Last updated: July 30, 2025

Introduction

MYCELEX-G, also known by its generic name clobetasol propionate, is a potent topical corticosteroid prescribed primarily for treating inflammatory skin disorders. Its market position, financial trajectory, and the overall dynamics surrounding its use are influenced by multiple factors, including regulatory approvals, competition from generics, patent statuses, and evolving dermatological treatment protocols. As a high-value dermatology drug, understanding these dynamics is essential for stakeholders aiming to assess future growth prospects and associated market risks.

Product Overview and Regulatory Landscape

MYCELEX-G is marketed as a super-potent corticosteroid indicated for severe dermatoses unresponsive to lower potency steroids. Its efficacy in managing psoriasis, eczema, and allergic dermatitis has cemented its utility in dermatology. Regulatory factors significantly shape its market dynamics.

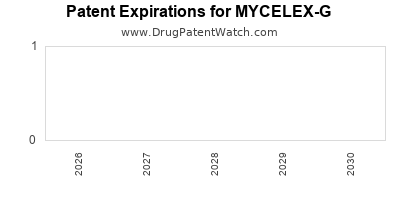

In North America and Europe, MYCELEX-G has navigated patent protections, with patent expiry dates often scheduled around the late 2020s. Once patents expire, generic competitors are allowed to enter the market, generally leading to substantial price reductions and increased market penetration. Regulatory bodies such as the FDA and EMA impose strict approval standards, influencing the timeliness of generic approvals and post-marketing surveillance costs.

Market Drivers

Several key drivers influence MYCELEX-G's market and financial trajectory:

-

Clinical Efficacy and Safety Profile

MYCELEX-G’s potency offers targeted relief for severe dermatological conditions, minimizing the need for systemic therapies. Its strong efficacy endorses continued clinician preference, especially in cases refractory to less potent corticosteroids.

-

Growing Prevalence of Skin Disorders

The rising incidence of dermatitis, psoriasis, and allergic skin conditions, compounded by factors like urbanization and environmental allergens, boosts demand. The Global Burden of Disease Study reports that skin diseases account for notable disability-adjusted life years (DALYs), underpinning the need for potent topical treatments.

-

Expansion into Emerging Markets

As healthcare infrastructure develops globally, emerging markets exhibit a rising adoption rate for advanced dermatological therapies. MYCELEX-G's entry into these regions via partnerships or licensing drives revenue growth.

-

Formulation Innovations and Delivery Systems

Advances like foam, gel, or lotion formulations optimize drug delivery, improve patient compliance, and expand therapeutic use cases, further boosting sales.

Competitive Landscape

The competitive environment for MYCELEX-G is characterized by:

-

Brand vs. Generic Competition

Patents confer market exclusivity temporarily. Once they expire, generic clobetasol propionate formulations flood the market, exerting downward pressure on prices. The entry of generics typically results in a significant revenue dip but also potentially expands market volume due to reduced access barriers.

-

Other Potent Corticosteroids

Several alternatives, including betamethasone and fluocinonide, provide clinical options with differing potency and side effect profiles. Physicians choose medications based on severity, patient response, and safety considerations.

-

Emerging Biologic and Non-Steroidal Therapies

For chronic conditions like psoriasis, biologics such as adalimumab and ixekizumab offer targeted immunomodulation. Though not direct competitors, they influence prescribing patterns, especially for severe or refractory cases.

Financial Trajectory

The financial performance of MYCELEX-G hinges on patent timings, market penetration, pricing strategies, and healthcare policy shifts.

-

Pre-Patent Expiry Period

During patent protection, the drug commands premium pricing. Companies often integrate direct marketing to dermatologists and leverage formulary approvals to maximize revenue. Margins are generally healthy, with high therapeutic value justified by clinical efficacy.

-

Post-Patent Expiry Period

Commoditization triggers a shift. Generic manufacturers enter with lower-priced formulations, often causing the original brand to lose significant market share. Companies mitigate this impact through strategies such as extending patent life via formulations or delivery system patents, developing new formulations, or expanding indications.

-

Market Penetration and Volume Growth

In regions with limited access to advanced dermatological care, MYCELEX-G can experience volume-driven growth. Conversely, in mature markets, revenue gains depend on price optimization and switching protocols.

-

Pricing and Reimbursement Dynamics

Payor policies influence product uptake. Governments and insurers favor cost-effective generics, pressuring prices of branded formulations. Conversely, high-cost branded formulations can justify premium pricing through superior delivery or indications.

-

Forecasts and Profitability

Industry analysts project an initial revenue plateau during patent protection, with potential decline post-expiry unless mitigated through biosimilar and formulation innovations. Investments in formulation improvements and indication expansion can sustain or grow profitability.

Market Challenges and Opportunities

-

Regulatory Hurdles

Stringent approval processes for generics and biosimilars can delay market entry, creating temporary monopolies and revenue windows.

-

Safety and Side Effects Concerns

As a super-potent corticosteroid, long-term use risks include skin atrophy and systemic absorption, prompting regulatory reviews and influencing prescribing behavior.

-

Patient Compliance and Delivery Systems

Improving formulations to reduce side effects and enhance adherence can create niche markets and premium pricing avenues.

-

Emerging Technologies

Novel topical delivery systems, such as microneedle patches or liposomal formulations, present opportunities for differentiation.

Strategic Outlook

The future trajectory of MYCELEX-G will rely on strategic patent management, innovation, and expanding into underserved markets. Companies that successfully extend patent life through formulation patents or explore new indications can maintain revenue streams. Additionally, a focus on biosimilar development may shorten the profit erosion post-patent expiry.

In emerging markets, increasing disease prevalence and improving healthcare access can lead to rapid growth, offsetting declines in mature markets. Moreover, partnerships with local distributors and healthcare providers are vital to penetrate these regions effectively.

Key Takeaways

-

Patent expiry timelines critically influence MYCELEX-G’s revenue trajectory. Strategic patent management and formulation innovations are essential to sustain profitability during generic competition.

-

Growing prevalence of dermatological conditions drives demand, especially in emerging markets. Tailoring marketing strategies and improving formulational offerings can capitalize on these trends.

-

Pricing power diminishes post-generic entry, requiring firms to innovate or expand indications to preserve margins.

-

Regulatory landscape and safety profiles significantly impact pharmacovigilance and prescribing trends. Maintaining a favorable safety profile is paramount for market retention.

-

Investments in delivery systems and new formulations can create differentiated products with premium pricing potential. Innovation leads to enhanced patient adherence and expanded therapeutic use.

Frequently Asked Questions (FAQs)

-

When is MYCELEX-G expected to face generic competition, and what impact will it have?

Patent expiry is anticipated in the late 2020s. Generic entry will typically lead to substantial price reductions and market share displacement, necessitating strategic adaptation from manufacturers.

-

Are there ongoing clinical trials or formulations that could extend MYCELEX-G’s patent protection?

Yes. Companies are exploring novel delivery systems, combination formulations, and new indications, which could be protected by secondary patents, extending market exclusivity.

-

How does the safety profile of MYCELEX-G influence its market sustainability?

As a potent corticosteroid, long-term safety concerns can limit prophylactic and maintenance use, influencing prescribing patterns and prompting reformulation efforts to mitigate risks.

-

What role do emerging markets play in MYCELEX-G’s growth prospects?

Emerging markets represent significant opportunities due to rising skin disease prevalence, improved healthcare infrastructure, and increased access to dermatological therapies.

-

How do biosimilars and biologics affect the corticosteroid market segment?

While biologics target systemic immune pathways, their high costs and specialized uses position corticosteroids like MYCELEX-G as first-line, cost-effective treatments, especially in resource-limited settings.

References

[1] Global Burden of Disease Study. (2021). Skin Disorders Data.

[2] U.S. Food & Drug Administration. (2022). Patent and exclusivity information on topical corticosteroids.

[3] MarketsandMarkets. (2022). Dermatology Therapeutics Market Analysis.

[4] European Medicines Agency. (2022). Regulatory guidelines for corticosteroid formulations.

[5] Industry Reports. (2023). Post-patent market dynamics for dermatological drugs.