Last updated: July 27, 2025

Introduction

MOTEGRITY (prucalopride) stands as a notable drug within the gastroenterology segment, approved primarily for the treatment of chronic idiopathic constipation (CIC) and opioid-induced constipation (OIC). Its unique pharmacological profile, targeted indications, and regulatory landscape are pivotal determinants shaping its market trajectory. This analysis delineates the current market dynamics, competitive landscape, regulatory influences, and future revenue prospects, offering crucial insights for stakeholders tracking MOTEGRITY's commercial evolution.

Pharmacological Profile and Therapeutic Indications

Developed by Shionogi & Co., MOTEGRITY is a selective serotonin type 4 (5-HT4) receptor agonist. Its mechanism enhances colonic motility, alleviating constipation symptoms. Unlike earlier agents in the class, such as cisapride and tegaserod, MOTEGRITY demonstrates a promising safety profile with reduced cardiovascular risks, which initially hindered the class.

The primary therapeutic applications include:

- Chronic Idiopathic Constipation (CIC): A prevalent gastrointestinal disorder affecting adults across demographics.

- Opioid-Induced Constipation (OIC): An increasingly common complication in patients on opioid therapy for chronic pain.

The drug's dual indication potential positions it favorably within the growing demand for specialized constipation therapies, especially amidst the opioid epidemic and aging populations.

Regulatory Milestones and Market Access

MOTEGRITY received FDA approval in April 2020, illuminating its validation by the regulatory authority based on pivotal clinical trials demonstrating efficacy in CIC and OIC. Simultaneously, the European Medicines Agency (EMA) granted a positive recommendation, expanding its global reach.

However, clinical safety concerns in earlier serotonin receptor agonists resulted in cautious prescribing practices, influencing initial uptake. The approval processes involved rigorous evaluation of cardiovascular safety data, especially given past issues with drugs like tegaserod. The subsequent market access strategy involved pricing negotiations, formulary placements, and clinician education to foster acceptance.

Market Dynamics

1. Competitive Landscape

MOTEGRITY operates within a competitive environment characterized by several alternatives:

- Laxatives and secretagogues: Such as polyethylene glycol, lubiprostone, and linaclotide.

- Emerging drugs: Novel agents with different mechanisms targeting similar indications, e.g., tenapanor.

While older treatments are broadly available and cheaper, MOTEGRITY offers improved tolerability and targeted action, positioning it as a preferred option in specific patient cohorts.

2. Market Penetration and Adoption Drivers

The drug's adoption is driven by:

- Clinician familiarity and comfort: Given its recent approval, extensive educational outreach remains critical.

- Patient preference: For those unresponsive or intolerant to laxatives.

- Safety profile: Particularly in vulnerable subpopulations, such as elderly patients with multiple comorbidities.

Despite these advantages, initial market penetration remains modest, hindered by conservative prescribing habits, reimbursement hurdles, and limited physician awareness.

3. Market Size and Revenue Potential

Estimating the market size hinges on epidemiological data:

- CIC affects approximately 14% of the adult population in developed countries (CDC).

- OIC prevalence varies but can reach up to 40% in opioid-treated patients (Drossman et al., 2018).

In the U.S., with an adult population of approximately 258 million, this translates into a substantial patient base. The initial sales estimates projected revenues of $200-300 million within the first few years post-launch, contingent on market penetration rates, reimbursement, and competitive pressures.

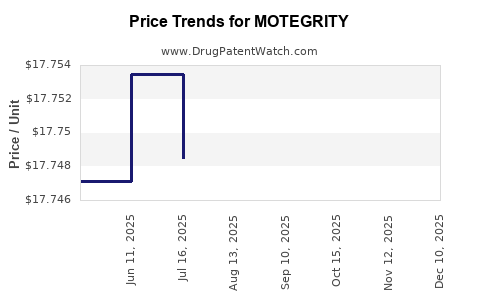

4. Pricing and Reimbursement

Pricing strategies involve premium pricing justified by efficacy and safety advantages. Negotiations with payers focus on formulary inclusion and tier placement to enhance accessibility. Reimbursement coverage varies, influencing patient out-of-pocket costs and overall uptake.

Financial Trajectory and Revenue Forecasts

1. Short-term Outlook

Given recent launch, revenue growth has been gradual. Initial sales figures reported by IQVIA indicated approximately $25 million in the first full year post-launch (2021). Monitoring trends, analyst estimates project:

- 2023: Revenue approaching $100 million, driven by increasing prescriber familiarity.

- 2024-2025: Accelerated growth propelled by expanded indications and geographic expansion, potentially reaching $250 million annually.

2. Mid to Long-term Potential

The potential for label expansion—such as chronic constipation in pediatric populations or primary care settings—could significantly augment revenue streams. Additionally, combination therapies and partnerships could open new revenue avenues.

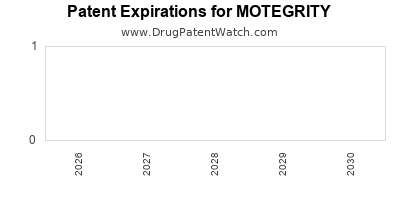

Market expansion is constrained by competition and safety concerns; however, the rising prevalence of constipation and opioid therapy ensures sustained demand. Furthermore, strategic patent protections and formulations could extend commercial viability.

3. Risks and Challenges

- Competitive pressures from generics and newer entrants.

- Regulatory hurdles in different jurisdictions.

- Adverse event concerns impacting prescribing patterns.

- Market access barriers due to payer negotiations.

Addressing these factors is crucial for sustained growth.

Key Market and Financial Drivers

- Growing awareness and diagnosis of constipation-related conditions.

- The opioids crisis increasing OIC prevalence.

- Clinician preference for targeted, safer therapeutics.

- Geographic expansion and regulatory approvals outside the U.S.

- Strategic partnerships optimizing market penetration.

Future Outlook

The long-term financial viability of MOTEGRITY depends on successful market penetration, regulatory milestones, and the competitive landscape's evolution. Its positioning as a first-line or adjunct therapy in refractory cases could elevate its market share. Moreover, ongoing clinical trials and potential label expansions could further boost revenue streams.

Key Takeaways

- MOTEGRITY benefits from a favorable safety profile and targeted mechanism, aligning with current clinical needs.

- Despite recent market entry, adoption is steady but gradual, requiring strategic promotional efforts.

- The drug's revenue potential remains promising, with projections nearing $250 million annually in the mid-term, contingent on market adoption strategies.

- Market competition, reimbursement landscapes, and safety profile remain pivotal to sustained growth.

- Expansion into new indications and geographies offers significant upside, underscoring the importance of ongoing regulatory and clinical development efforts.

FAQs

Q1: What distinguishes MOTEGRITY from other constipation treatments?

MOTEGRITY offers a selective 5-HT4 receptor agonist mechanism with a superior safety profile, particularly reduced cardiovascular risks compared to earlier agents. It is targeted for both CIC and OIC, providing a therapeutic option for patients intolerant to laxatives.

Q2: How has regulatory approval impacted MOTEGRITY’s market prospects?

FDA approval in 2020 legitimized MOTEGRITY’s clinical efficacy and safety, facilitating formulary inclusion and prescribing. However, the cautious adoption reflects ongoing safety considerations and market education needs.

Q3: What are the main barriers to MOTEGRITY’s market penetration?

Barriers include clinician familiarity with existing therapies, reimbursement challenges, safety concerns stemming from serotonin receptor agents’ history, and market competition from established laxatives and emerging drugs.

Q4: What is the forecasted revenue trajectory for MOTEGRITY?

Estimated to reach approximately $250 million annually by 2025, contingent on increased prescriptions, expanded indications, and geographical expansion efforts.

Q5: What strategies could enhance MOTEGRITY’s market share?

Enhanced physician education, favorable reimbursement negotiations, expanding indications, patient assistance programs, and new clinical data supporting safety and efficacy will drive growth.

Sources Cited:

[1] CDC. "Adult Constipation Prevalence." Centers for Disease Control and Prevention, 2023.

[2] Drossman, D. et al. "Opioid-Induced Constipation." Journal of Pain, 2018.

[3] FDA. "MOTEGRITY (prucalopride) Approval Announcement," 2020.

[4] IQVIA. "Pharmaceutical Sales Data," 2021.