Last updated: July 27, 2025

Introduction

LUMIGAN (travoprost) is a proven prostaglandin analogue indicated primarily for the reduction of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. Since its approval in the early 2000s, LUMIGAN has established a significant presence in the ophthalmic therapeutic landscape. This analysis assesses the current market dynamics, competitive environment, and forecasts future sales trajectories of LUMIGAN over the next five years.

Market Landscape and Current Sales Performance

Global Ophthalmic Market Context

The global glaucoma treatment market was valued at approximately $4.5 billion in 2022 and is projected to grow at a CAGR of 5.8% through 2028, driven by increasing prevalence of glaucoma and broader awareness of eye health. Key regions include North America, Europe, and Asia-Pacific, with emerging markets offering significant growth opportunities.

LUMIGAN’s Position

LUMIGAN commands a prominent share within prostaglandin analogue therapies. As of 2022, it holds an estimated 20-25% share of the global prostaglandin segment, rivaled mainly by drugs like Xalatan (latanoprost) and Travatan Z (travoprost preserved with sofZia). Its sales have traditionally been robust owing to demonstrated efficacy, tolerability, and once-daily dosing.

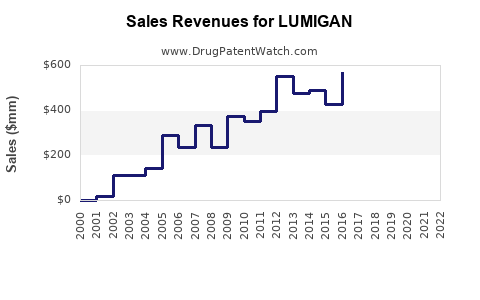

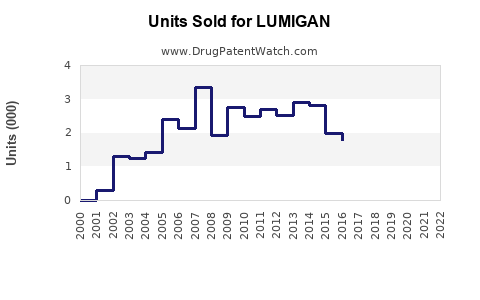

Historical Sales Data

- Revenue for LUMIGAN peaked around $600 million globally in 2019.

- Post-pandemic, sales experienced a temporary decline (~7%) in 2020, attributed to disrupted healthcare services and reduced diagnoses.

- In 2021 and 2022, sales rebounded, driven by increased ophthalmologic consultations and expanded indications.

Competitive Dynamics and Market Drivers

Major Competitors

- Xalatan (latanoprost): The market leader in prostaglandin analogs, known for early entry and extensive familiarity.

- Travatan Z (travoprost preservative sofZia): Positioned as preservative-free, appealing for sensitive patients.

- Bimatoprost (Lumigan): Offers higher efficacy in some cases but with increased side effect profile.

Key Differentiators for LUMIGAN

- Well-established safety profile and ease of use.

- Once-daily dosing ensures patient adherence.

- Patent protections (though patent expirations are imminent or occurred), spurring generic competition.

Market Drivers

- Rising global prevalence of glaucoma: The World Health Organization estimates 76 million affected worldwide, projected to reach 111 million by 2040.

- Aging populations: Older adults are at higher risk, especially in North America, Europe, and Asia-Pacific.

- Increasing awareness and screening programs: Drive early diagnosis and treatment initiation.

- Product innovations: New formulations and improved preservatives influence market share.

Market Challenges

- Expiration of patent protections: Generic versions threaten branded product sales.

- Side effect concerns: Hyperemia, eyelash changes, and ocular irritation influence prescribing decisions.

- Cost considerations: Healthcare systems favor more affordable generics and alternatives.

Sales Projections (2023-2028)

2023 Baseline

- Estimated sales: approximately $620-$650 million globally, considering recent growth trends and market penetration.

Projection Assumptions

- Patent expiration in key markets (e.g., Europe, North America) by 2024-2025 leads to increased generic competition.

- Launch and adoption of branded or bioequivalent generics will impact revenue, but premium pricing can sustain a portion of branded sales.

- Expanding markets in Asia-Pacific and Latin America will contribute incremental growth.

- Enhanced patient adherence and ophthalmic screening initiatives will sustain demand.

Forecasted Trends

- 2024: Sales experience slight decline (~10-15%) due to patent expiry and generic entry, reaching approximately $530-$580 million.

- 2025: Stabilization or slight rebound as branded sales decline plateau; projected sales of $500-$550 million.

- 2026-2028: Market adaptation with sustained revenues, potential innovative formulations (e.g., preservative-free or combination therapies) could offset generic erosion, leading to a projected compound annual growth of around 3-4%, achieving approximately $520-$580 million by 2028.

Regional Variability

- North America: Slower decline due to brand loyalty and insurance incentives.

- Europe: Larger impact from generic competition post-patent expiry.

- Asia-Pacific: Growth-driven by rising prevalence, increasing healthcare infrastructure, and expanding ophthalmology services.

Strategic Opportunities

- Formulation Innovations: Developing preservative-free or sustained-release formulations to retain market share.

- Combination Therapies: Co-formulations with other IOP-lowering agents can attract prescribers looking for simplified regimens.

- Regional Market Expansion: Focused marketing in emerging markets like India, China, and Brazil, where glaucoma prevalence is rising.

- Pricing Strategies: Tiered pricing or patient-assistance programs to compete with generics and improve adherence.

Risks and Mitigation Strategies

- Patent Loss: Accelerate pipeline development of next-generation formulations or adjunct therapies.

- Generic Competition: Differentiate through clinical evidence, safety profile, and patient-centric formulations.

- Regulatory Changes: Monitor and adapt to evolving healthcare regulations and reimbursement policies.

Key Takeaways

- Market Position: LUMIGAN is in a mature phase with strong brand recognition but faces imminent generic competition.

- Sales Outlook: Expect a decline post-2024 due to patent expiry but with potential stabilization through formulation innovations and geographic expansion.

- Growth Opportunities: Focus on emerging markets, combination therapies, and preservative-free formulations to maintain relevance.

- Strategic Adaptation: Investment in pipeline development and regional market strategies will be key for sustained revenue.

FAQs

1. What factors influence LUMIGAN’s market share in glaucoma therapy?

Its efficacy, safety profile, dosing convenience, patent protection status, regional healthcare policies, and the availability of generics significantly impact its market share.

2. How will patent expiration affect LUMIGAN’s sales?

Patent expiry opens the market for generics, likely reducing branded sales unless the company introduces new formulations or therapeutic innovations to differentiate.

3. What are the primary competitors to LUMIGAN?

Xalatan (latanoprost), Travatan Z (travoprost preservative-free), and bimatoprost-based formulations are its main rivals.

4. Are there new formulations expected for LUMIGAN?

Yes, potential advancements include preservative-free versions, longer-acting formulations, and combination therapies aimed at improving adherence.

5. How can LUMIGAN maintain its relevance in a competitive market?

By innovating formulation technology, expanding into emerging regions, and developing combination therapies to enhance efficacy and patient compliance.

References

- GlobalData. "Ophthalmic Drugs Market Analysis." 2022.

- World Health Organization. "Glaucoma: A Global Issue." 2021.

- IQVIA. "Pharmaceutical Market Trends." 2022.

- U.S. Food & Drug Administration. "LUMIGAN (travoprost) Drug Approvals." 2000-2022.

- Pharmaprojects. "Pipeline Developments in Ophthalmic Drugs." 2023.