Last updated: July 28, 2025

Introduction

Obeticholic acid (OCA), a potent farnesoid X receptor (FXR) agonist, has garnered considerable attention within the pharmaceutical landscape since its initial approval for certain liver diseases. Its developmental and commercial journey exemplifies evolving market dynamics driven by unmet medical needs, regulatory decisions, and competitive innovations. This analysis explores the current market environment, anticipated financial trends, and influencing factors shaping the trajectory of OCA and its therapeutic class.

Therapeutic Indication and Market Landscape

Obeticholic acid gained FDA approval in 2016 for primary biliary cholangitis (PBC) in patients with an inadequate response to ursodeoxycholic acid (UDCA), fulfilling unmet needs in this rare, progressive liver disease [1]. Subsequently, OCA has been evaluated for nonalcoholic steatohepatitis (NASH), a prevalent and rapidly growing indication linked to the global rise in metabolic syndrome and obesity.

The NASH market, targeted by OCA in phase 3 trials, represents a multibillion-dollar opportunity due to the absence of FDA-approved pharmacotherapies explicitly indicated for NASH [2]. The complexity of NASH pathogenesis, coupled with the significant burden of liver-related morbidity and mortality, sustains high interest from pharmaceutical developers.

Market Dynamics

1. Regulatory and Clinical Development Factors

The regulatory landscape for OCA has been dynamic. The FDA initially granted accelerated approval for PBC based on surrogate endpoints, reflecting the urgent need for new therapies [3]. However, subsequent phase 3 trials for NASH, such as REGENERATE, have yielded mixed results—demonstrating histological improvements but raising questions about the clinical significance of endpoints used [4].

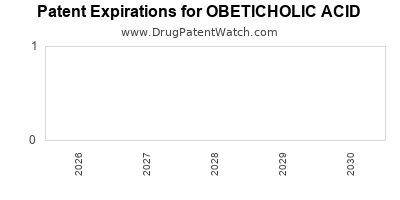

The outcomes of ongoing trials and regulatory authorities' responses will influence future approval pathways, reimbursement, and market access strategies. Moreover, potential patent expirations and exclusivity periods are critical for medtech firms planning long-term investments.

2. Competitive Environment

OCA operates in a competitive landscape filled with emerging NASH candidates, including triple-acting FXR, peroxisome proliferator-activated receptor (PPAR) modulators, and combination therapies. Companies such as Intercept Pharmaceuticals, Novartis, and Gilead Sciences are actively developing and commercializing NASH-related drugs, impacting OCA’s market share and pricing strategies [5].

3. Pricing, Reimbursement, and Market Access

Pricing strategies for OCA will be pivotal, especially in long-term chronic indications like NASH, where cost-effectiveness analyses influence reimbursement decisions. In PBC, where OCA gained approval, the drug was priced at a premium—reflecting its specialized use and clinical benefit. For NASH, high development costs and uncertain long-term benefits complicate pricing, potentially limiting reimbursement levels [6].

Reimbursement policies vary globally, with European and U.S. payers scrutinizing drug value propositions amid escalating healthcare costs. Achieving favorable formulary positioning requires robust clinical evidence and health economic data.

4. Patient Adoption and Physician Acceptance

Physician familiarity, patient eligibility, and safety considerations shape OCA’s market penetration. For PBC, the patient population is well-defined; however, in NASH, diagnostic complexities, disease heterogeneity, and safety concerns—such as pruritus and lipid profile alterations—pose adoption barriers. Educational initiatives and companion diagnostic tools could facilitate broader acceptance.

Financial Trajectory

1. Revenue Projections

In its initial years post-approval, OCA’s revenues for PBC indications reflected solid adoption, with intercept Pharmaceuticals reporting hundreds of millions in annual sales [7]. Yet, market saturation and competitive pressures have tempered growth trajectories.

For NASH, revenue forecasts hinge on successful trial outcomes, regulatory approvals, and market penetration. Industry analysts project peak sales potentially ranging from $1 billion to $3 billion annually, contingent on efficacy demonstrations, safety profiles, and payer acceptance [8].

2. Investment in R&D and Strategic Alliances

Significant R&D expenditure underpins the expansion strategy, notably for NASH pipeline development. The financial trajectory assumes ongoing investment in clinical trial expansion, biomarker development, and potential combination therapies.

Strategic partnerships with biotech firms and licensing agreements serve as catalysts for innovation and risk mitigation. These collaborations may influence revenue sharing, royalty payments, and commercialization rights.

3. Market Risks and Revenue Uncertainties

Key risks include unmet clinical endpoints, regulatory rejections or delays, safety concerns, and evolving competition. Additionally, healthcare policy reforms, drug pricing pressures, and shifting reimbursement policies could constrict revenue streams.

Future Outlook and Strategic Implications

The future market trajectory for OCA will heavily depend on clinical trial success, regulatory decisions, and competitive innovations. If NASH trials demonstrate significant clinical benefits and regulatory agencies grant full approvals, OCA could realize substantial revenues. Conversely, failure to meet primary endpoints or safety issues could limit indications and revenue prospects.

Pharmaceutical firms may pursue combination therapies integrating OCA with other agents, amplified by scientific advances in NASH pathophysiology, to broaden therapeutic efficacy and market share.

Key Takeaways

-

Market Expansion: While OCA’s established niche in PBC offers stable revenue, the primary growth driver lies in NASH, a lucrative but competitive space with high unmet need.

-

Regulatory and Clinical Outcomes: Success hinges on robust trial results and regulatory clarity, influencing approval and reimbursement prospects.

-

Pricing and Reimbursement: Market access depends on demonstrating long-term value through clinical and economic benefits, especially given the chronic nature of indications.

-

Competitive Pressures: Emerging therapies, combination strategies, and evolving biomarkers threaten to challenge OCA’s market share, requiring proactive positioning.

-

Investment and Innovation: Ongoing R&D, strategic alliances, and pipeline diversification are essential to capitalize on emerging opportunities and mitigate risks.

FAQs

1. What are the primary therapeutic indications for obeticholic acid?

Obeticholic acid is approved for primary biliary cholangitis and is under investigation for nonalcoholic steatohepatitis. Its efficacy in these areas depends on clinical trial outcomes and regulatory approval.

2. How does the regulatory landscape impact OCA’s market potential?

Regulatory decisions, including approvals, labeling, and post-marketing requirements, directly influence market access, reimbursement, and revenue streams, especially for complex indications like NASH.

3. What competitive factors influence OCA’s financial prospects?

Emerging therapies, combination treatments, and advancements in diagnostic tools intensify market competition, potentially reducing OCA’s monotherapy market share and revenue.

4. How do reimbursement policies affect OCA’s commercialization?

Pricing negotiations and health economic evaluations determine reimbursement levels, impacting patients’ access and overall profitability for manufacturers.

5. What strategic actions can augment OCA’s market success?

Investing in clinical research, forging strategic alliances, pursuing regulatory pathways, and engaging payers are critical to expanding OCA’s market footprint and financial returns.

References

- FDA approval of obeticholic acid for PBC

- NASH market overview and unmet needs

- FDA accelerated approval details

- REGENERATE trial analysis

- Competitive landscape in NASH therapies

- Pricing and reimbursement considerations

- Intercept Pharmaceuticals sales reports

- Market analysts’ revenue forecasts