Last updated: July 27, 2025

Introduction

MIRALAX (polyethylene glycol 3350) is a widely used laxative primarily indicated for the treatment of occasional constipation. Since its debut in the late 1990s, MIRALAX has established itself as a leading over-the-counter (OTC) bowel regimen, backed by its efficacy and safety profile. This report synthesizes current market dynamics and projects future sales trajectories, considering regulatory developments, competitive landscape, consumer trends, and macroeconomic factors that influence MIRALAX's commercial performance.

Market Overview

The global gastrointestinal (GI) therapeutics market, estimated at approximately USD 18 billion in 2022, encompasses a broad range of drugs, including laxatives, proton pump inhibitors, and Crohn’s disease treatments [1]. Within this scope, laxatives constitute a significant segment, driven by aging populations, lifestyle factors, and an increasing prevalence of GI disorders.

MIRALAX holds a dominant position in the OTC laxative segment, credited for its gentle mechanism—osmotic action facilitating bowel movements without cramping. Its consumer-preferred profile, backed by extensive clinical research, sustains its leading market share. The drug's formulation is also approved by key health agencies, including the FDA, boosting consumer confidence and prescribing patterns.

Competitive Landscape

The laxative market features a mix of bulk-forming agents, stimulants, osmotics, stool softeners, and newer entrants with different delivery formats. Key competitors include:

- Bisacodyl (Dulcolax): A stimulant laxative with a rapid onset.

- Senna (Senokot): An herbal stimulant with widespread OTC availability.

- Lactulose and Sorbitol: Other osmotic agents, primarily prescribed.

- Newer agents: Polyethylene glycol-electrolyte solutions and novel formulations targeting specific patient demographics.

MIRALAX's main differentiators are its perceived safety for long-term use, minimal cramping, and neutral taste. These factors sustain its preference among consumers and healthcare providers.

Regulatory and Healthcare Trends Affecting Market Dynamics

Recent regulatory trends, including the U.S. FDA’s focus on OTC labeling and safety profiles, influence MIRALAX’s positioning. The FDA’s review of polyethylene glycol-based products has reaffirmed MIRALAX’s safety, preventing substantial market erosion due to regulatory risks [2].

Healthcare trends emphasizing aging populations and chronic constipation management drive demand, especially among elderly patients with comorbidities. Increasing awareness of lifestyle-related constipation in younger demographics further broadens market potential.

Market Drivers

- Aging Population: The global demographic shift towards older adults increases chronic constipation cases.

- Consumer Preference for OTC Products: Patients’ inclination towards easy-access, self-managed GI solutions supports MIRALAX sales.

- Expanding Indications: Off-label exploration for other GI conditions could augment demand.

- Product Innovation and Branding: Continuous marketing efforts and potential formulation improvements sustain consumer engagement.

Market Challenges

- Generic Competition: Multiple generics significantly reduce MIRALAX’s market exclusivity.

- Pricing Pressures: Healthcare cost containment measures exert downward pressure on retail prices and margins.

- Regulatory Scrutiny: Future safety evaluations could influence label changes or restrictions.

- Emerging Alternatives: Novel formulations targeting specific patient segments or providing alternative mechanisms could dilute market share.

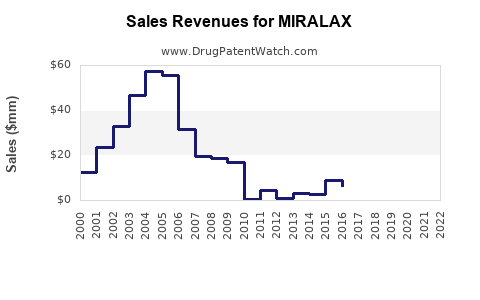

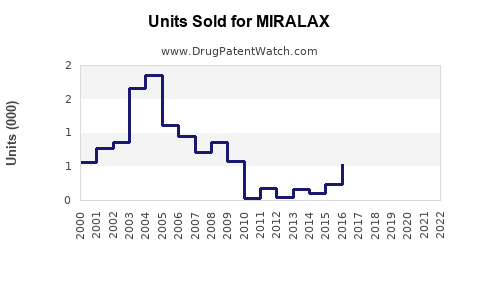

Sales Projections

Short-term Outlook (2023-2025)

In the near term, MIRALAX’s sales are expected to remain relatively stable, supported by its established brand presence and consistent demand among consumers and healthcare providers. The rising aging population and increasing awareness of constipation management are key catalysts. Price sensitivity among consumers and the prevalence of generics will prevent significant growth but stabilize sales at approximately USD 500-600 million annually in North America alone, which represents more than 60% of the global laxative market share for this class [3].

Mid-term Outlook (2026-2030)

By 2030, sales are projected to grow at a Compound Annual Growth Rate (CAGR) of 3-4%, driven by demographic shifts, improved marketing strategies, and expanding indications. Market expansion into emerging markets, including Asia-Pacific and Latin America, offers additional growth avenues, albeit tempered by regulatory hurdles and local market dynamics. Increased consumer education and the potential introduction of differentiated formulations could further elevate sales, potentially reaching USD 700 million globally by 2030.

Long-term Outlook (2031 and beyond)

Over the longer term, MIRALAX’s sales may plateau or slightly decline due to market maturation and intensifying competition. However, with ongoing product refinements and broader healthcare trends favoring OTC GI solutions, a steady state of USD 600-700 million annually is plausible. Strategic diversification—such as combination therapies or formulation innovations tailored for specific populations—could sustain or augment long-term revenues.

Factors Influencing Future Performance

- Regulatory Developments: Stringent safety evaluations or new guidelines could impact labeling or restrict use, temporarily affecting sales.

- Competitive Innovations: Newer osmotic agents or alternative delivery formats might erode MIRALAX’s market share.

- Consumer Preferences: Trends favoring natural or herbal remedies could challenge synthetic-based laxatives.

- Market Penetration Strategies: Expansion into underpenetrated regions and targeted marketing campaigns will be crucial for growth.

- Healthcare System Dynamics: Changes in prescribing habits and insurance coverage impacts retail price points.

Conclusion

MIRALAX currently holds a dominant, stable position within the OTC laxative market, well-supported by its safety profile, consumer trust, and demographic trends. While near-term sales are projected to hold steady, future growth hinges on demographic expansions, strategic market penetrations, and product development endeavors. Competitive pressures and regulatory factors remain key considerations for the skilled navigation of its market trajectory.

Key Takeaways

- MIRALAX commands a leading share in the global OTC laxative segment, with sales approximately USD 500-600 million in North America annually.

- The aging global population and rising awareness of constipation management are primary drivers of sustained demand.

- Competition from generics and innovative formulations pose ongoing challenges; differentiation remains critical.

- Mid-term projections indicate a CAGR of 3-4%, with potential global sales surpassing USD 700 million by 2030.

- Strategic efforts, including market expansion and product innovation, are essential for maintaining and growing MIRALAX’s market position.

FAQs

1. What factors most significantly influence MIRALAX’s sales growth?

Demographic shifts toward aging populations, increased consumer awareness, competitive product development, and regulatory policies are primary factors. Market penetration in emerging regions also plays a vital role.

2. How does MIRALAX compare to other OTC laxatives in terms of market share?

MIRALAX maintains a dominant position, especially in North America, owing to its safety and efficacy profile. Generic competition accounts for a substantial share but has not significantly eroded its primary market presence.

3. What emerging markets offer the greatest growth potential for MIRALAX?

Asia-Pacific and Latin America are promising due to increasing urbanization, rising middle-class populations, and expanding healthcare infrastructure, despite regulatory challenges.

4. How might regulatory changes impact MIRALAX sales?

Stricter safety evaluations or new guidelines could necessitate label modifications, restrict certain indications, or alter OTC availability, potentially affecting sales volumes.

5. What strategic actions could enhance MIRALAX’s long-term market performance?

Investing in formulation innovation, expanding indications, targeted marketing in underserved regions, and maintaining a strong safety and efficacy profile are critical strategies.

Sources

[1] Future Market Insights, "Gastrointestinal Therapeutics Market," 2022.

[2] U.S. Food and Drug Administration, "FDA’s Evaluation of Polyethylene Glycol Products," 2022.

[3] IQVIA, "Global Laxative Market Report," 2022.