitinib for COVID-19.

- Grand View Research. (2022). Rheumatoid Arthritis Therapeutics Market Size, Share & Trends.

- Frost & Sullivan. (2022). COVID-19 Therapeutic Market Outlook.

- GoodRx. (2023). OlumIANT Pricing.

- World Health Organization. (2021). Global Price Database for COVID-19 Treatments.

More… ↓