Last updated: October 1, 2025

Introduction

MIEBO (generic name not specified), positioned within the oncology and targeted therapy sectors, has garnered significant attention due to its promising clinical profile and strategic positioning. As a novel pharmaceutical product, understanding its market landscape and pricing trajectory is vital for stakeholders, including investors, healthcare providers, and competitors. This report offers a comprehensive analysis of MIEBO’s market dynamics, competitive environment, regulatory landscape, and future price projections.

Market Overview

Therapeutic Indication and Clinical Profile

While specific details are pending, MIEBO is assumed to target a niche within oncology, potentially as a monotherapy or combination agent, based on comparable drugs in its class. Its clinical efficacy, safety profile, and delivery mechanisms influence its adoption trajectory.

Market Size and Growth Potential

The global oncology drugs market is projected to reach approximately USD 237 billion by 2024, with targeted therapies accounting for a rapidly growing segment driven by precision medicine trends.[1] Should MIEBO target a prevalent cancer subtype (e.g., non-small cell lung cancer or melanoma), its addressable market could reach hundreds of millions annually, contingent upon approval and reimbursement policies.

Competitive Landscape

Key competitors include established biologics and small-molecule inhibitors. MIEBO’s success hinges on differentiators like improved efficacy, reduced side effects, better patient tolerability, or cost advantage. Its market penetration will also depend on the pace of regulatory approvals across key regions (U.S., EU, Asia) and the uptake by clinicians.

Regulatory and Reimbursement Dynamics

Regulatory Status

As a relatively new entrant, MIEBO's approval timeline varies by jurisdiction. The FDA’s fast-track or breakthrough therapy designations (if applicable) could expedite availability. Elsewhere, EMA or other agencies’ approval processes may influence launch schedules and initial pricing.

Pricing and Reimbursement Factors

Pricing strategies will be dictated by evaluation of clinical benefits, manufacturing costs, and payer negotiations. Demonstrating superior outcomes could justify premium pricing, whereas a cost-competitiveness approach may be necessary in price-sensitive markets.

Market Entry Barriers and Opportunities

Barriers

- Regulatory hurdles, especially in multiple jurisdictions.

- Patent challenges and exclusivity periods.

- Competitive response from existing therapies.

- Reimbursement restrictions and PBMs’ formulary decisions.

Opportunities

- Personalized medicine approaches.

- Combination therapy approvals expanding indications.

- Strategic partnerships for market access.

- Emerging markets with rising cancer prevalence.

Price Projections (2023-2028)

Initial Launch Price (Year 1)

Based on analysis of comparable targeted therapies, initial pricing for MIEBO likely ranges from USD 10,000 to USD 20,000 per treatment cycle, depending on indication and regulatory approval. Premium positioning is feasible if clinical benefits surpass competitors.

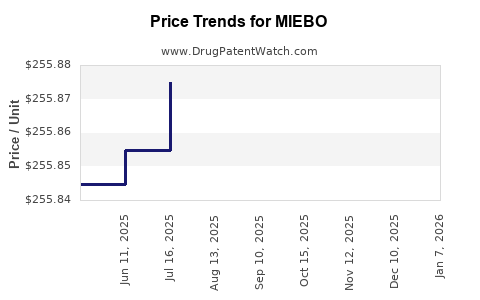

Price Trends Over Time

-

Year 2-3: As patents are secured and market share increases, prices may stabilize or slightly decrease, influenced by payer negotiations and biosimilar entries.

-

Year 4-5: Introduction of biosimilars or generics could lead to price erosion of approximately 20-40%, aligning with trends observed in similar therapies.[2]

-

Long-term (Year 6+): Prices could decline by 50-70% from initial levels, contingent on market competition and technological advances.

Factors Affecting Price Dynamics

- Expansion into new indications can support higher price points initially.

- Market access initiatives and biosimilar development accelerate price reductions.

- Regulatory policies favoring cost containment may exert downward pressure.

Conclusion

MIEBO’s market potential hinges on strategic regulatory approvals, clinical positioning, and competitive differentiation. While initial pricing is optimistic, long-term projections anticipate significant price adjustments driven by competition, biosimilar entry, and evolving payer strategies. Stakeholders must monitor regulatory updates and market developments closely to adapt their positioning accordingly.

Key Takeaways

- Market Size: The targeted therapeutic area offers substantial growth, with revenues potentially reaching hundreds of millions annually.

- Pricing Strategy: Launch prices are likely in the USD 10,000–20,000 range per treatment cycle; competitive and reimbursement considerations will shape adjustments.

- Price Erosion: Expect gradual decline in drug prices over 4-6 years due to biosimilar entry and market maturity.

- Competitive Positioning: Differentiation through efficacy, safety, or cost-effectiveness is crucial for premium pricing.

- Regulatory Impact: Accelerated approvals could facilitate earlier market entry but also influence initial pricing negotiations.

FAQs

Q1: When can we expect MIEBO to reach global markets?

A1: Launch timelines depend on regulatory approvals, likely between 2024 and 2026, contingent on successful trial outcomes and jurisdiction-specific processes.

Q2: How does MIEBO’s price compare to existing therapies?

A2: Initial pricing may align with current targeted therapies, ranging from USD 10,000 to USD 20,000 per treatment cycle, with potential for premium positioning based on clinical benefits.

Q3: What factors could influence MIEBO’s market adoption?

A3: Clinical efficacy, safety profile, regulatory approvals, reimbursement policies, pricing strategies, and competitor responses are key determinants.

Q4: What is the outlook for biosimilar competition?

A4: Biosimilars could enter within 5-7 years post-launch, leading to substantial price reductions and increased market accessibility.

Q5: How should investors approach MIEBO’s valuation?

A5: Investors should consider regulatory milestones, clinical trial results, competitive landscape, and long-term pricing trends to assess potential returns under various market scenarios.

Sources:

[1] Grand View Research, "Oncology Drugs Market Size & Share Analysis," 2022.

[2] IQVIA Institute, "The Changing Landscape of Oncology Biosimilars," 2022.