OFEV Drug Patent Profile

✉ Email this page to a colleague

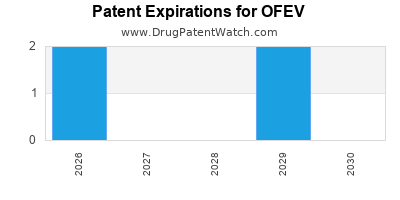

When do Ofev patents expire, and when can generic versions of Ofev launch?

Ofev is a drug marketed by Boehringer Ingelheim and is included in one NDA. There are four patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and ninety-seven patent family members in fifty-three countries.

The generic ingredient in OFEV is nintedanib esylate. There are nine drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the nintedanib esylate profile page.

DrugPatentWatch® Generic Entry Outlook for Ofev

Ofev was eligible for patent challenges on October 15, 2018.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be December 7, 2029. This may change due to patent challenges or generic licensing.

There have been two patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There is one tentative approval for the generic drug (nintedanib esylate), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for OFEV?

- What are the global sales for OFEV?

- What is Average Wholesale Price for OFEV?

Summary for OFEV

| International Patents: | 197 |

| US Patents: | 4 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 76 |

| Patent Applications: | 360 |

| Drug Prices: | Drug price information for OFEV |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for OFEV |

| What excipients (inactive ingredients) are in OFEV? | OFEV excipients list |

| DailyMed Link: | OFEV at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for OFEV

Generic Entry Date for OFEV*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Pharmacology for OFEV

| Drug Class | Kinase Inhibitor |

| Mechanism of Action | Protein Kinase Inhibitors |

Paragraph IV (Patent) Challenges for OFEV

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| OFEV | Capsules | nintedanib esylate | 100 mg and 150 mg | 205832 | 4 | 2018-10-15 |

US Patents and Regulatory Information for OFEV

OFEV is protected by four US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of OFEV is ⤷ Get Started Free.

This potential generic entry date is based on patent 9,907,756.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

Expired US Patents for OFEV

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Boehringer Ingelheim | OFEV | nintedanib esylate | CAPSULE;ORAL | 205832-001 | Oct 15, 2014 | 7,119,093 | ⤷ Get Started Free |

| Boehringer Ingelheim | OFEV | nintedanib esylate | CAPSULE;ORAL | 205832-002 | Oct 15, 2014 | 7,119,093 | ⤷ Get Started Free |

| Boehringer Ingelheim | OFEV | nintedanib esylate | CAPSULE;ORAL | 205832-001 | Oct 15, 2014 | 7,989,474 | ⤷ Get Started Free |

| Boehringer Ingelheim | OFEV | nintedanib esylate | CAPSULE;ORAL | 205832-002 | Oct 15, 2014 | 7,989,474 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for OFEV

When does loss-of-exclusivity occur for OFEV?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 2059

Patent: FORMA DE DOSIFICACION FARMACEUTICA EN CAPSULA QUE COMPRENDE UNA FORMULACION EN SUSPENSION DE UN DERIVADO DE INDOLINONA

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 09254548

Patent: Capsule pharmaceutical dosage form comprising a suspension formulation of an indolinone derivative

Estimated Expiration: ⤷ Get Started Free

Patent: 15227503

Patent: Capsule pharmaceutical dosage form comprising a suspension formulation of an indolinone derivative

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0913434

Patent: forma de dosagem farmacêutica em cápsula compreendendo uma formulação de um derivado de indolinona em supensão

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 26267

Patent: FORME POSOLOGIQUE PHARMACEUTIQUE EN CAPSULE COMPRENANT UNE FORMULATION EN SUSPENSION D'UN DERIVE D'INDOLINONE (CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 10001279

Patent: Forma de dosificacion que comprende 3-z-[1-(4-(n-((4-metil-piperazin-1-il)-metilcarbonil)-n-metil-amino)-anilino)-1-fenil-metileno]-6-metoxicarbonil-2-indolinona-monoetanosulfonato, un vehiculo lipidico, un espesante y un agente de deslizamiento/solubilizante, de grupos definidos.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2056598

Patent: Capsule pharmaceutical dosage form comprising a suspension formulation of an indolinone derivative

Estimated Expiration: ⤷ Get Started Free

Patent: 5193720

Patent: CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 80467

Patent: FORMA DE DOSIFICACION FARMACEUTICA EN CAPSULA QUE COMPRENDE UNA FORMULACION EN SUSPENSION DE UN DERIVADO DE INDOLINONA

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0180709

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 20533

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 99987

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 10010660

Patent: FORMA DE DOSIFICACIÓN FARMACÉUTICA EN CÁPSULA QUE COMPRENDE UNA FORMULACIÓN EN SUSPENCIÓN DE UN DERIVADO DE INDOLINONA

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 9996

Patent: КАПСУЛЯРНАЯ ЛЕКАРСТВЕННАЯ ФОРМА, СОДЕРЖАЩАЯ СУСПЕНЗИОННУЮ КОМПОЗИЦИЮ ПРОИЗВОДНОГО ИНДОЛИНОНА (CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE)

Estimated Expiration: ⤷ Get Started Free

Patent: 1001856

Patent: КАПСУЛЯРНАЯ ЛЕКАРСТВЕННАЯ ФОРМА, СОДЕРЖАЩАЯ СУСПЕНЗИОННУЮ КОМПОЗИЦИЮ ПРОИЗВОДНОГО ИНДОЛИНОНА

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 99987

Patent: FORME POSOLOGIQUE PHARMACEUTIQUE EN CAPSULE COMPRENANT UNE FORMULATION EN SUSPENSION D'UN DÉRIVÉ D'INDOLINONE (CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 39187

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 8954

Patent: צורת מינון רוקחית שהינה קפסולה המכילה הרכב תרחיפי של נגזרת אינדולינון (Capsule pharmaceutical dosage form comprising a suspension formulation of an indolinone derivative)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 61031

Estimated Expiration: ⤷ Get Started Free

Patent: 05542

Estimated Expiration: ⤷ Get Started Free

Patent: 11522812

Estimated Expiration: ⤷ Get Started Free

Patent: 14208712

Patent: インドリノン誘導体の懸濁液製剤を含むカプセル医薬投薬形態 (CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING SUSPENSION FORMULATION OF INDOLINONE DERIVATIVE)

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 99987

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 8930

Patent: CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 9229

Patent: FORMA DE DOSIFICACIÓN FARMACÉUTICA EN CÁPSULA QUE COMPRENDE UNA FORMULACIÓN EN SUSPENSIÓN DE UN DERIVADO DE INDOLINONA. (CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE.)

Estimated Expiration: ⤷ Get Started Free

Patent: 10013203

Patent: FORMA DE DOSIFICACION FARMACEUTICA EN CAPSULA QUE COMPRENDE UNA FORMULACION EN SUSPENSION DE UN DERIVADO DE INDOLINONA. (CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE.)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 385

Patent: شكل جرعات صيدلانية لكبسولة تتألف من صياغة مستعلقة من مشتقة الإيندولينون

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 3162

Patent: Capsule pharmaceutical dosage form comprising a suspension formulation of an indolinone derivative

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 99987

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 100254

Patent: FORMA DE DOSIFICACION FARMACEUTICA EN CAPSULA QUE COMPRENDE UNA FORMULACION EN SUSPENSION DE UN DERIVADO DE INDOLINONA

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 99987

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 99987

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 142

Patent: FARMACEUTSKI DOZNI OBLIK U VIDU KAPSULE KOJI SADRŽI FORMULACIJU SUSPENZIJE INDOLINON DERIVATA (CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 99987

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1007636

Patent: CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1725469

Estimated Expiration: ⤷ Get Started Free

Patent: 110017872

Patent: CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE

Estimated Expiration: ⤷ Get Started Free

Patent: 170020557

Patent: 인돌리논 유도체의 현탁 제형을 포함하는 캡슐 약제학적 투여 형태 (Capsule pharmaceutical dosage form comprising a suspension formulation of an indolinone derivative)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 69469

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 1002691

Patent: Capsule pharmaceutical dosage form comprising a suspension formulation of an indolinone derivative

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 10000558

Patent: CAPSULE PHARMACEUTICAL DOAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 4590

Patent: КАПСУЛИРОВАННАЯ ЛЕКАРСТВЕННАЯ ФОРМА, СОДЕРЖАЩАЯ СУСПЕНЗИОННУЮ КОМПОЗИЦИЮ ПРОИЗВОДНОЙ ИНДОЛИНОНА;КАПСУЛЬОВАНА ЛІКАРСЬКА ФОРМА, ЩО МІСТИТЬ СУСПЕНЗІЙНУ КОМПОЗИЦІЮ ПОХІДНОЇ ІНДОЛІНОНУ (CAPSULE PHARMACEUTICAL DOSAGE FORM COMPRISING A SUSPENSION FORMULATION OF AN INDOLINONE DERIVATIVE)

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 879

Patent: FORMA DE DOSIFICACIÓN FARMACÉUTICA EN CÁPSULA QUE COMPRENDE UNA FORMULACIÓN EN SUSPENSIÓN DE UN DERIVADO DE INDOLINONA

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering OFEV around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Netherlands | 300725 | ⤷ Get Started Free | |

| Poland | 355433 | ⤷ Get Started Free | |

| World Intellectual Property Organization (WIPO) | 2004017948 | ⤷ Get Started Free | |

| Croatia | P20190181 | ⤷ Get Started Free | |

| European Patent Office | 2281561 | Utilisation d'inhibiteur LCK pour le traitement d'affectations immunologiques (Use of LCK inhibitors for treatment of immunologic diseases) | ⤷ Get Started Free |

| Ukraine | 107560 | ФАРМАЦЕВТИЧНА ЛІКАРСЬКА ФОРМА ДЛЯ НЕГАЙНОГО ВИВІЛЬНЕННЯ ПОХІДНОЇ ІНДОЛІНОНУ | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for OFEV

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1830843 | C20150026 00160 | Estonia | ⤷ Get Started Free | PRODUCT NAME: NINTEDANIIB;REG NO/DATE: EU/1/14/979 19.01.2015 |

| 1830843 | 300747 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: NINTEDANIB, OF EEN TAUTOMEER, DE MENGSELS DAARVAN OF EEN ZOUT DAARVAN; IN HET BIJZONDER NINTEDANIBESILAAT; REGISTRATION NO/DATE: EU/1/14/979 20150115 |

| 1830843 | 92762 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: NINTEDANIB , OU UN TAUTOMERE, LES MELANGES OBTENUS OU UN DESES SELS, EN PARTICULIER NINTEDANIB ESILATE. FIRST REGISTRATION: 20150119 |

| 1830843 | PA2015025 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: NINTEDANIBUM; REGISTRATION NO/DATE: EU/1/14/979/001 - EU/1/14/979/004 20150115 |

| 1830843 | C 2015 026 | Romania | ⤷ Get Started Free | PRODUCT NAME: NINTEDANIB SAU UN TAUTOMER SAU AMESTECURI ALE ACESTORA SAU O SARE A ACESTORA, IN SPECIAL ESILAT DE NINTEDANIB; NATIONAL AUTHORISATION NUMBER: EU/1/14/979/001-004; DATE OF NATIONAL AUTHORISATION: 20150115; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/14/979/001-004; DATE OF FIRST AUTHORISATION IN EEA: 20150115 |

| 1224170 | 15C0024 | France | ⤷ Get Started Free | PRODUCT NAME: NINTEDANIB,SES TAUTOMERES ET SES SELS,EN PARTICULIER LES SELS PHYSIOLOGIQUEMENT ACCEPTABLES DE NINTEDANIB ET PLUS PARTICULIEREMENT L'ESILATE; REGISTRATION NO/DATE: EU/1/14/954 20141125 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for OFEV (Nintedanib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.