Last updated: July 28, 2025

Introduction

Methazolamide, a carbonic anhydrase inhibitor primarily utilized in the management of glaucoma and ocular hypertension, holds a niche in the pharmaceutical landscape. Its role in reducing intraocular pressure makes it a vital option where other medications may be contraindicated or ineffective. Understanding market dynamics and price forecasts for methazolamide is essential for stakeholders across pharmaceutical companies, healthcare providers, and investors seeking to navigate this specialized market segment.

Market Overview

Therapeutic Landscape

Methazolamide belongs to the class of carbonic anhydrase inhibitors (CAIs), used chiefly in ophthalmology but also in some cases for altitude sickness and epilepsy. Its advantages over alternatives like acetazolamide include a longer duration of action and fewer systemic side effects, fueling its continued clinical relevance where indicated.

Market Size and Demand Drivers

The global ophthalmic pharmaceuticals market has experienced steady growth, driven by increasing prevalence of glaucoma and age-related ocular diseases. According to Mordor Intelligence, the global glaucoma therapeutics market was valued at approximately USD 5.4 billion in 2021, with a Compound Annual Growth Rate (CAGR) forecast of around 6.0% from 2022 to 2027. While most of this revenue is derived from constructs like prostaglandin analogs and beta-blockers, niche medications such as methazolamide benefit from ongoing clinical adoption, particularly in regions with emerging ophthalmic care infrastructure.

Global demand for methazolamide remains limited compared to first-line agents, but its usage persists in specific markets such as Asia-Pacific, South America, and certain European countries. The uptake is often linked to prescriber familiarity, regulatory approvals, and cost considerations.

Regulatory and Patent Landscape

Methazolamide is available as a generic medication in several regions, which influences pricing and market competition. Its patent expiration, generally occurring over a decade ago, has led to widespread generic manufacturing, underpinning lower prices but also constraining revenue for brand-name manufacturers. Regulatory approvals vary by country, influencing availability and prescribing patterns.

Market Dynamics and Competitive Landscape

Key Players and Distribution Channels

Generic manufacturers dominate the synthetic space for methazolamide, including Indian and Chinese pharmaceutical companies. Limited patent protection and minimal brand-name presence reduce market exclusivity, pressuring prices downward.

Distribution channels include hospitals, retail pharmacies, and specialty ophthalmology clinics. Cost-sensitive markets often favor generics, while premium or specialized formulations are available through selective channels.

Pricing Factors

- Production Costs: Manufacturing costs for generics are relatively low, especially in economies with high-volume production.

- Market Competition: The presence of multiple generic suppliers leads to aggressive pricing strategies.

- Regulatory Environment: Stringent regulatory approval processes can inflate costs in certain regions, impacting wholesale prices.

- Healthcare System and Reimbursement Policies: In countries with national health services or insurance reimbursement, prices are often negotiated downward, influencing retail prices.

Price Projections for Methazolamide

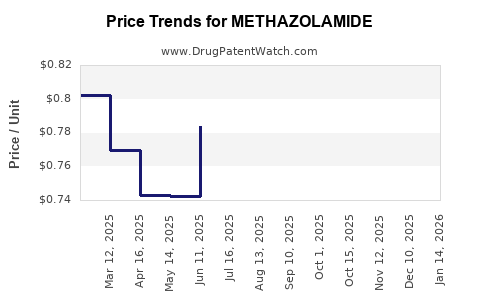

Historical Pricing Trends

In markets such as India and China, methazolamide has historically been sold at prices significantly lower than alternative agents like acetazolamide and dorzolamide. For example, in India, a 25 mg tablet ranges from USD 0.05 to USD 0.10 per tablet, reflecting intense price competition.

In contrast, in developed markets such as the U.S. and Europe, methazolamide's off-label use is limited, with availability mainly through imports or specialized channels. Prices there tend to be higher, often USD 1.00 to USD 3.00 per tablet, primarily driven by import costs and niche demand.

Projected Price Trends (2023-2030)

- Continued Price Stability: Given the mature generic market and low barriers to entry, prices are expected to remain relatively stable, with minor fluctuations influenced by raw material costs, currency exchange rates, and regulatory changes.

- Potential for Slight Decrease: Market saturation and increased manufacturing efficiencies are likely to exert downward pressure, especially in emerging markets, potentially pushing prices to below USD 0.05 per tablet for bulk procurement.

- Regional Variations: Prices in developed countries could remain higher due to importation and distribution costs, but trends suggest a gradual decline aligned with global generic pricing standards.

Influencing Factors

- Regulatory shifts: Any new approvals or restrictions could alter market access, influencing prices.

- Market demand fluctuations: Growth in glaucoma prevalence or shifts in treatment protocols may temporarily affect prices.

- Emergence of new therapies: Advances in glaucoma treatment could reduce demand, pressuring prices further downward over time.

Market Challenges and Opportunities

Challenges

- Limited Market Penetration: Narrow therapeutic niche restricts extensive market growth.

- Pricing Pressures: High generic competition suppresses margins.

- Regulatory Hurdles: Variations in approval status impede consistent global distribution.

Opportunities

- Emerging Markets: Growing healthcare infrastructure and increasing ophthalmic diagnoses offer expansion avenues.

- Formulation Innovation: Developing new formulations or combination therapies could elevate product value.

- Strategic Alliances: Partnerships with regional generic producers can enhance market access and pricing power.

Conclusion

Methazolamide occupies a specialized niche with steady but modest market potential. The abundance of generic competition and incremental demand growth suggest a largely flat price trajectory, with prices in emerging markets remaining at historically low levels, and slight declines projected globally. Stakeholders should focus on regional regulatory landscapes, potential for formulary expansion, and emerging ophthalmic needs for strategic positioning.

Key Takeaways

- Market Size: Small but stable, driven by niche ophthalmic indications and regional demand, especially in non-Western markets.

- Price Stability: Due to widespread generic manufacturing, prices are expected to stay low, with minor downward pressure.

- Regional Variations: Prices are significantly lower in emerging markets; controlled and higher in developed economies.

- Competitive Landscape: Highly commoditized segment with minimal brand differentiation, influencing prices.

- Future Outlook: Opportunities tied to regional healthcare development and formulation innovation; significant price declines unlikely given current market dynamics.

FAQs

1. What factors influence methazolamide pricing across different markets?

Pricing is primarily impacted by the level of market competition, manufacturing costs, regulatory approvals, import tariffs, and regional healthcare reimbursement policies.

2. How does the patent landscape affect methazolamide prices?

As a largely off-patent generic drug, methazolamide faces limited intellectual property protections, leading to increased competition and lower prices globally.

3. Are there any premium formulations of methazolamide?

Currently, no prominent premium formulations exist; the market predominantly consists of standard generic tablets with comparable efficacy.

4. What emerging trends could influence methazolamide's market and pricing?

Introduction of new glaucoma treatments, novel formulations, or improved delivery systems may impact demand for methazolamide, potentially reducing its market share and further pressuring prices.

5. How significant is methazolamide's role in the global glaucoma treatment market?

Its role is limited but vital in specific settings; it serves as an alternative or adjunct in cases where first-line agents are unsuitable or unavailable.

References

[1] Mordor Intelligence. (2022). Global Glaucoma Therapeutics Market.

[2] EvaluatePharma. (2021). Pharmaceutical Price and Market Trends.

[3] World Health Organization. (2020). Global Burden of Disease Study.

[4] Indian Pharmacopoeia Commission. (2021). Official Drug Price Listings.

[5] U.S. Food and Drug Administration. (2022). Regulatory Status of Ophthalmic Drugs.