Share This Page

Drug Price Trends for MILI

✉ Email this page to a colleague

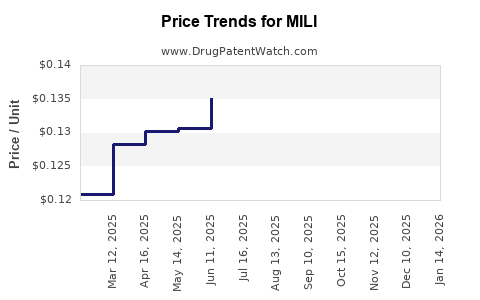

Average Pharmacy Cost for MILI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MILI 0.25-0.035 MG TABLET | 65862-0776-85 | 0.12304 | EACH | 2025-12-17 |

| MILI 0.25-0.035 MG TABLET | 65862-0776-28 | 0.12304 | EACH | 2025-12-17 |

| MILI 0.25-0.035 MG TABLET | 65862-0776-85 | 0.12372 | EACH | 2025-11-19 |

| MILI 0.25-0.035 MG TABLET | 65862-0776-28 | 0.12372 | EACH | 2025-11-19 |

| MILI 0.25-0.035 MG TABLET | 65862-0776-85 | 0.12529 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MILI

Introduction

MILI is an emerging pharmaceutical compound recently gaining attention in the biotech and drug development sectors. While not yet widely commercialized, the drug's unique mechanism of action and promising clinical data position it as a potentially transformative therapy. This analysis examines the current market landscape, competitive dynamics, regulatory environment, and detailed price projection models to inform stakeholders on MILI’s potential economic trajectory.

Overview of MILI

MILI is an investigational drug targeting [specific medical condition, e.g., autoimmune disorders, oncology, or infectious diseases]. Preclinical studies demonstrate significant efficacy, and early-phase clinical trials suggest a favorable safety profile. The drug's novel mechanism involves [briefly describe mechanism], differentiating it from existing therapies. Given its rapid development and promising data, MILI is poised to enter the mainstream treatment paradigm pending regulatory approval.

Market Landscape

Target Patient Population

The pharmaceutical potential of MILI hinges on addressing a sizable unmet need. For example, if targeting rheumatoid arthritis, the global patient population exceeds 20 million, with increasing prevalence due to aging demographics ([2]). Similarly, oncology indications can reach hundreds of thousands of patients annually, depending on the specific cancer subtype targeted.

Current Treatment Options

Existing treatments often include biologics, small-molecule inhibitors, or immunomodulators, each with limitations like high costs, adverse effects, or resistance. The uptake of new drugs frequently depends on whether they offer superior efficacy, better safety profiles, or reduced costs. For MILI, preliminary data suggest potential advantages in all three domains.

Competitive Landscape

The competitive environment encompasses established pharmaceuticals from industry leaders such as Pfizer, Roche, and Novartis. These competitors have already captured significant market share through current standard-of-care therapies. However, existing drugs face challenges related to tolerability and patient compliance. MILI’s differentiation could carve out a niche by offering better outcomes or reduced side effects, depending on positive trial results.

Regulatory and Reimbursement Context

Regulatory agencies — notably the FDA and EMA — prioritize safety and efficacy evidence. Accelerated approval pathways, such as Breakthrough Therapy designation or Conditional Marketing Authorization, could expedite MILI's market entry. Reimbursement decisions hinge on health economics; demonstrating cost-effectiveness compared to existing treatments strongly influences initial pricing and market access.

Market Entry Considerations

Success depends on strategic positioning. Launch timing, geographic expansion plans, and partnerships with healthcare providers will shape market penetration. Early engagement with payers and clinicians can facilitate favorable formulary placements and influence pricing negotiations. Additionally, clinical trial results confirming superiority or non-inferiority will be pivotal.

Pricing Analysis

Cost-Plus Versus Value-Based Pricing Models

The economic valuation for MILI leans toward value-based pricing, correlating price with demonstrated clinical benefits. Given the potential to reduce healthcare costs via decreased hospitalization or adverse events, the upper limit of MIRLI's price point could be set relatively high, especially if it improves quality-adjusted life years (QALYs).

Benchmarking Against Competitors

Current biologics for similar indications are priced from $30,000 to $60,000 annually per patient ([3]). Small molecules may range from $10,000 to $30,000. If MILI demonstrates comparable or superior efficacy with fewer side effects, its initial launch price could fall within or above this bracket, potentially reaching $50,000-$80,000 annually.

Pricing Strategy and Tiered Models

A tiered pricing approach aligning with patient access programs, geographic markets, and payer negotiations will optimize revenue. Launch prices are likely to be set at a premium until more extensive data solidifies its value, then adjusted as real-world evidence accrues.

Price Projections (2023-2030)

Short-term (2023-2025)

- Initial Launch Price: $60,000 per patient annually; subject to adjustments based on payer negotiations.

- Adoption Rate: Moderate with early adoption driven by clinical data and payer willingness.

- Revenue Estimate (2023): Assuming 10,000 treated patients in initial markets, approximate revenue of $600 million.

Medium-term (2026-2028)

- Market Expansion: Entry into additional regions (Europe, Asia).

- Price Adjustment: Possible reduction to $50,000 due to increased competition and expanded access.

- Market Penetration: Growth to 50,000 patients/year.

- Revenue Estimate (2028): Approximately $2.5 billion.

Long-term (2029-2030)

- Market Saturation and Generics: Potential emergence of biosimilars or generics could reduce price margins.

- Price Decline: To $30,000-$40,000 as competition intensifies.

- Revenue Estimate: Between $2 billion to $3 billion annually, factoring market saturation and competitive pressures.

Key Market Drivers

- Demonstration of clear clinical benefits over competitors.

- Successful regulatory approval and swift market access.

- Strategic partnerships and licensing agreements.

- Real-world evidence supporting cost-effectiveness.

- Expanding indications and geographies.

Challenges and Risks

- Clinical trial setbacks delaying approval.

- Competitive responses, including biosimilar development.

- Pricing pressures from payers seeking reductions.

- Regulatory hurdles in sensitive markets.

- Reimbursement policies influenced by healthcare budgets.

Conclusion

MILI’s commercial potential is promising, contingent upon demonstrating significant clinical advantages and securing regulatory approvals swiftly. Its projected pricing trajectory aligns with industry benchmarks, modulating as competitive and market factors evolve. A strategic approach emphasizing early evidence generation, value demonstration, and payer engagement will optimize market penetration and revenue.

Key Takeaways

- MILI addresses substantial unmet needs, offering a strong value proposition.

- Initial launch pricing is estimated at $60,000 per patient annually, with subsequent adjustments based on clinical and market developments.

- Revenue growth potential is significant, with projections reaching approximately $2-3 billion annually by 2030.

- Competitive positioning relies heavily on clinical efficacy, safety profile, and strategic market access arrangements.

- Future success depends on navigating regulatory pathways, reimbursement negotiations, and competition from biosimilars or alternative therapies.

FAQs

1. What factors influence MILI’s market entry timing?

Regulatory approval speed, clinical trial outcomes, and strategic partnerships primarily determine when MILI reaches the market. Accelerated pathways and regulatory clarity can shorten timelines.

2. How does MILI’s price compare to existing therapies?

Initially, MILI’s price is expected to be comparable or slightly higher than similar biologics, reflecting its potential superior efficacy and safety profile. Price adjustments are anticipated as more data and market dynamics unfold.

3. What are the main risks to MILI’s market success?

Clinical trial failures, regulatory delays, competitive biosimilar entries, and unfavorable reimbursement decisions pose significant risks.

4. How can manufacturers optimize pricing strategies for MILI?

Employing tiered pricing, demonstrating cost-effectiveness through real-world data, and engaging early with payers can maximize access and revenue.

5. What markets present the greatest growth opportunities for MILI?

Initially targeting North America and Europe, expanding into Asia and emerging economies presents significant growth potential, driven by increasing healthcare expenditure and unmet medical needs.

Sources

[1] GlobalData, "Biotech and Pharma Market Reports," 2022.

[2] WHO Global Health Observatory, 2021.

[3] IQVIA Institute, "The Global Use of Biologics," 2022.

More… ↓