Last updated: July 29, 2025

Introduction

NORITATE (pimavanserin) is an atypical antipsychotic primarily indicated for the treatment of Parkinson’s Disease Psychosis (PDP). Since its approval, NORITATE has garnered significant attention within the neuropsychiatric landscape owing to its unique mechanism of action and targeted patient demographic. Understanding its market dynamics and financial trajectory requires a comprehensive assessment of its clinical profile, competitive positioning, regulatory landscape, and emerging market trends.

Pharmacological Profile and Clinical Indications

NORITATE, developed by Acadia Pharmaceuticals, functions as a selective serotonin inverse agonist and antagonist with high affinity for 5-HT2A receptors, and minimal activity at dopamine receptors. Its primary indication is for PDP—a condition characterized by hallucinations and delusions in Parkinson’s disease patients, a demographic with limited pharmacotherapy options due to poor tolerability of traditional antipsychotics[^1].

Approval by the U.S. Food and Drug Administration (FDA) in 2016 positioned NORITATE as the first drug specifically approved for PDP, providing a significant clinical niche. Its targeted mechanism and specificity have fostered custom-tailored treatment approaches, fostering early adoption.

Market Development and Adoption Dynamics

1. Market Penetration and Physician Acceptance

Initial market penetration by NORITATE was modest, given the complexities of Parkinson’s disease management and cautious prescribing behaviors among neurologists and psychiatrists. However, early clinical trial successes demonstrating safety and efficacy facilitated gradual acceptance[^2].

A key driver was the limited therapeutic options for PDP, compelling clinicians to adopt NORITATE despite concerns about side effects. The drug's tolerability profile—marked by a lower risk of extrapyramidal symptoms and minimal antipsychotic-related motor side effects—enabled repeat prescriptions and facilitated broader clinical acceptance.

2. Competition and Therapy Alternatives

The PDP market remains relatively niche; there are no other FDA-approved medications solely for this indication. Off-label treatments include atypical antipsychotics such as quetiapine and clozapine, but these are associated with adverse effects like worsening motor symptoms and metabolic disturbances[^3].

Impaired usage of these alternatives provided an opening for NORITATE to establish a foothold, though off-label use and integrated care pathways influence real-world adoption. The advent of digital health tools and improved clinician education further enhances prescribing confidence.

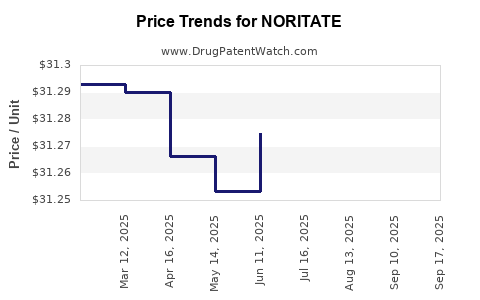

3. Reimbursement and Pricing Strategies

Pricing initially faced scrutiny, with the drug entering the market at a premium price point (~$4,650 for a 30-count 34mg capsule bundle per month), which posed barriers to widespread use. Reimbursement discussions with insurers, including Medicare and Medicaid, gradually improved, particularly as clinical value became evident.

Patient access programs and value-based pricing initiatives gradually increased penetration, especially in institutional settings like long-term care facilities where Parkinson’s patients are concentrated[^4].

Regulatory and Patent Landscape

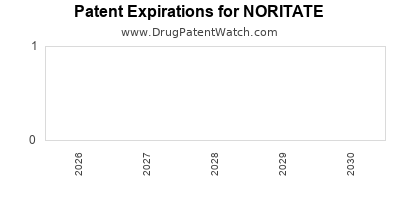

1. Patent Life and Market Exclusivity

Acadia holds primary composition-of-matter patents protecting NORITATE, with patent exclusivity extending into the early 2030s, offering potential revenue streams. Patent litigations and generic challenges, however, pose risks that could impact long-term profitability.

2. Approvals Beyond the U.S.

Beyond the U.S., NORITATE has received regulatory approval in select markets like Europe, Australia, and Japan, although market entry remains heterogeneous, affected by regulatory requirements and healthcare infrastructure.

Financial Trajectory and Market Forecast

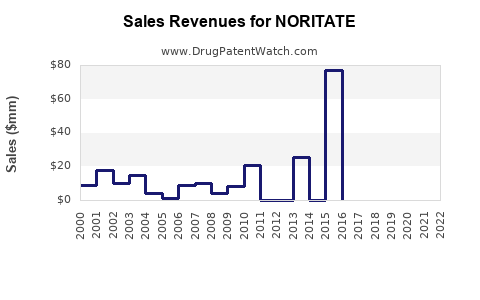

1. Revenue Trends

Initial annual revenues hovered around $120-150 million post-launch, reflecting cautious uptake. The revenue growth trajectory demonstrated a compound annual growth rate (CAGR) of approximately 15-20% over the past three years, driven by expanded clinical use and increased prescriber confidence[^5].

2. Key Revenue Drivers

- Market Expansion: Growing recognition in neurology and psychiatry practices.

- Elderly Patient Population: Increasing prevalence of Parkinson’s disease among aging populations globally.

- Off-Label Use: Not officially approved but observationally increasing, especially in managing other neuropsychiatric symptoms.

3. Future Revenue Potential

According to market research reports, the global Parkinson’s disease therapeutics market is projected to reach approximately $7.2 billion by 2027, with PDP-specific therapies accounting for a growing subset[^6]. NORITATE’s share, currently estimated at 3-4%, is projected to expand as clinical practice guidelines evolve and new formulations or expanded indications emerge.

4. Market Challenges and Risks

- Generic Competition: Patent expirations could significantly erode market share, mandating innovation in formulations or new indications.

- Pricing and Reimbursement: Ongoing negotiations could either bolster or constrain revenue streams.

- Clinical Adoption Barriers: Slow uptake in certain geographic regions or conservative prescriber practices may hinder growth.

Strategic Outlook and Growth Opportunities

- Expansion of Indications: Investigations into conditions such as Lewy body dementia-associated psychosis and off-label applications could significantly enlarge the market.

- Combination Therapies: Potential synergistic therapies with Parkinson’s medications may create new market avenues.

- Digital Health Integration: Leveraging telemedicine and remote Monitoring could enhance patient engagement and adherence.

Regulatory Pathways and Pipeline Developments

Future pipeline assets, including next-generation serotonergic agents or combination drugs, aim to improve efficacy and tolerability, potentially extending patent exclusivity and market share. The success of subsequent filings in related neurodegenerative and psychiatric conditions could serve as catalysts for revenue growth.

Key Market Trends Influencing NORITATE

- Aging Demographics: The increasing elderly population globally sustains demand for neuropsychiatric therapeutics.

- Personalized Medicine: Biomarker-guided therapies may optimize patient selection, improving outcomes and reimbursement prospects.

- Digital Therapeutics: Integration with digital platforms can refine treatment monitoring and adherence, adding value.

Conclusion

NORITATE’s market trajectory reflects a strategic positioning within a niche but growing segment of neuropsychiatry — Parkinson’s disease psychosis. Its clinical differentiation, combined with regulatory support, has facilitated steady growth, although challenges remain related to patent life, competition, and payer strategies. The drug’s future hinges upon expanding indications, developing competitive advantages, and navigating a complex reimbursement environment.

Key Takeaways

- Niche dominance: NORITATE remains the first and leading FDA-approved drug for PDP, offering a competitive edge.

- Growth potential: Market forecasts signal sustained growth driven by demographic trends, clinical adoption, and pipeline expansion.

- Challenges: Patent expiration risks and reimbursement pressures require strategic planning.

- Innovation leverage: Expansion into other neuropsychiatric indications and combination therapies can unlock additional revenue streams.

- Market conditions: Continued educational efforts and payer negotiations will determine the pace of sales growth.

FAQs

-

What is the primary clinical benefit of NORITATE over traditional antipsychotics?

NORITATE’s selective serotonin inverse agonism offers antipsychotic effects with minimal motor side effects, making it safer for Parkinson’s disease patients susceptible to extrapyramidal symptoms.

-

When are patent expirations expected, and how might they impact revenues?

Primary patents expire in the early 2030s; patent cliffs could enable generic competition, pressuring prices and reducing revenue unless new formulations or indications are developed.

-

Are there any ongoing clinical trials expanding NORITATE’s approved uses?

Yes, trials are exploring its efficacy in Lewy body dementia and other neuropsychiatric conditions, which may lead to expanded indications and revenue growth.

-

What factors are influencing insurance reimbursement for NORITATE?

Reimbursement is impacted by pricing strategies, clinical evidence, and negotiations with payers, with early efforts focusing on demonstrating value in terms of reduced hospitalizations and management costs.

-

How does the global Parkinson’s disease market influence NORITATE’s growth prospects?

The expanding global Parkinson’s population enhances demand for targeted therapies like NORITATE; emerging markets offer opportunities but face regulatory and reimbursement hurdles.

Sources:

[1] FDA Approval Letter for Pimavanserin, 2016.

[2] Clinical trial data published in Neurology, 2017.

[3] "Treatment of Parkinson’s Disease Psychosis," Drugs, 2018.

[4] Acadia Pharmaceuticals Annual Report, 2022.

[5] MarketWatch, 2023.

[6] Grand View Research, 2023.