Last updated: July 27, 2025

Introduction

Methazolamide, a carbonic anhydrase inhibitor primarily used for the management of glaucoma and edema, has maintained a niche position within ophthalmology and neurology markets. Its unique mechanism of reducing intraocular pressure and cerebral fluid production makes it a critical therapeutic agent for specific indications. However, despite its clinical importance, the drug's market share, revenue trajectory, and competitive landscape are influenced by broader market dynamics, emerging therapeutic alternatives, regulatory considerations, and evolving healthcare paradigms.

This report offers a comprehensive analysis of the market forces shaping methazolamide’s commercial landscape, its financial trajectory, and the factors influencing future growth prospects.

Market Overview and Clinical Applications

Methazolamide's primary indications include:

- Glaucoma: Used as an adjunct or alternative to other carbonic anhydrase inhibitors (e.g., acetazolamide) for reducing intraocular pressure (IOP). Its longer duration of action and fewer systemic side effects position it as a favorable choice for chronic management.

- Edema and Certain Neurological Conditions: Off-label applications include treatment of edema and specific neurological conditions associated with hydrocephalus, although these constitute a smaller portion of its market.

Despite being an established medication, methazolamide is often overshadowed by its more widely known counterparts, like acetazolamide, which enjoy broader approval, extensive marketing, and higher prescription volumes.

Market Dynamics

1. Competitive Landscape

The pharmaceutical market for carbonic anhydrase inhibitors (CAIs) is characterized by intense competition:

- Generic Availability: Methazolamide is available as a generic in multiple markets, significantly impacting pricing and profit margins. The widespread availability of cheaper alternatives reduces its revenue potential.

- Emerging Therapeutics: Newer drugs with improved safety profiles and targeted delivery systems, such as prostaglandin analogs, have shifted treatment paradigms towards medications with fewer systemic side effects.

- Combination Therapies: Increasing reliance on fixed-dose combinations offers convenience but often excludes older drugs like methazolamide, further constraining its growth potential.

2. Regulatory and Reimbursement Influences

Global regulatory pathways, such as the FDA’s and EMA’s approval processes, determine drug accessibility and market entry:

- Approval Status: Methazolamide enjoys approval in certain regions but faces regulatory hurdles elsewhere, limiting global expansion.

- Healthcare Policies: Reimbursement frameworks favor newer, innovator drugs with proven safety and efficacy profiles. This dynamic marginalizes older, generic drugs like methazolamide unless they are explicitly preferred for cost reasons.

3. Prescribing Trends

Physician prescribing behavior hinges on:

- Efficacy and Safety Profile: While effective, methazolamide’s side effects—such as metabolic acidosis and electrolyte imbalance—encumber its risk-benefit balance, reducing its appeal over newer agents.

- Patient Compliance: Once-daily formulations are favored for improving adherence, but newer drugs designed with advanced delivery mechanisms threaten methazolamide's market share.

4. Market Penetration in Emerging Economies

In lower-income regions, cost considerations sustain demand for generics like methazolamide. However, local competition and regulatory changes influence its penetration, with some countries favoring newer or locally produced alternatives.

Financial Trajectory

1. Revenue Trends

Historical data indicates that methazolamide's global sales have remained relatively stable yet modest, constrained mainly by generic competition and niche indication use:

- Market Size Estimates: The estimated global market for ophthalmic and neurological CAIs ranges between USD 300–500 million annually, with methazolamide accounting for approximately 10–15% depending on regional prevalence and prescriber preferences.

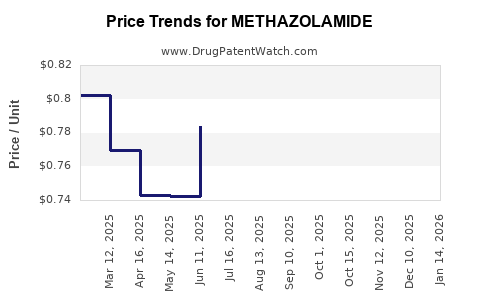

- Revenue Stability: As a largely generic product, profit margins are narrow, and revenues are sensitive to pricing pressures and formulary restrictions.

2. Influencing Factors

- Generic Price Erosion: Price reductions due to generic competition have likely led to declining per-unit margins.

- Regional Variations: Emerging markets’ demand sustains a steady revenue stream, whereas mature markets exhibit stagnation or slight declines.

- Patent Status: Being off-patent for decades influences a flat revenue trajectory; innovations or new formulations could alter this dynamic.

3. Future Revenue Opportunities

- New Formulations: Development of controlled-release formulations or combination therapies could enhance value.

- Regulatory Expansion: Obtaining approvals in additional markets could open avenues for increased sales, albeit with significant investment.

- Strategic Partnerships: Alliances with regional generic manufacturers may sustain or boost sales, especially where healthcare cost constraints dominate.

Market Challenges and Opportunities

Challenges:

- Side Effect Profile: Older drugs like methazolamide face resistance due to adverse effects.

- Competition from Newer Agents: Advances in glaucoma therapeutics, especially drug delivery innovations, threaten market share.

- Limited Marketing: As a generic, it typically receives less promotional support, impacting prescriber awareness.

Opportunities:

- Niche Markets: Focused application in specific patient segments with contraindications to newer agents.

- Cost-effective Treatment: Growing demand for affordable medications in developing countries supports continued use.

- Combination Strategies: Incorporating methazolamide into combination formulations could recapture market interest.

Future Outlook

The financial trajectory for methazolamide appears modestly stable but exhibits a neutral or declining trend without strategic repositioning:

- Short-term (1–3 years): Expect marginal revenue decline driven by generics and alternative treatment options.

- Medium-term (3–5 years): Opportunities may arise through formulation innovations and expanding approval — but significant gains depend on strategic investments.

- Long-term (>5 years): The drug’s position will likely diminish barring breakthroughs; focus should shift to niche applications.

Key Takeaways

- Methazolamide’s market remains constrained by generic competition, safety concerns, and evolving treatment preferences.

- The drug’s revenue prospects depend heavily on geographic and therapeutic niche exploitation.

- Innovations in formulation or expanded regulatory approval could temporarily bolster its financial trajectory.

- The overall trend suggests a plateau or slight decline unless new strategic initiatives are implemented.

- Cost-effective and targeted use in emerging markets continues to sustain its relevance but offers limited upside.

FAQs

1. What are the main drivers of methazolamide's market demand?

Demand is primarily driven by its use in glaucoma management, especially in regions with limited access to newer therapies, and in patients intolerant to other CAIs.

2. How does generic drug competition impact methazolamide’s profitability?

Generic competition significantly reduces prices, compresses profit margins, and limits marketing efforts, resulting in a stable or declining revenue trajectory.

3. Are there any ongoing efforts to improve methazolamide’s market position?

Innovations like controlled-release formulations and new indications are under exploration but are not yet established in the market.

4. Which regions hold the most promise for methazolamide’s growth?

Emerging markets, where cost considerations favor generics, remain the most promising, provided regulatory hurdles are navigated effectively.

5. What strategic steps could revitalize methazolamide’s sales?

Developing combination therapies, expanding indications, improving formulations, and targeted marketing in niche markets could sustain or enhance its market presence.

References

[1] Market research reports and industry analyses, 2022-2023.

[2] Published pharmaco-economic studies on glaucoma medications.

[3] Regulatory agency publications on drug approvals and status.

[4] Scientific literature on the safety profile and therapeutic efficacy of carbonic anhydrase inhibitors.