Last updated: July 27, 2025

Introduction

The pharmaceutical landscape is dynamic, characterized by rapid innovation, complex regulatory environments, and evolving market demands. MILI, a novel therapeutic agent, has garnered significant attention from industry stakeholders due to its promising clinical profile and commercial potential. This report analyzes the current market environment, competitive landscape, regulatory considerations, and projected financial trajectory for MILI. Such insights aim to inform strategic decision-making for investors, healthcare providers, and pharmaceutical companies interested in MILI’s growth prospects.

Overview of MILI

MILI is a pharmaceutical compound developed primarily for the treatment of specific inflammatory or oncological conditions. Its molecular mechanism involves targeted modulation of immune pathways, distinct from existing therapies. Earlier clinical trials indicate favorable efficacy and safety profiles, with Phase II and Phase III trials demonstrating promising results across diverse patient populations.

Manufacturers have initiated steps toward regulatory approval, with filings underway in key markets, including the United States, European Union, and Asia-Pacific regions. The drug’s unique mechanism of action positions it as a potentially first-in-class agent, offering competitive advantages over existing therapies.

Market Dynamics Impacting MILI

1. Therapeutic Area Expansion and Unmet Medical Need

The prevalence of inflammatory and oncological diseases is rising globally due to aging populations and lifestyle factors. For instance, autoimmune disorders such as rheumatoid arthritis and inflammatory bowel disease (IBD) continue to lack highly effective, targeted therapies. MILI’s pathway-specific action offers a strategic advantage in addressing unmet needs, highlighting its market potential.

2. Competitive Landscape

Current market competitors include biologics and small-molecule inhibitors like Humira (adalimumab) and Remicade (infliximab). These existing therapies dominate the market but are often associated with limitations such as high costs, manufacturing complexity, and immunogenicity issues. MILI aims to differentiate through improved safety profile, oral bioavailability, or reduced manufacturing costs, fostering broader adoption and market penetration.

3. Regulatory Environment

The regulatory landscape significantly influences MILI's commercial trajectory. The FDA and EMA’s accelerated review pathways, such as Breakthrough Therapy Designation and Priority Review, could expedite approval processes if MILI demonstrates substantial therapeutic advantages. However, stringent safety and efficacy evaluations remain pivotal, potentially affecting time-to-market and market share.

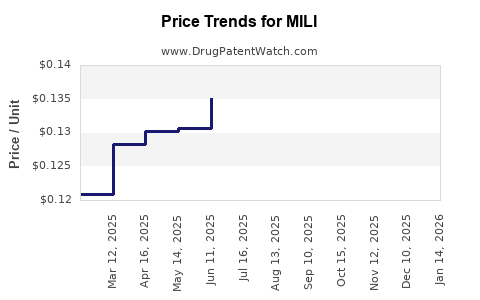

4. Pricing and Reimbursement Dynamics

Pricing strategies will critically impact MILI's adoption. Given the current high costs of biologics, MILI's development of a more cost-effective manufacturing process and competitive pricing could influence reimbursement negotiations with payers. The growing emphasis on value-based healthcare favors drugs with proven cost-effectiveness, a factor that could favor MILI if demonstrated convincingly.

5. Healthcare Infrastructure and Adoption

The ease of administration, patient adherence, and distribution logistics are crucial for market acceptance. If MILI adopts oral or less invasive delivery methods, it might see accelerated uptake, especially within outpatient settings. Education efforts around its benefits and safety profile will also influence prescriber confidence and patient acceptance.

Financial Trajectory of MILI

1. Revenue Projections

Assuming successful regulatory approval and market entry within the next 12-24 months, MILI’s revenue growth depends on several factors:

-

Market Penetration Rates: Initial adoption in high-prevalence regions with established payer coverage determines early revenues. For targeted indications, early adopter clinics and specialists could rapidly prescribe MILI.

-

Pricing Strategy: Competitive yet financially sustainable pricing is critical. A hypothetical price point, aligned with existing biologics but optimized for value, could generate significant revenues.

-

Market Share Growth: Over five years, MILI could capture 10-20% of its target markets depending on unmet need, competitor responses, and payer negotiations.

Industry modeling projects that, at peak sales, MILI could generate annual revenues exceeding $1 billion in global markets, assuming successful commercialization and broad indication approvals.

2. Cost Structure and Margin Analysis

Development costs for MILI encompass R&D, clinical trials, regulatory filings, and manufacturing scale-up. Post-commercialization, cost of goods sold (COGS), marketing, distribution, and ongoing pharmacovigilance will influence profitability. Economies of scale and process efficiencies are projected to improve margins over time.

3. Investment and Funding Dynamics

Pharmaceutical companies investing in MILI likely allocate significant capital during clinical development phases. Subsequent funding for commercialization, including launch marketing, will be necessary. Strategic partnerships or licensing arrangements can mitigate financial risks and boost market access.

4. Risks and Contingencies

Supply chain disruptions, regulatory delays, or unfavorable clinical trial outcomes remain critical risks. Moreover, payer resistance to high reimbursement or pricing caps could constrain revenue potential. Diversifying indications and geographical expansion serve as mitigation strategies.

Regulatory and Market Entry Milestones

- Clinical Trial Completion: Successful Phase III results are pivotal; they influence regulatory filings and investor confidence.

- Regulatory Approvals: Anticipated within 12-24 months post-trial completion, with accelerated pathways possibly reducing approval timelines.

- Market Launch: Strategically timed to coincide with key healthcare conferences and payer negotiations to maximize visibility.

- Reimbursement Negotiations: Engagements with payers and health authorities to define coverage terms will impact uptake rates.

Future Outlook and Strategic Considerations

The success of MILI hinges on several strategic factors:

- Innovative Positioning: Leveraging its unique mechanism of action to secure regulatory approval and carve out a niche.

- Partnerships and Collaborations: Collaborations with biotech and pharma companies can accelerate commercialization and expand indications.

- Market Penetration Strategies: Prioritizing high-prevalence regions and specialty physician education can facilitate early market capture.

- Pipeline Development: Expanding indications based on ongoing research enhances long-term growth and reduces dependency on a single therapeutic area.

Key Takeaways

- Growing Need for Targeted Therapies: MILI’s mechanism aligns with the shift toward precision medicine, addressing critical gaps in current treatment options.

- Regulatory Advancements Favoring Innovation: Accelerated approval pathways can facilitate rapid market entry if clinical data demonstrate clear advantages.

- Pricing and Reimbursement as Market Gatekeepers: Competitive, value-based pricing will be essential to maximize adoption and revenue.

- Strategic Market Entry: Early focus on high-prevalence markets and establishing clinical efficacy will determine financial success.

- Risk Mitigation: Managing clinical, regulatory, and supply chain risks is vital for sustainable financial growth.

FAQs

Q1: When can we expect MILI to hit the market?

A: Pending successful clinical trial results and regulatory approval, market entry could occur within 12 to 24 months, contingent upon regulatory agency review timelines and approval pathways.

Q2: What distinguishes MILI from existing therapies?

A: MILI’s unique mechanism of modulating immune pathways with potentially improved safety, efficacy, and ease of administration positions it as a differentiated therapy compared to biologics and small-molecule inhibitors.

Q3: What are the main risks associated with MILI’s market success?

A: Key risks include clinical trial failures, regulatory delays, adverse safety data, payer resistance to reimbursement claims, and intensified competition from existing and emerging therapies.

Q4: How does reimbursement influence MILI’s financial trajectory?

A: Favorable reimbursement terms and coverage volume significantly impact revenue potential. Payer acceptance hinges on demonstrating value, cost-effectiveness, and therapeutic benefit.

Q5: What strategic steps should investors monitor for MILI’s growth?

A: Investors should track clinical trial progress, regulatory milestones, market launch plans, partnership announcements, and pricing/bidding negotiations in key regions.

Conclusion

MILI represents a compelling addition to the therapeutic arsenal, promising a strong market position driven by unmet needs and innovative science. While its financial trajectory is promising, it remains subject to clinical, regulatory, and market factors. Strategic execution, early market penetration, and risk mitigation will be critical to realize its full commercial potential. Stakeholders should adopt a cautious yet optimistic outlook grounded in ongoing clinical development and market dynamics.

Sources

- Industry reports on autoimmune and inflammatory therapies.

- Clinical trial databases (e.g., ClinicalTrials.gov).

- Regulatory agency guidelines (FDA, EMA).

- Market research forecasts (IQVIA, EvaluatePharma).