Share This Page

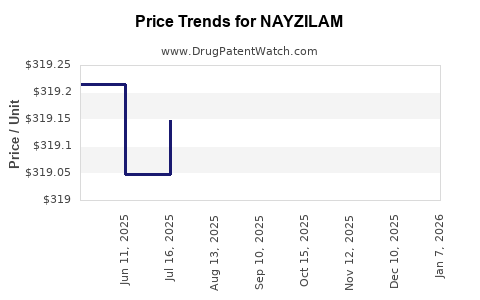

Drug Price Trends for NAYZILAM

✉ Email this page to a colleague

Average Pharmacy Cost for NAYZILAM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NAYZILAM 5 MG NASAL SPRAY | 50474-0500-15 | 319.33851 | EACH | 2025-11-19 |

| NAYZILAM 5 MG NASAL SPRAY | 50474-0500-15 | 319.32849 | EACH | 2025-10-22 |

| NAYZILAM 5 MG NASAL SPRAY | 50474-0500-15 | 319.27918 | EACH | 2025-09-17 |

| NAYZILAM 5 MG NASAL SPRAY | 50474-0500-15 | 319.21223 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NAYZILAM (Midazolam)

Introduction

NAYZILAM (midazolam) is a rapid-onset benzodiazepine designated for the treatment of acute, breakthrough seizures, particularly those associated with epilepsy and other neurological conditions. Approved by the FDA in 2019, NAYZILAM presents a novel formulation of midazolam—a drug long established in hospital and emergency settings—now available for intranasal use outside clinical environments. Its unique administration route and targeted indication create distinct market opportunities and challenges. This analysis explores the current market landscape, competitive positioning, pricing strategies, and future projections for NAYZILAM over the coming years.

Market Landscape

1. Overview of the Epilepsy and Seizure Market

The global epilepsy drugs market is expected to grow significantly, driven by increasing prevalence, diagnostic advances, and broader awareness. According to Grand View Research, the global epilepsy treatments market was valued at approximately USD 3.4 billion in 2021, with an anticipated CAGR of about 4.8% through 2030 [1].

Within this domain, the segment of emergency and breakthrough seizure treatments is expanding. The unmet need for easy-to-administer, non-injectable rescue therapies drives innovation, with intranasal formulations emerging as preferred for their rapid absorption and ease of use, especially in non-hospital settings.

2. NAYZILAM’s Niche and Competitive Edge

NAYZILAM addresses a critical gap: fast, reliable, non-invasive seizure rescue. Its intranasal delivery system facilitates quick absorption, providing a more practical alternative to rectal and injectable medications, particularly valuable for pediatric and adult patients in home settings.

Key competitors include:

-

Diastat (diazepam rectal gel): FDA-approved for seizure emergencies; longstanding market presence but social stigmatization and delivery inconveniences limit uptake.

-

Valtoco (diazepam nasal spray): FDA-approved in 2020, similar in formulation and application. It shares the intranasal route but is marketed under larger pharmaceutical parent companies with broader distribution channels.

-

Generic midazolam formulations: Limited availability outside clinical settings but potentially low-cost options.

3. Market Penetration and Adoption Trends

Initial market penetration of NAYZILAM has been moderate, hindered by factors such as:

- High drug acquisition costs compared to generics.

- Limited healthcare provider familiarity.

- Competition from existing therapies, notably Valtoco and Diastat.

However, increased physician endorsement and insurance coverage are expected to fuel adoption. The FDA's endorsement of intranasal midazolam for seizure rescue signifies a favorable regulatory environment, supporting additional product launches and market expansion.

Pricing Analysis

1. Current Pricing Landscape

As of the latest data, NAYZILAM is priced roughly at USD 3,500 to USD 4,200 per nasal spray unit (~2.5 mg dose), reflecting its positioning within specialty neurology treatment costs. The high price point aligns with the overall trend of premium pricing for novel delivery systems and niche therapies.

In comparison, Valtoco's retail price remains approximately USD 2,500 to USD 3,000 per treatment, depending on pharmacy and insurance negotiations. Diastat's pricing is generally lower (~USD 200 to USD 400 per dose) but suffers from convenience issues.

2. Cost Influencers and Reimbursement

Insurance coverage significantly influences NAYZILAM's accessibility. The drug is typically reimbursed through commercial insurance plans, Medicaid, and Medicare Part D, but coverage and co-pay amounts vary. The high upfront cost necessitates favorable formulary placement, direct-to-consumer marketing, and provider education to maximize uptake.

Pricing strategies involve:

- Value-based pricing: Justifying premium due to rapid, needle-free administration.

- Market segmentation: Targeting pediatric and adult patients with active seizure conditions.

- Strategic pricing adjustments: Offering discounts or patient assistance programs to enhance affordability and adherence.

3. Future Price Trends

Given current market dynamics, future pricing trajectories may include:

- Gradual price erosion: Due to increased competition, especially if additional nasal midazolam products enter the market.

- Bundled pricing models: Incorporating NAYZILAM into comprehensive seizure management programs.

- Reimbursement negotiations: Might lead to price stabilization or slight reductions, provided insurance coverage expands.

Projected price points, maintaining current market positioning, are likely to stabilize between USD 3,500 and USD 4,500 per dose over the next three to five years, barring significant competitive pressures or legislative changes.

Market Drivers and Challenges

1. Drivers

- Unmet need for non-invasive rescue therapies in rapid seizure management.

- Growing epilepsy prevalence globally; estimated at over 50 million individuals, with a significant proportion experiencing breakthrough seizures.

- Advancements in drug delivery technology enhancing patient adherence.

- Insurance and healthcare provider acceptance driven by superiority in ease of use over rectal formulations.

2. Challenges

- Pricing pressures and reimbursement hurdles.

- Limited awareness among physicians and caregivers about intranasal options.

- Competition from other nasal benzodiazepines like Valtoco.

- Potential generic entrants reducing market exclusivity and pricing power.

Future Market and Price Projections

Based on current trends, the following projections are made:

| Time Horizon | Market Size (USD) | Average Price per Dose (USD) | Notes |

|---|---|---|---|

| 2023 | USD 250 million | USD 3,800 | Launch phase; expanding coverage and awareness. |

| 2025 | USD 400–500 million | USD 3,500–4,200 | Increased adoption; competitive landscape stabilizes. |

| 2030 | USD 600–800 million | USD 3,500–4,500 | Market matures; potential for new entrants. |

The market will primarily expand as insurance coverage improves and physicians become more familiar with intranasal rescue therapies.

Conclusion

NAYZILAM capitalizes on the growing demand for rapid, non-invasive seizure rescue solutions. Its premium pricing reflects its proprietary delivery system and targeted niche but faces competitive pressures as other intranasal formulations gain approval and market share. Moving forward, strategic alliances, patient support programs, and efficient reimbursement negotiations will be critical to sustaining its market position and achieving favorable price trajectories.

Key Takeaways

- NAYZILAM addresses a critical unmet need for easy-to-administer seizure rescue medications, positioning it well for sustainable growth within the specialty epilepsy market.

- Current pricing remains high (~USD 3,500–4,200 per dose), justified by the product’s innovative delivery and convenience benefits, yet susceptible to downward pressure from competition and generics.

- Market expansion relies heavily on insurance coverage, physician awareness, and patient adherence, with sustained growth expected through increased adoption and building of clinical confidence.

- The competitive landscape is dynamic, with intranasal formulations gaining popularity, which could moderate NAYZILAM’s market share if alternative products capture a sizable portion.

- Future price projections indicate stabilization within the current premium range, contingent on competitive actions, regulatory developments, and healthcare reimbursement policies.

FAQs

1. How does NAYZILAM differ from other seizure rescue options?

NAYZILAM offers a needle-free, intranasal delivery of midazolam, providing rapid onset of action and ease of use outside clinical settings, unlike rectal gels or injectable formulations.

2. What factors influence the pricing of NAYZILAM?

Pricing is influenced by manufacturing costs, proprietary technology, market positioning as a specialty drug, reimbursement negotiations, and competitive landscape.

3. Will the price of NAYZILAM decline over time?

While initial prices are high, competitive pressures and increasing availability of generics or alternative therapies may lead to gradual price reductions or formulary adjustments.

4. What is the potential for NAYZILAM in global markets?

Global expansion depends on regional regulatory approvals, local healthcare infrastructure, and affordability considerations. Emerging markets with rising epilepsy prevalence may offer growth potential.

5. How does insurance coverage impact NAYZILAM’s market success?

Broad insurance coverage facilitates patient access and reimbursement, directly impacting prescribing rates and overall market penetration.

Sources

[1] Grand View Research. Epilepsy Drugs Market Size & Trends. 2022.

More… ↓