Last updated: July 31, 2025

Introduction

LUPRON, a brand of leuprolide acetate, is a gonadotropin-releasing hormone (GnRH) agonist widely used in the treatment of hormone-dependent conditions such as prostate cancer, endometriosis, uterine fibroids, and central precocious puberty. Since its FDA approval decades ago, its market landscape has evolved, influenced by technological, regulatory, and competitive shifts. Analyzing its market dynamics and financial trajectory provides vital insights for stakeholders navigating this complex pharmaceutical terrain.

Historical Market Position and Revenue Generation

LUPRON, marketed predominantly by AbbVie (formerly a part of Abbott), has established itself as a pivotal therapeutic in hormone-modulating therapies. Historically, the drug’s revenue stems from its staple indications—most notably prostate cancer management, which accounts for a significant proportion. In 2020, LUPRON’s global sales surpassed $1.2 billion, with individual markets like the U.S. contributing around $700 million (per IQVIA data). The strong foothold in prostate cancer treatment, combined with the chronic nature of its indications, ensures steady revenue streams.

Market Drivers

1. Aging Population and Demographic Shifts

The global increase in aging populations fosters a higher prevalence of prostate cancer and endometriosis, directly elevating demand for LUPRON. The expanding elderly demographic in the U.S., Europe, and Asia amplifies market size, especially in prostate cancer, where late-stage patients require ongoing therapy.

2. Disease Prevalence and Diagnosis Rates

The rising awareness and improved diagnostic practices for hormone-related conditions have increased the identified patient base, aligning with earlier treatment initiation using LUPRON. Noteworthy is the heightened detection of prostate cancer, boosting the consistent need for androgen deprivation therapy.

3. Expanding Indications

Recent approvals and clinical trials exploring LUPRON’s utility in indications such as hormone-sensitive breast cancer and pediatric central precocious puberty diversify revenue sources. Such expansion safeguards against market saturation in existing indications.

4. Competitive Landscape

While LUPRON commands significant market share, competition from generics and biosimilars, particularly in mature markets, constrains unbridled revenue growth. Notably, generic versions of leuprolide acetate entered the market post-patent expiry (critical dates roughly around 2018–2020), exerting downward pressure on prices.

Market Challenges

1. Patent Expiry and Generics

Patent cliffs in recent years have enabled generic manufacturers to introduce biosimilar versions at substantially lower costs, eroding revenue margins. The smaller margin can threaten profitability unless differentiated through formulation or delivery innovations.

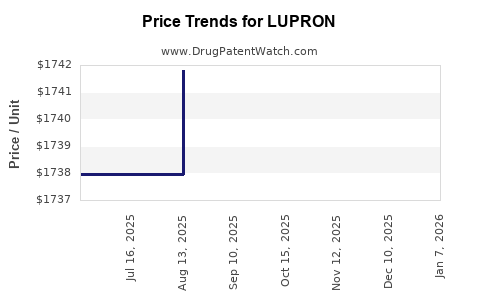

2. Pricing Pressures and Reimbursement Policies

In the U.S., growing scrutiny of drug prices by policymakers and payers compels pharmaceutical companies to implement price concessions, impacting revenues. Additionally, reimbursement restrictions for injectable biologics have encouraged shifts towards oral alternatives or other treatment modalities.

3. Advancements in Alternative Therapies

Emerging therapies, including oral GnRH antagonists (e.g., relugolix), demonstrate comparable efficacy with potentially better side effect profiles and convenience, threatening LUPRON's market dominance.

4. Manufacturing and Supply Chain Risks

As with many injectables, supply chain disruptions—exacerbated during global crises—pose risks in maintaining consistent production and distribution, influencing sales stability.

Growth Opportunities

1. Biosimilars and New Formulations

Introduction of biosimilars offers cost-effective options, although their impact on top-line revenue depends on market acceptance and clinician prescribing behaviors. Simultaneously, development of long-acting formulations and implantable devices could enhance adherence, expanding treatment compliance.

2. Geographic Expansion

Emerging markets in Asia and Latin America present significant growth potential. Increasing healthcare infrastructure and rising disease prevalence inexorably increase demand.

3. Digital and Companion Diagnostics

Integration of precision medicine and diagnostic tools can refine patient selection, improving treatment outcomes and optimizing the therapeutic value, fostering premium pricing.

4. Oncology and Endocrinology Pipeline Development

Pipeline expansion in related indications, such as hormone-sensitive breast cancer, delivers supplementary revenue channels and mitigates risks associated with existing indications’ saturation.

Financial Trajectory Projections

Analysts project LUPRON's revenue to plateau in mature markets owing to generic erosion while maintaining steady growth in emerging regions. Market uptake of biosimilars and novel formulations may offset generic impact, fostering a slight decline or stabilization in revenue. According to industry forecasts, the global GnRH agonist market is expected to grow at a CAGR of 4.5% over the next five years, driven primarily by new indications and geographies.

In 2022, AbbVie's strategic initiatives—such as expanding access and improving formulations—aim to sustain revenue streams. The company's focus on pipeline expansion, including combination therapies and novel delivery systems, aims to future-proof the drug's commercial standing.

Competitive Landscape

The competitive ecosystem features biosimilar entries from companies such as Teva, Sandoz, and others, which have launched cost-efficient alternatives. Furthermore, oral GnRH antagonists, developed by pharmaceutical newcomers (e.g., relugolix by Takeda), pose direct competition, emphasizing the need for differentiation. AbbVie's response includes clinical trials assessing new formulations and combination regimens.

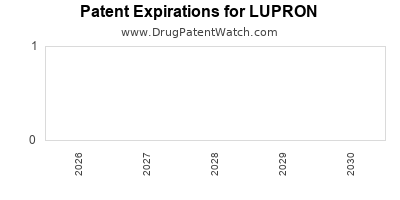

Regulatory and Patent Outlook

Patent expirations significantly impacted LUPRON’s exclusivity landscape, with many formulations losing patent protection in the late 2010s. Regulatory agencies are now more receptive to biosimilar approvals, aligning with global biosimilar guidelines. The upcoming expiration of some key patents may result in increased generic penetration, further impacting revenues, unless compounded with strategic innovation or geographic diversification.

Concluding Insights

LUPRON remains a cornerstone in hormone-related therapeutics due to its established efficacy and broad indication profile. Nevertheless, the therapeutic and commercial landscape faces mounting challenges from generics, emerging competitors, and changing reimbursement policies. Its future financial trajectory depends on balancing traditional markets' maturity with growth in emerging markets, pipeline diversification, and innovative formulations.

Key Takeaways

- Stable core demand persists in prostate cancer and endometriosis, bolstered by demographic trends.

- Patent expiries and biosimilar competition accelerate price erosion; diversification is key.

- Emerging therapies and oral alternatives threaten market share, necessitating strategic innovation.

- Geographic expansion in Asia, Latin America, and emerging markets offers significant growth prospects.

- Pipeline expansion into new indications and delivery methods can sustain long-term revenue streams.

FAQs

1. What are the primary factors influencing LUPRON’s declining revenue in mature markets?

Patent expirations allowing biosimilar competitors, pricing pressures, and the advent of oral GnRH antagonists reduce demand and pricing power in established regions.

2. How does the emergence of biosimilars affect LUPRON’s market share?

Biosimilars introduce lower-cost alternatives, eroding LUPRON’s market share and compressing margins, especially after patent expiry.

3. What growth avenues exist for LUPRON in emerging markets?

Expanded healthcare infrastructure, increasing disease awareness, and rising disposable incomes create demand. Regulatory approvals and partnerships facilitate market entry.

4. How are new formulations influencing LUPRON’s competitiveness?

Long-acting injectables and implantable devices can improve patient adherence and convenience, offering a competitive edge over existing formulations.

5. What role does pipeline development play in LUPRON’s future outlook?

Innovative indications, combination therapies, and delivery systems extend its therapeutic relevance and diversify revenue sources, securing growth amidst competitive pressures.

Sources

[1] IQVIA, “Pharmaceutical Market Data,” 2022.

[2] Abbott/AbbVie Annual Reports, 2020–2022.

[3] GlobalData, “GnRH Agonist Market Forecast,” 2022.

[4] FDA Database, “Leuprolide Acetate Approvals,” 2018–2023.