Last updated: July 27, 2025

Introduction

MOVIPREP, a prominent bowel preparation agent indicated for colon cleansing before colonoscopy procedures, has established itself within the highly competitive gastrointestinal (GI) medication segment. As a combination of polyethylene glycol (PEG) with ascorbate and sodium chloride, MOVIPREP's efficacy, safety profile, and convenience have driven its adoption globally. This analysis explores the current market dynamics influencing MOVIPREP, evaluates its financial trajectory, and assesses strategic factors shaping its future.

Market Overview

The global gastrointestinal (GI) drugs market is projected to reach approximately USD 35 billion by 2025, with colonoscopy preparations constituting a significant segment. The rising prevalence of colorectal cancer (CRC), gastrointestinal disorders, and increased screening programs have amplified demand for bowel cleansing agents. MOVIPREP, introduced by Ferring Pharmaceuticals, commands a substantial share owing to its improved tolerability compared to older PEG formulations.

Key Drivers of Market Growth

-

Increase in Colorectal Cancer Screening: Globally, CRC remains a leading cause of cancer-related mortality. Regular screenings necessitate effective bowel prep, amplifying demand for agents like MOVIPREP [1].

-

Rising Incidence of GI Disorders: Conditions requiring colonoscopy, such as inflammatory bowel disease (IBD), propel usage rates.

-

Patient Preference for Convenience: MOVIPREP's taste-masking and dosing regimen address previous patient compliance issues with traditional PEG solutions.

-

Expanding Age Demographics: An aging population predisposed to colorectal pathologies bolsters market expansion.

-

Regulatory Approvals and Healthcare Investments: Growing acceptance in emerging markets, facilitated by regulatory approvals, continues to open new revenue avenues.

Market Challenges

-

Competitive Landscape: Presence of alternatives like Pico-Salax, Suprep, and OTC options impacts market share.

-

Cost Considerations: Higher costs relative to generic PEG formulations may limit adoption in price-sensitive regions.

-

Patient Compliance and Tolerance: Despite improvements, adverse effects and taste issues remain potential barriers.

Financial Trajectory Analysis

Revenue Trends

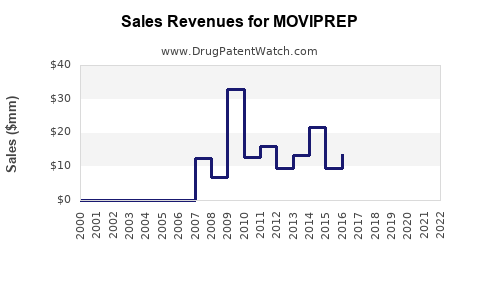

Ferring Pharmaceuticals has reported steady growth in MOVIPREP revenues, driven by expanding indications and geographic reach. Global sales historically grew mid-single digits annually, with notable expansion in Asia-Pacific and Latin America, where colorectal screening programs intensify [2].

Pricing Strategies

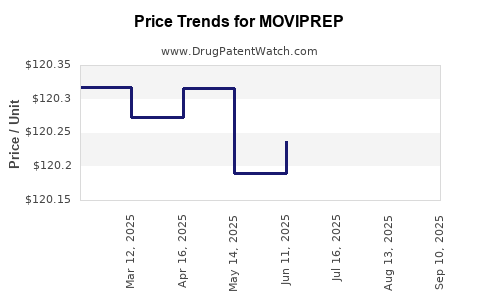

Ferring leverages premium pricing aligned with its product quality and convenience benefits. However, price erosion due to increased generic competition, especially in mature markets, presents a potential risk to profit margins.

Market Penetration and Adoption

In developed markets such as North America and Europe, MOVIPREP enjoys a high adoption rate due to entrenched clinical guidelines and insurance coverage. Emerging markets are witnessing growing adoption, often facilitated by local partnerships and educational campaigns.

Pipeline and Innovation Impact

Ferring continues to innovate, aiming to develop next-generation bowel prep formulations with improved taste, dosing, and minimal side effects. These efforts could further enhance market share and revenue streams, aligning with the broader trend of patient-centered GI solutions.

Impact of Regulatory Changes

Stringent regulatory standards, especially regarding safety and efficacy documentation, influence market entry and expansion strategies. Positive regulatory decisions bolster revenue prospects, whereas delays or rejections could hinder growth.

Potential Market Challenges

-

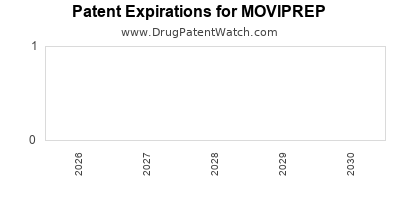

Patent Expirations: Loss of exclusivity could lead to increased biosimilar or generic competition, exerting downward pressure on prices.

-

Reimbursements and Healthcare Policies: Shifts towards value-based care and reimbursement caps may impact profitability.

-

Market Saturation: In mature markets, slow growth may necessitate diversification into related GI therapeutics.

Future Outlook and Strategic Considerations

The outlook for MOVIPREP remains cautiously optimistic. Continued emphasis on clinical data supporting safety, tolerability, and efficacy is essential. Expansion into unserved or underpenetrated markets could provide substantial revenue growth. Moreover, partnerships with healthcare providers and payers to emphasize cost-effectiveness and improved patient outcomes will be critical.

Ferring's ongoing R&D investments aimed at optimizing bowel preparation could redefine the market standard, influencing pricing and adoption. Additionally, engaging in educational campaigns to improve patient compliance has potential to boost prescription rates.

Key Market Trends Impacting Financial Trajectory

-

Digital and Telehealth Integration: Facilitates wider dissemination of patient education and adherence programs.

-

Personalized Medicine Approaches: Tailoring bowel prep to patient profiles could enhance efficacy and reduce adverse effects, creating a competitive advantage.

-

Emerging Market Expansion: Growth opportunities in Asia-Pacific, Middle East, and Latin America are meteoric given expanding healthcare infrastructure.

-

Regulatory and Reimbursement Incentives: Favorable policies can accelerate product uptake and revenue growth.

Conclusion

MOVIPREP's market dynamics are characterized by steady demand driven by escalating colorectal cancer screening and advancements in formulation technology. The financial trajectory indicates potential for sustained growth, contingent upon strategic positioning amidst competitive pressures and evolving healthcare policies. Ferring Pharmaceuticals' focus on innovation, geographic expansion, and stakeholder engagement will determine its capacity to capitalize on these opportunities.

Key Takeaways

-

The global GI drug market is expanding, with colonoscopy preparations like MOVIPREP positioned for continued growth due to rising CRC screening rates.

-

Competitive landscape and pricing pressures necessitate ongoing innovation and strategic marketing.

-

Geographic diversification, especially in emerging markets, remains vital for revenue growth.

-

Regulatory developments and reimbursement policies significantly influence the financial outlook.

-

Investment in patient-centered formulations and digital health integration can offer competitive advantages for sustained market share.

FAQs

1. How does MOVIPREP compare to other bowel cleansing agents?

MOVIPREP offers improved taste and dosing convenience over traditional PEG solutions, with a safety profile suitable for most patients. However, competing agents like Suprep and Pico-Salax may offer different dosing regimens or cost benefits.

2. What are the primary factors influencing MOVIPREP's market growth?

Key factors include increasing colorectal cancer screening programs, patient preferences for convenient dosing, expanding healthcare infrastructure in emerging markets, and ongoing innovation by manufacturers.

3. What challenges does MOVIPREP face in the evolving pharmaceutical landscape?

Challenges encompass generic competition, pricing pressures, regulatory hurdles, and shifts in healthcare policies emphasizing cost-effectiveness.

4. How is Ferring Pharmaceuticals positioning MOVIPREP for future growth?

Ferring is investing in product innovation, expanding access in emerging markets, building strategic partnerships, and emphasizing educational initiatives to improve compliance and adoption.

5. What is the outlook for MOVIPREP’s revenue in the next five years?

Assuming successful execution of expansion and innovation strategies, MOVIPREP's revenues are projected to grow at a low to mid-single-digit CAGR, driven by market expansion and product enhancements, barring significant regulatory or competitive disruptions.

Sources:

[1] Global Gastrointestinal Drugs Market Reports. (2022). MarketWatch.

[2] Ferring Pharmaceuticals Annual Report. (2022).