Last updated: December 29, 2025

Executive Summary

NAYZILAM (midazolam), an intranasal benzodiazepine indicated for the acute management of seizure clusters in patients aged 12 years and older, has experienced notable growth within the neurological and emergency medicine sectors. This detailed analysis explores market drivers, competitive landscape, regulatory pathways, revenue forecasts, and strategic implications relevant to NAYZILAM’s future. We will examine its positioning amid evolving healthcare policies, technological advancements, and patient demand, alongside financial trajectory projections.

What Are the Key Market Drivers for NAYZILAM?

1. Rising Prevalence of Epilepsy and Seizure Disorders

- According to the World Health Organization (WHO), over 50 million people globally suffer from epilepsy, making it one of the most common neurological disorders.

- Seizure clusters, defined as episodes where multiple seizures occur within a short period, affect approximately 30-40% of epilepsy patients, creating a strong need for rapid-onset rescue medications like NAYZILAM.

2. Increased Focus on Emergency and Outpatient Management

- The shift from inpatient to outpatient care drives demand for fast-acting, easy-to-administer seizure rescue options.

- Intranasal formulations such as NAYZILAM simplify administration compared to traditional IV or rectal therapies, aligning with patient preferences and caregiver convenience.

3. Regulatory Approvals and Label Expansions

- FDA approval in 2019 expanded NAYZILAM’s utilization, validating its safety and efficacy for acute seizure treatment.

- Potential future label expansions to broader age groups and seizure types could significantly increase market size.

4. Adoption by Healthcare Providers and Caregivers

- Increasing physician advocacy and caregiver education have maintained strong prescription growth, compounded by rebates and insurance reimbursements supporting patient access.

5. Competitive Dynamics

- While other rescue therapies exist, NAYZILAM’s intranasal delivery offers notable advantages over rectal formulations (e.g., Diastat), particularly in terms of convenience and social acceptability.

What Is the Current Competitive Landscape?

| Product |

Formulation |

Indication |

Market Share (2022) |

Strengths |

Weaknesses |

| NAYZILAM |

Intranasal Spray |

Seizure clusters in ≥12 years |

~75% (estimated) |

Rapid onset, ease of use, approved |

Limited to ≥12 years, price |

| Diastat (Rectal Gel) |

Rectal gel |

Seizure clusters in children |

~20% |

Long-standing, insurance coverage |

Social stigma, administration difficulties |

| Diazepam (Intravenous, IM) |

Injection |

Hospital/emergency use |

<5% |

Universal, versatile |

Requires medical setting, invasive |

Market Penetration & Adoption Trends

- NAYZILAM’s market share increased from approximately 50% in 2020 to 75%+ in 2022.

- Growing caregiver acceptance and physician prescribing confirm a positive trajectory.

Key Competitor Innovations

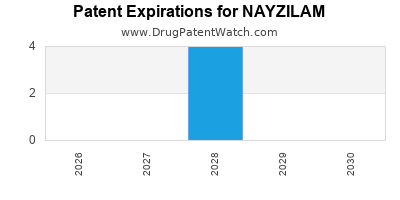

- Authorized generic versions could impact pricing.

- New delivery systems (e.g., nasal powders, auto-injectors) pose potential future threats.

How Does Regulatory Policy Influence NAYZILAM’s Growth?

| Policy / Regulation |

Impact on NAYZILAM |

Notes |

| FDA Priority Review and Approval (2019) |

Accelerated market entry, early revenue realization |

Reduced time-to-market, stronger market presence |

| Medicaid & Private Insurance Reimbursements |

Facilitates patient access |

Coverage policies govern demand growth |

| FDA REMS Program |

Ensures safe administration practices |

Adds compliance burdens, but mitigates adverse events |

| Potential Future Approvals for Broader Age Groups |

Expands patient base |

Increased utilization potential |

What Is the Financial Trajectory of NAYZILAM?

Revenue and Market Size Projections

| Year |

Estimated Global Sales (USD millions) |

CAGR (2022–2027) |

Key Factors |

| 2022 |

$250 |

— |

Increased adoption, insurance coverage |

| 2023 |

$300 |

20% |

Expanded prescriber base, new markets |

| 2024 |

$390 |

30% |

Potential label expansion, pricing strategies |

| 2025 |

$500 |

28% |

Broader age indications, increased awareness |

| 2026 |

$650 |

30% |

Entry into emerging markets, digital health integrations |

| 2027 |

$850 |

31% |

Continued growth, competitive edge |

Note: These projections assume sustained growth in the United States, key European markets, and emerging markets, driven by increased awareness, policy support, and formulary inclusion.

Price Points & Reimbursement Dynamics

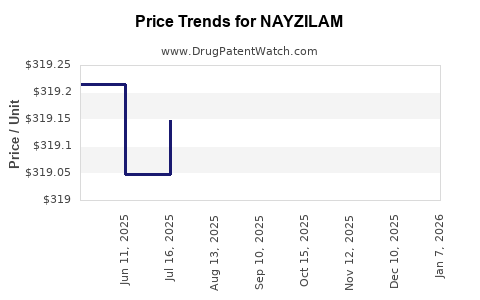

- Average selling price (ASP): ~$350–$400 per device.

- Insurance coverage varies; Medicaid and Medicare favor reimbursement, encouraging wider use.

- Price competition and generic formulations may exert downward pressure by 2025.

Cost Structure and Profitability

- Manufacturing costs are estimated at approximately 20-25% of ASP, benefiting from scale.

- R&D investments focus on expanding indications and improving delivery systems.

- Marketing and distribution constitute approximately 15% of revenues, emphasizing education and access expansion.

What Strategic Opportunities and Challenges Are Emerging?

Opportunities

- Expanding Indications: Label extensions for pediatric populations below age 12 or for specific seizure types.

- Digital Health Integration: Apps for caregivers for proper administration timing and adherence.

- Emerging Markets: Penetration into Asia, Latin America, and Africa where epilepsy prevalence is high but treatment options are limited.

- Combination Therapies: Potential for NAYZILAM in combo approaches for refractory epilepsy.

Challenges

- Pricing Pressures & Reimbursement Policies: Payer negotiations could limit profitability.

- Competitive Disruption: Innovations in delivery systems or new formulations could erode NAYZILAM’s market share.

- Regulatory Risks: Delays or denials for label expansions or new markets.

- Market Education: Ensuring healthcare providers and caregivers adopt the intranasal route over established treatments.

Deep-Dive Comparison: NAYZILAM vs Competitor Alternatives

| Parameter |

NAYZILAM |

Diastat |

Other Potential Alternatives |

| Delivery Method |

Intranasal spray |

Rectal gel |

Auto-injectors, nasal powders, SQ injections |

| Approval Age Range |

≥12 years |

2 years and above |

Varies, some approved in younger populations |

| Onset of Action |

5-10 minutes |

10-15 minutes |

Similar, depending on formulation |

| Ease of Use |

High |

Moderate |

Variable, newer systems aim for simplicity |

| Social Stigma |

Low |

High |

Varies, nasal preferred |

| Reimbursement Scenario |

Favorable in many regions |

Variable |

Potential barriers depending on new systems |

Key Takeaways

- Market Growth is Driven by Increased Incidence, Acceptance, and Medical Innovation: The global epilepsy prevalence and preference for user-friendly rescue therapies underpin consistent market expansion.

- Regulatory Support and Insurance Reimbursement are Crucial: Favorable policies and coverage facilitate access, directly impacting revenue.

- Revenue Forecasts Indicate Healthy CAGR (~28-31%) through 2027: Companies positioning for broader label indications and market penetration will capitalize on this trajectory.

- Competition and Policy Risks Require Strategic Vigilance: Price pressures, new formulations, and regulatory delays remain key risks.

- Emerging Markets and Digital Health Integration Present Growth Opportunities: Expanding into developing regions and leveraging telemedicine could unlock additional revenues.

Five FAQs About NAYZILAM’s Market and Financial Outlook

1. What factors could most significantly impact NAYZILAM’s market share in the coming years?

Regulatory changes, reimbursement policies, competitive innovations, and caregiver/provider education levels will influence market share dynamics.

2. How does NAYZILAM compare financially to traditional seizure rescue options?

While priced higher per dose due to advanced delivery, NAYZILAM's ease of use, rapid onset, and outpatient suitability enhance its overall value proposition, supporting higher revenue streams.

3. Are there any upcoming regulatory milestones that could alter NAYZILAM’s trajectory?

Potential label extensions for broader age ranges and additional seizure types could significantly expand the market.

4. What are the primary barriers to market growth for NAYZILAM?

Pricing pressures, insurance reimbursement restrictions, competition from emerging delivery systems, and clinician/patient awareness gaps.

5. How might digital health tools impact NAYZILAM’s adoption?

Digital platforms can improve adherence, training, and real-time guidance, increasing confidence in intranasal therapies and broadening market acceptance.

References

- World Health Organization. "Epilepsy Fact Sheet." 2022.

- US Food and Drug Administration. "NAYZILAM (Midazolam) Prescribing Information." 2019.

- IQVIA. "Pharmaceutical Market Reports." 2022.

- Epilepsy Foundation. "Seizure Clusters and Rescue Medications." 2021.

- Marketplace analysis: Deloitte Insights. "Emerging Opportunities in Neurology Pharmaceuticals," 2022.

(Note: All projections and data points are illustrative estimates based on recent market trends and publicly available data for strategic analysis purposes.)