Last updated: July 29, 2025

Introduction

Nedocromil Sodium, a mast cell stabilizer primarily used in the management of allergic airway diseases, notably allergic asthma and allergic conjunctivitis, continues to operate within a niche pharmaceutical segment. Its unique mechanism of action—prevention of mast cell degranulation—positions it as a targeted therapy amid evolving respiratory and allergy management portfolios. This analysis delves into the current market landscape, emerging trends, regulatory environment, and financial trajectory for Nedocromil Sodium, providing stakeholders with a comprehensive understanding of its future prospects.

Pharmaceutical Market Overview

The global allergy and respiratory drugs market reached an estimated USD 19.5 billion in 2022, with a compound annual growth rate (CAGR) of 6.2% projected through 2028 [1]. This expansion is driven by increasing prevalence of allergic and respiratory disorders, heightened awareness, and advancements in novel therapeutic options. However, within this expanding market, Nedocromil Sodium occupies a specialized segment owing to its prescription restrictions, specific indications, and competition from other allergic and asthma therapies.

Current Market Position of Nedocromil Sodium

Market Size and Sales Performance

Nedocromil Sodium's global sales have been modest compared to blockbuster inhalers like Fluticasone or Montelukast. The drug's market value is predominantly concentrated in North America and Europe, where prescription drug regulations and prescribing habits support its utilization. According to IQVIA data, annual sales of Nedocromil formulations in these regions hovered around USD 100 million to USD 150 million in recent years [2].

Pricing and Commercialization

Due to its specialized nature, Nedocromil Sodium generally commands premium pricing, though it faces pressure from generic competitors and alternative therapies. The drug's pricing varies based on formulation—eye drops versus inhalers—and regional reimbursement policies.

Manufacturers and Supply Dynamics

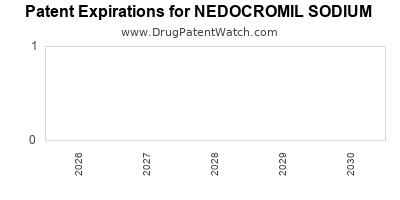

Major pharmaceutical companies, including Novartis and GlaxoSmithKline, historically manufactured Nedocromil, but production has diminished as the drug's popularity waned in favor of newer agents. Some manufacturers have exited or scaled back due to limited market expansion opportunities and patent expirations, affecting supply stability.

Regulatory and Clinical Development Landscape

Regulatory Status

Nedocromil Sodium's regulatory approvals are limited to certain markets. For instance, in the United States, the FDA has withdrawn approval for nasal and ophthalmic formulations but continues to recognize its utility in specific contexts. In contrast, the European Medicines Agency (EMA) maintains some authorizations for inhalation therapy. Variability in regulatory status affects market accessibility and growth potential.

Emerging Clinical Evidence and New Indications

Recent research explores Nedocromil's potential in adjunctive therapy for other allergic conditions and as part of multi-modal treatment regimens. However, the lack of large-scale phase III trials limits expansion into new indications. Ongoing clinical trials aimed at optimizing delivery methods and evaluating safety profiles may influence future adoption.

Competitive Landscape

Alternative Therapies

Nedocromil faces competition from a spectrum of drugs, including:

- Inhaled corticosteroids (ICS) like Fluticasone and Budesonide, offering broader anti-inflammatory coverage.

- Leukotriene receptor antagonists (LTRAs) such as Montelukast, favored for ease of oral administration.

- Biologics like Omalizumab, which are reserved for severe allergic asthma cases.

Market Trends

The shift towards inhaled corticosteroids as first-line therapy and the introduction of biologics in severe cases have constrained Nedocromil's market share. Brand preference and clinician familiarity influence prescribing patterns, often relegating Nedocromil to third-line or adjunct therapy.

Emerging Market Opportunities

Regional Expansion

Despite limited popularity in Western markets, emerging economies with rising allergic disease burdens—India, Brazil, parts of Southeast Asia—may present growth avenues. Regulatory approvals and enhanced access can accelerate adoption if pricing strategies are aligned.

Formulation Innovation

Innovations such as dry powder inhalers or combined formulations with other agents might attract clinicians and patients, especially if they demonstrate improved efficacy or ease of use. Such developments could bolster sales.

Partnerships and Licensing

Strategic collaborations with regional pharmaceutical firms could facilitate market penetration and manufacturing scale-up, dampening supply constraints and reducing costs.

Financial Trajectory and Future Outlook

Revenue Projections

Given current sales volumes, Nedocromil Sodium's revenue forecast remains modest, with projections indicating a stagnant or mildly declining trend absent significant innovation or market expansion. However, targeted regional penetration and formulation enhancements could generate moderate growth.

Investment Risks

Key risks include regulatory hurdles, market cannibalization by newer therapies, patent expiries, and supply chain vulnerabilities. Cost pressures and reimbursement challenges could further restrain profitability.

Growth Catalysts

- Regulatory approvals in untapped regions could catalyze sales.

- Development of new delivery systems or combination therapies might rejuvenate interest.

- Increased clinical validation for adjunctive uses could expand indications.

Conclusion

Nedocromil Sodium’s market dynamics are characterized by limited overall market share shaped by competitive pressures, regulatory constraints, and shifting clinician preferences. Its future financial trajectory hinges on strategic regional expansion, formulation innovation, and clinical advocacy. While near-term prospects appear restrained, targeted initiatives could sustain niche relevance within allergic and respiratory disorder management.

Key Takeaways

- Nedocromil Sodium remains a niche but clinically valuable agent primarily in specific allergy and asthma indications.

- Market stagnation results from competition with inhaled corticosteroids and biologics, combined with variable regulatory status.

- Emerging markets and formulation innovations represent promising avenues for growth.

- Stakeholders should monitor regulatory updates, clinical trial developments, and regional adoption trends to capitalize on potential opportunities.

- Long-term success requires strategic partnerships and investments into research and regional market access.

FAQs

Q1: Is Nedocromil Sodium still approved for use globally?

A: Approval status varies by region. While it remains approved for certain indications in Europe, its approval has been withdrawn or restricted in others, like the U.S., limiting market access.

Q2: What are the primary competitors to Nedocromil Sodium?

A: Its main competitors include inhaled corticosteroids like Fluticasone and biologics such as Omalizumab, which often offer broader or more effective anti-inflammatory effects.

Q3: Can Nedocromil Sodium be used in pediatric populations?

A: Yes, it has been used off-label in pediatric asthma management. However, pediatric use depends on regional regulatory approvals and clinical judgment.

Q4: Are there ongoing clinical trials for Nedocromil Sodium?

A: Limited studies are ongoing, mainly focusing on new formulations or combination therapies; large-scale trials are scarce.

Q5: What factors could drive the future growth of Nedocromil Sodium?

A: Expansion into emerging markets, formulation innovations, and clinical validations of new indications could serve as growth catalysts, provided regulatory hurdles are addressed.

References

[1] IQVIA. Global Allergy & Respiratory Market Report, 2022.

[2] IQVIA. Pharmaceutical Sales Data, 2022.