MIEBO Drug Patent Profile

✉ Email this page to a colleague

When do Miebo patents expire, and what generic alternatives are available?

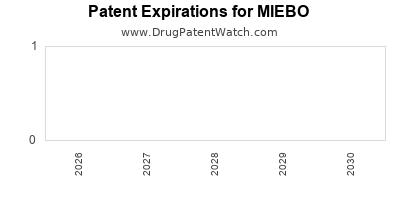

Miebo is a drug marketed by Bausch And Lomb Inc and is included in one NDA. There are six patents protecting this drug.

This drug has one hundred and nine patent family members in sixteen countries.

The generic ingredient in MIEBO is perfluorohexyloctane. One supplier is listed for this compound. Additional details are available on the perfluorohexyloctane profile page.

DrugPatentWatch® Generic Entry Outlook for Miebo

Miebo will be eligible for patent challenges on May 18, 2027. This date may extended up to six months if a pediatric exclusivity extension is applied to the drug's patents.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be May 18, 2028. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for MIEBO?

- What are the global sales for MIEBO?

- What is Average Wholesale Price for MIEBO?

Summary for MIEBO

| International Patents: | 109 |

| US Patents: | 6 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

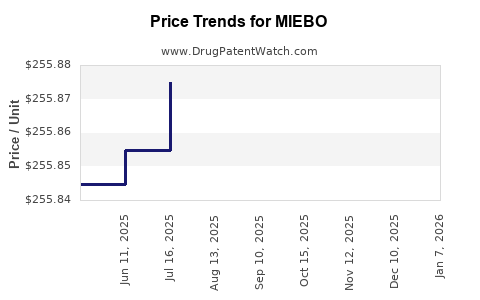

| Drug Prices: | Drug price information for MIEBO |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for MIEBO |

| What excipients (inactive ingredients) are in MIEBO? | MIEBO excipients list |

| DailyMed Link: | MIEBO at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for MIEBO

Generic Entry Date for MIEBO*:

Constraining patent/regulatory exclusivity:

NEW CHEMICAL ENTITY NDA:

Dosage:

SOLUTION/DROPS;OPHTHALMIC |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Pharmacology for MIEBO

| Drug Class | Semifluorinated Alkane |

US Patents and Regulatory Information for MIEBO

MIEBO is protected by six US patents and one FDA Regulatory Exclusivity.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of MIEBO is ⤷ Get Started Free.

This potential generic entry date is based on NEW CHEMICAL ENTITY.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bausch And Lomb Inc | MIEBO | perfluorohexyloctane | SOLUTION/DROPS;OPHTHALMIC | 216675-001 | May 18, 2023 | RX | Yes | Yes | 10,576,154 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Bausch And Lomb Inc | MIEBO | perfluorohexyloctane | SOLUTION/DROPS;OPHTHALMIC | 216675-001 | May 18, 2023 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Bausch And Lomb Inc | MIEBO | perfluorohexyloctane | SOLUTION/DROPS;OPHTHALMIC | 216675-001 | May 18, 2023 | RX | Yes | Yes | 10,369,117 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Bausch And Lomb Inc | MIEBO | perfluorohexyloctane | SOLUTION/DROPS;OPHTHALMIC | 216675-001 | May 18, 2023 | RX | Yes | Yes | 10,507,132 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Bausch And Lomb Inc | MIEBO | perfluorohexyloctane | SOLUTION/DROPS;OPHTHALMIC | 216675-001 | May 18, 2023 | RX | Yes | Yes | 10,449,164 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Bausch And Lomb Inc | MIEBO | perfluorohexyloctane | SOLUTION/DROPS;OPHTHALMIC | 216675-001 | May 18, 2023 | RX | Yes | Yes | 11,357,738 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Bausch And Lomb Inc | MIEBO | perfluorohexyloctane | SOLUTION/DROPS;OPHTHALMIC | 216675-001 | May 18, 2023 | RX | Yes | Yes | 10,058,615 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for MIEBO

When does loss-of-exclusivity occur for MIEBO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 13314303

Patent: Semifluorinated alkane compositions

Estimated Expiration: ⤷ Get Started Free

Patent: 13314370

Patent: Compositions comprising mixtures of semifluorinated alkanes

Estimated Expiration: ⤷ Get Started Free

Patent: 16219611

Patent: Compositions comprising mixtures of semifluorinated alkanes

Estimated Expiration: ⤷ Get Started Free

Patent: 17200907

Patent: SEMIFLUORINATED ALKANE COMPOSITIONS

Estimated Expiration: ⤷ Get Started Free

Patent: 18201364

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2015004997

Patent: composições contendo misturas de alcanos semifluorados

Estimated Expiration: ⤷ Get Started Free

Patent: 2015005008

Patent: composições de alcano semifluorado

Estimated Expiration: ⤷ Get Started Free

Patent: 2019024319

Patent: USO DE COMPOSIÇÕES DE ALCANO SEMIFLUORADO NA FABRICAÇÃO DE UM MEDICAMENTO PARA O TRATAMENTO DE UMA CONDIÇÃO ASSOCIADA COM QUERATOCONJUNTIVITE SECA

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 83002

Patent: COMPOSITIONS COMPRENANT DES MELANGES D'ALCANES SEMI-FLUORES (COMPOSITIONS COMPRISING MIXTURES OF SEMIFLUORINATED ALKANES)

Estimated Expiration: ⤷ Get Started Free

Patent: 83003

Patent: COMPOSITIONS D'ALCANES SEMIFLUORES (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 97744

Patent: COMPOSITIONS COMPRENANT DES MELANGES D'ALCANES SEMI-FLUORES (COMPOSITIONS COMPRISING MIXTURES OF SEMIFLUORINATED ALKANES)

Estimated Expiration: ⤷ Get Started Free

Patent: 42049

Patent: COMPOSITIONS D'ALCANES SEMIFLUORES (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 4619314

Patent: Compositions comprising mixtures of semifluorinated alkanes

Estimated Expiration: ⤷ Get Started Free

Patent: 4755073

Patent: Semifluorinated alkane compositions

Estimated Expiration: ⤷ Get Started Free

Patent: 6511322

Patent: 包含半氟化烷烃的混合物的组合物 (Compositions comprising mixtures of semifluorinated alkanes)

Estimated Expiration: ⤷ Get Started Free

Patent: 3679697

Patent: 包含半氟化烷烃的混合物的组合物 (COMPOSITIONS COMPRISING MIXTURES OF SEMIFLUORINATED ALKANES)

Estimated Expiration: ⤷ Get Started Free

Patent: 3679698

Patent: 包含半氟化烷烃的混合物的组合物 (COMPOSITIONS COMPRISING MIXTURES OF SEMIFLUORINATED ALKANES)

Estimated Expiration: ⤷ Get Started Free

Patent: 3679699

Patent: 包含半氟化烷烃的混合物的组合物 (COMPOSITIONS COMPRISING MIXTURES OF SEMIFLUORINATED ALKANES)

Estimated Expiration: ⤷ Get Started Free

Patent: 3694048

Patent: 包含半氟化烷烃的混合物的组合物 (COMPOSITIONS COMPRISING MIXTURES OF SEMIFLUORINATED ALKANES)

Estimated Expiration: ⤷ Get Started Free

Patent: 3952321

Patent: 包含半氟化烷烃的混合物的组合物 (Compositions comprising mixtures of semifluorinated alkanes)

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 95144

Estimated Expiration: ⤷ Get Started Free

Patent: 81119

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 95144

Patent: COMPOSITIONS D'ALCANE SEMIFLUORÉ (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 95158

Patent: COMPOSITIONS COMPRENANT DES MÉLANGES D'ALCANES SEMI-FLUORÉS (COMPOSITIONS COMPRISING MIXTURES OF SEMIFLUORINATED ALKANES)

Estimated Expiration: ⤷ Get Started Free

Patent: 00722

Patent: D'ALCANES SEMI-FLUORÉS POUR SOLUBILISER DE MEIBUM (SEMIFLUORINATED ALKANES FOR USE IN SOLUBILIZING MEIBUM)

Estimated Expiration: ⤷ Get Started Free

Patent: 81119

Patent: COMPOSITIONS D'ALKANE SEMIFLUORÉ POUR UTILISATION DANS LE TRAITEMENT DE LA SECHERESSE OCULAIRE (SEMIFLUORINATED ALKANE COMPOSITIONS FOR USE IN THE TREATMENT OF KERATOCONJUNCTIVITIS SICCA)

Estimated Expiration: ⤷ Get Started Free

Patent: 88847

Patent: COMPOSITIONS D'ALCANE SEMIFLUORÉ (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 42537

Patent: COMPOSITIONS D'ALCANE SEMIFLUORÉ (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Germany

Patent: 2013012742

Estimated Expiration: ⤷ Get Started Free

Patent: 2013012753

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 10041

Patent: 包含半氟化烷烴的混合物的組合物 (COMPOSITIONS COMPRISING MIXTURES OF SEMIFLUORINATED ALKANES)

Estimated Expiration: ⤷ Get Started Free

Patent: 10052

Patent: 半氟化烷烴組合物 (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 39152

Estimated Expiration: ⤷ Get Started Free

Patent: 53717

Estimated Expiration: ⤷ Get Started Free

Patent: 52266

Estimated Expiration: ⤷ Get Started Free

Patent: 52366

Estimated Expiration: ⤷ Get Started Free

Patent: 40893

Estimated Expiration: ⤷ Get Started Free

Patent: 40919

Estimated Expiration: ⤷ Get Started Free

Patent: 15527386

Patent: 半フッ素化アルカン組成物

Estimated Expiration: ⤷ Get Started Free

Patent: 15531344

Patent: 半フッ化アルカンの混合物を含む組成物

Estimated Expiration: ⤷ Get Started Free

Patent: 16193931

Patent: 半フッ化アルカンの混合物を含む組成物 (COMPOSITIONS CONTAINING SEMIFLUORINATED ALKANE MIXTURES)

Estimated Expiration: ⤷ Get Started Free

Patent: 17048228

Patent: 半フッ素化アルカン組成物 (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 18111704

Patent: 半フッ化アルカンの混合物を含む組成物 (COMPOSITION CONTAINING MIXTURE OF SEMI-FLUORIDATED ALKANE)

Estimated Expiration: ⤷ Get Started Free

Patent: 18150377

Patent: 半フッ素化アルカン組成物 (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 19001818

Patent: 半フッ素化アルカン組成物 (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 20073535

Patent: 半フッ素化アルカン組成物 (SEMIFLUORINATED ALKANE COMPOSITIONS)

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 5124

Estimated Expiration: ⤷ Get Started Free

Patent: 6228

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 0588

Estimated Expiration: ⤷ Get Started Free

Patent: 0469

Estimated Expiration: ⤷ Get Started Free

Patent: 3182

Estimated Expiration: ⤷ Get Started Free

Patent: 15003228

Estimated Expiration: ⤷ Get Started Free

Patent: 15003229

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 95144

Estimated Expiration: ⤷ Get Started Free

Patent: 81119

Estimated Expiration: ⤷ Get Started Free

Patent: 88847

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 95144

Estimated Expiration: ⤷ Get Started Free

Patent: 81119

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1874219

Estimated Expiration: ⤷ Get Started Free

Patent: 2115111

Estimated Expiration: ⤷ Get Started Free

Patent: 2158400

Estimated Expiration: ⤷ Get Started Free

Patent: 2171897

Estimated Expiration: ⤷ Get Started Free

Patent: 150054996

Estimated Expiration: ⤷ Get Started Free

Patent: 150054997

Estimated Expiration: ⤷ Get Started Free

Patent: 160104747

Estimated Expiration: ⤷ Get Started Free

Patent: 180101640

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 21226

Estimated Expiration: ⤷ Get Started Free

Patent: 45084

Estimated Expiration: ⤷ Get Started Free

Patent: 70398

Estimated Expiration: ⤷ Get Started Free

Patent: 65828

Estimated Expiration: ⤷ Get Started Free

Patent: 74663

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering MIEBO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Japan | 6039152 | ⤷ Get Started Free | |

| Hong Kong | 1257185 | ⤷ Get Started Free | |

| Malaysia | 165124 | ⤷ Get Started Free | |

| Denmark | 2895144 | ⤷ Get Started Free | |

| Japan | 2018150377 | 半フッ素化アルカン組成物 (SEMIFLUORINATED ALKANE COMPOSITIONS) | ⤷ Get Started Free |

| Mexico | 2015003229 | ⤷ Get Started Free | |

| Mexico | 2015003228 | COMPOSICIONES DE ALCANOS SEMIFLUORADOS. (SEMIFLUORINATED ALKANE COMPOSITIONS.) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: MIEBO

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.