Last updated: July 27, 2025

Introduction

Meropenem, a broad-spectrum carbapenem antibiotic, plays a pivotal role in combating severe bacterial infections, especially those resistant to other antibiotics. Approved for use since the early 2000s, meropenem’s market trajectory is influenced by evolving antimicrobial resistance, regulatory policies, and emerging competition. This comprehensive analysis examines the global market dynamics, pricing strategies, revenue projections, and key factors shaping the financial landscape of meropenem.

Market Overview

Therapeutic Indications and Usage

Meropenem targets complicated intra-abdominal infections, meningitis, pneumonia, and sepsis, primarily in hospital settings. Its broad efficacy against multidrug-resistant organisms (MDROs) has cemented its position within critical care pharmacotherapy. The global rise of resistant pathogens, notably carbapenem-resistant Enterobacteriaceae (CRE), underpins increasing demand for meropenem [1].

Manufacturers and Market Players

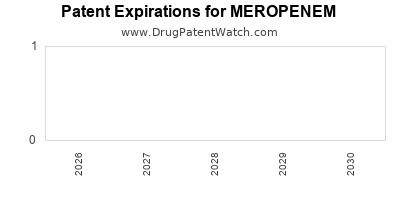

Leading pharmaceutical firms—such as SMR, Fresenius Kabi, and biosimilar manufacturers—are active in production and distribution. Patent statuses have largely expired, encouraging generic entries that have significantly lowered prices and expanded access worldwide.

Market Dynamics

Drivers

- Antibiotic Resistance Crisis: The escalation of bacterial resistance directly correlates with increased reliance on meropenem as a last-resort therapy.

- Hospital-Centric Usage: Extensive usage in hospital intensive care units (ICUs) sustains steady demand.

- Regulatory Approvals and Off-Label Uses: Expanded indications bolster market size; regulatory endorsements in emerging markets broaden geographic reach.

- Growing Global Healthcare Spending: Investments in infectious disease management, especially in Asia-Pacific and Latin America, open new markets.

Challenges

- Antimicrobial Stewardship: Heightened surveillance and stewardship programs limit overuse to slow resistance development, impacting sales volumes.

- Resistance Development: Emergence of resistance to carbapenems threatens future efficacy, potentially leading to market saturation or declines.

- Price Pressures: Increased generic competition has driven prices downward, impacting revenue margins.

- Regulatory Hurdles: Stringent approval pathways and laudable efforts to curb antibiotic overuse may hamper new market entries.

Opportunities

- Development of Fixed-Dose Combinations: Combining meropenem with adjuvants to counteract resistance offers growth potential.

- Emerging Market Expansion: Countries like China, India, and Brazil exhibit surging antimicrobial consumption, representing sizable opportunities.

- Alternative Delivery Formulations: Innovations such as once-daily dosing could improve compliance and marketability.

Financial Trajectory

Revenue Streams

Meropenem’s revenue is primarily derived from hospital procurement contracts and direct sales. As of recent data, global sales are estimated to surpass $750 million annually, with growth rates around 3-5% contingent on regional demand and resistance trends.

Pricing Trends

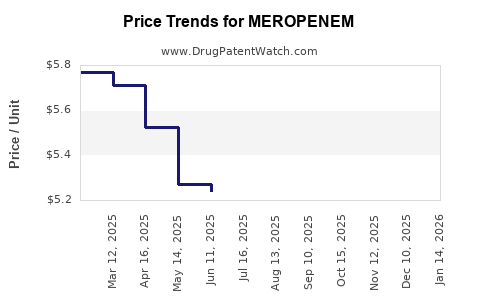

Post-patent expiration, median generic prices for meropenem have declined by approximately 30-50%, with disparities based on geographic regions and procurement volumes. High-income markets retain premium pricing for branded formulations, whereas developing nations focus on cost-effective generics.

Forecasts

Analysts predict the global meropenem market will grow steadily at a compound annual growth rate (CAGR) of 4% to 6% over the next five years. This growth reflects the expanding burden of resistant infections and increased hospitalizations for infectious diseases.

Impact of Resistance and Stewardship

While resistance threatens long-term viability, ongoing research and stewardship are mitigating immediate impacts. Prices could stabilize or slightly decline if resistance causes shifts in hospital formularies or prompts alternative therapies.

Regulatory and Policy Influences

Stringent antimicrobial resistance policies, such as the CDC's and WHO's stewardship programs, emphasize prudent use, potentially constraining volume growth. Conversely, regulatory incentives for novel antibiotics or formulations may foster innovation and new revenue streams.

Regional Market Insights

North America

Dominates due to high healthcare expenditure, advanced hospital infrastructure, and robust antimicrobial stewardship programs. Despite narrower margins driven by generic competition, steady demand persists.

Europe

Market growth driven by aging populations and stringent infection control measures. Patent expiries have led to increased generic penetration.

Asia-Pacific

Highest growth potential; rapid pharmaceutical industry expansion, rising healthcare access, and burgeoning prevalence of resistant infections contribute to an expanded market.

Latin America and Middle East

Increasing adoption due to healthcare infrastructure development and international procurement initiatives, albeit with pricing constraints.

Strategic Considerations

- Pricing Strategy: Manufacturers need dynamic pricing models balancing affordability with profit margins amidst fierce generic competition.

- Research and Development: Investment in nominating formulations or combination therapies addressing resistance can augment market share.

- Market Penetration: Focused marketing in emerging markets, coupled with strategic partnerships, can accelerate growth.

- Stewardship Collaboration: Aligning with stewardship programs can ensure sustained demand while mitigating resistance development.

Key Takeaways

- Growing Need Amid Resistance: The escalating bacterial resistance, especially against carbapenems, sustains demand for meropenem, positioning it as a critical antibiotic in hospital settings.

- Pricing and Competition: Post-patent generic proliferation has driven prices down, impacting revenue margins, necessitating strategic adaptation by manufacturers.

- Emerging Markets: Rapid economic growth and expanding healthcare infrastructure in Asia-Pacific and Latin America present significant growth avenues.

- Innovation Drives Growth: Developing new formulations or combination therapies targeting resistance can reinvigorate market interest and extend drug lifecycle.

- Regulatory and Stewardship Balance: Navigating global policies requires strategic agility to maximize revenue while supporting responsible antibiotic use.

FAQs

1. How will antimicrobial resistance impact the future sales of meropenem?

Antimicrobial resistance threatens meropenem's efficacy, potentially reducing its clinical utility. However, the rising incidence of multidrug-resistant infections ensures sustained, albeit possibly reduced, demand. Continued investment in stewardship programs and innovation can mitigate negative impacts.

2. What role do generic manufacturers play in the meropenem market?

Generic manufacturers have expanded accessibility, significantly reducing prices post-patent expiry. Their role is crucial in lowering healthcare costs in emerging markets but pressures branded stakeholders’ margins.

3. Are there upcoming innovations that could influence meropenem’s market evolution?

Yes. Research into fixed-dose combinations with β-lactamase inhibitors, novel formulations, or delivery methods aims to improve activity against resistant strains, potentially opening new revenue streams and extending market relevance.

4. How significant is the impact of global healthcare expenditure on meropenem’s market?

Higher healthcare spending, particularly in emerging economies, correlates with increased access to advanced antibiotics like meropenem. This factor significantly influences regional growth trajectories and pricing strategies.

5. What regulatory challenges could affect meropenem’s market expansion?

Regulatory efforts targeting antimicrobial stewardship, approval delays for new indications, or restrictions on over-the-counter sales can limit availability, affecting market expansion.

References

[1] World Health Organization. (2021). Global antimicrobial resistance surveillance system (GLASS) report.

[2] MarketWatch. (2022). Meropenem Market Size, Share & Trends Analysis by Region, Drug Type, and Application.

[3] GlobalData. (2023). Antibiotics Market Forecast and Trends.

[4] CDC. (2022). Antibiotic Stewardship Programs and Their Impact on Resistance Trends.

[5] IMS Health. (2021). Pharmaceutical Market Data Analytics.

In conclusion, meropenem’s market trajectory remains robust amid challenges posed by resistance and pricing pressures. Strategic innovation, regional expansion, and stewardship-conscious policies are vital to capitalize on growth opportunities in the evolving antimicrobial landscape.