Last updated: July 29, 2025

Introduction

MIRALAX (polyethylene glycol 3350) is a widely prescribed osmotic laxative primarily used to treat occasional constipation. Developed by Bayer Healthcare and marketed under the brand name MIRALAX, it has become a staple in gastrointestinal therapy. This article explores the evolving market landscape, competitive factors, regulatory environment, and the financial trajectory of MIRALAX, providing business professionals with comprehensive insights for strategic decision-making.

Market Overview

Global Gastrointestinal Therapeutics Market

The global gastrointestinal (GI) therapeutics market, estimated at approximately USD 42 billion in 2022, is driven by increasing prevalence of GI diseases, aging populations, and rising awareness about digestive health [1]. Constipation alone affects an estimated 14% of the global population, illustrating a significant demand base for laxative therapies like MIRALAX. The market's growth is further amplified by lifestyle factors, including dietary habits and sedentary behavior.

Dominance of Osmotic Laxatives

Osmotic laxatives, including polyethylene glycol (PEG) formulations, account for over 35% of the laxative market share. PEG-based options like MIRALAX are preferred for their efficacy, minimal side effects, and suitability for long-term use. The global PEG laxatives market is expected to grow at a compound annual growth rate (CAGR) of approximately 4.2% through 2027 [2].

Market Dynamics

Increasing Prevalence of Chronic Constipation

The surge in chronic constipation cases, especially among elderly populations, sustains high demand for effective laxatives. According to the American Gastroenterological Association, about 20% of adults in the United States experience chronic constipation, positioning MIRALAX as a frontline therapy [3].

Aging Population and Lifestyle Factors

Demographic shifts toward an aging population augment the need for safe, tolerable bowel management solutions. Additionally, modern lifestyles characterized by low fiber diets, dehydration, and sedentary routines contribute to higher constipation incidence, bolstering MIRALAX's market relevance.

Competitive Landscape

MIRALAX faces competition from:

- Prescription-duty laxatives such as Lactulose and Miralax's closest OTC equivalents.

- Newer formulations, including stimulant laxatives and prokinetics.

- Natural and herbal remedies that appeal to health-conscious consumers.

Despite competition, MIRALAX maintains a dominant position owing to its established efficacy, safety profile, and widespread brand recognition.

Regulatory Environment

Regulatory agencies like the FDA oversee the approval and labeling of OTC laxatives, necessitating ongoing compliance and safety monitoring. New formulations or indications require rigorous clinical trials, potentially impacting product diversification strategies. Bayer's ability to maintain regulatory approvals and update labeling as needed is crucial for sustained market presence.

Reimbursement and Market Access

MIRALAX's predominant OTC status limits reimbursement complexities. However, in certain jurisdictions where prescriptions are required, coverage policies influence revenue streams. Insurance coverage, formulary placements, and pricing strategies are instrumental in maximizing sales.

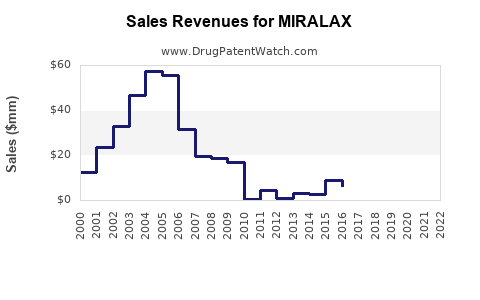

Financial Trajectory

Revenue Streams and Market Penetration

MIRALAX has demonstrated stable revenue generation since its launch, with global sales estimated at over USD 600 million annually. While US markets account for a significant share, expanding access in emerging markets through strategic partnerships and distribution enhances growth potential.

Pricing Strategies

Pricing varies globally, influenced by regulatory frameworks, market competition, and purchasing power. In mature markets like the United States, MIRALAX is positioned as a premium OTC product with a typical retail price of USD 10–15 for a 30-dose package, translating into consistent revenue.

Market Expansion and Portfolio Diversification

Bayer continues to explore indications beyond constipation, including use in bowel preparation and pediatric applications, potentially unlocking new revenue streams. Additionally, formulation innovations such as lower-dose or flavored options could stimulate sales growth.

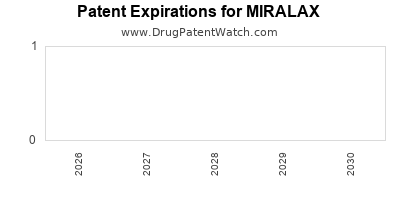

Impact of Patent and Manufacturing Considerations

While generic formulations abound, Bayer's proprietary formulations and brand loyalty afford some pricing power. Patent expiration timelines influence generics' market entry, impacting revenue volatility. Efficient manufacturing and supply chain management ensure consistent product availability, directly affecting financial stability.

Innovation and R&D Outlook

Investments in research targeting new delivery mechanisms, combination therapies, or indications are critical for future growth. The ongoing development of adjunctive therapies and potential introduction of prescription-only variants may expand MIRALAX's market footprint, albeit with associated regulatory hurdles.

Market Challenges

- Regulatory Scrutiny: Potential risks of adverse effects, such as electrolyte imbalance, require transparent labeling and post-market surveillance.

- Market Saturation: The proliferation of OTC laxatives limits the scope for significant market expansion in mature regions.

- Consumer Preferences: Increasing consumer inclination toward natural or herbal remedies necessitates innovation and marketing strategies aligned with health trends.

- Pricing Pressures: Competitive pricing from generics and biosimilars may erode margins.

Strategic Outlook

To sustain growth, Bayer is likely to pursue:

- Geographic expansion, particularly targeting emerging markets with rising GI disorder prevalence.

- Product line extensions, including pediatric or bowel preparation formulations.

- Clinical research to support expanded indications and reinforce safety profiles.

- Consumer engagement and education campaigns emphasizing MIRALAX's efficacy and safety.

Conclusion

MIRALAX’s market position remains robust amid evolving market dynamics, driven by demographic shifts, lifestyle factors, and persistent unmet needs for effective laxatives. While competitive pressures and regulatory challenges persist, strategic investments in innovation, geographic expansion, and brand loyalty will underpin its financial trajectory. Business professionals should monitor regulatory developments and consumer trends to capitalize on growth opportunities within this resilient segment.

Key Takeaways

- The global GI therapeutics market, with a focus on osmotic laxatives, offers continued growth prospects driven by demographic trends.

- MIRALAX maintains a strong market share due to proven efficacy, safety profile, and consumer familiarity.

- Geographic expansion, product innovation, and indications beyond constipation are vital to future revenue streams.

- Competitive pressures and regulatory oversight necessitate strategic agility for sustained profitability.

- Enhancing supply chain efficiencies and consumer engagement will be critical in maintaining MIRALAX’s market dominance.

FAQs

1. What factors contribute to MIRALAX’s market stability?

Its proven safety profile, effectiveness, strong brand recognition, and OTC availability underpin MIRALAX’s stable market position despite competition and regulatory challenges.

2. How is the global demand for laxatives projected to evolve?

Demand is expected to grow at a CAGR of approximately 4.2% through 2027, driven by increasing GI disorder prevalence, aging populations, and lifestyle-related constipation.

3. What are the primary competitive threats to MIRALAX?

Generic formulations, natural remedies, and newer prescription options pose ongoing competition, alongside regulatory challenges and consumer preferences for organic products.

4. How might Bayer expand MIRALAX’s market share?

Through geographic expansion in emerging markets, product line extensions, and developing new indications, particularly in bowel preparation and pediatric use.

5. What regulatory concerns could impact MIRALAX’s future income?

Adverse event reports, labeling restrictions, and approval delays for new indications may influence sales and market access strategies.

Sources

[1] Market Research Future, “Gastrointestinal Therapeutics Market Forecast,” 2022.

[2] Grand View Research, “PEG Laxatives Market Analysis,” 2022.

[3] American Gastroenterological Association, “Constipation Prevalence,” 2021.