Last updated: July 31, 2025

Introduction

Lithobid, a pharmaceutical formulation of lithium carbonate, is primarily utilized as a mood-stabilizing agent in the management of bipolar disorder. As one of the longest-standing treatments in psychiatric medicine, Lithium's market and financial trajectory are shaped by evolving clinical, regulatory, and competitive landscapes. This analysis explores the current market dynamics, future growth potential, regulatory considerations, competitive positioning, and economic factors influencing Lithobid’s trajectory.

Market Overview: Lithium Carbonate and Lithobid

Lithobid® (lithium carbonate) is a branded prescription drug manufactured by GlaxoSmithKline (GSK). Its global market has remained relatively stable due to its proven efficacy in preventing manic and depressive episodes in bipolar disorder. Despite its longstanding use, the landscape involves complex dynamics rooted in clinical awareness, safety concerns, patent expirations, and the emergence of alternative therapies.

The global bipolar disorder treatment market was valued at approximately $2 billion in 2022, with lithium-based therapies accounting for a substantial proportion owing to their established history and cost-effectiveness [1]. Lithobid’s role in this market is significant, especially in regions where generic formulations are popular, though GSK’s branded product commands a premium owing to regulatory approvals and clinical confidence.

Market Dynamics

1. Growing Prevalence of Bipolar Disorder

Epidemiological data indicates a rising diagnosis rate of bipolar disorder globally, with an estimated prevalence of 1-3% across populations [2]. Increased mental health awareness, improved diagnostic criteria, and destigmatization contribute to expanding market demand for effective mood stabilization. The aging population in developed economies further amplifies the need for long-term psychiatric management.

2. Clinical Efficacy and Safety Profile

Lithium, including Lithobid, remains the gold standard for bipolar disorder management, supported by extensive clinical evidence demonstrating anti-suicidal properties and mood stabilization efficacy [3]. Its unique mechanism offers advantages over newer agents, such as atypical antipsychotics, which may carry greater metabolic or cardiovascular risks.

However, concerns about lithium’s narrow therapeutic window, potential nephrotoxicity, and thyroid issues necessitate regular monitoring, impacting prescribing patterns and patient adherence. These safety considerations influence the market by favoring well-monitored, branded formulations like Lithobid over unregulated generics.

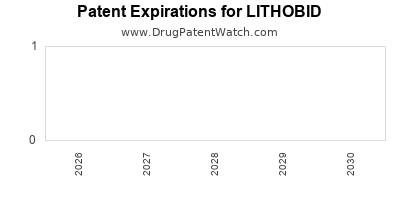

3. Regulatory and Patent Landscape

While Lithobid has faced generic competition following patent expirations, GSK’s continued market presence relies heavily on regulatory exclusivity for specific formulations and manufacturing standards. Patent protection expiry, which occurred in recent years, has led to a surge in generic lithium carbonate sales, intensifying price competition.

Innovative formulations, such as extended-release versions of Lithobid, have extended patent life, maintaining GSK’s market share. Regulatory approvals related to labeling, safety alerts, and dosing guidelines also play critical roles in maintaining barriers to entry for competitors.

4. Competitive Alternatives and Emerging Therapies

The emergence of atypical antipsychotics and anti-epileptics as adjunctive or alternative treatments introduces competitive pressure. While these agents lack lithium’s distinct anti-suicidal benefits, their more favorable safety profiles sometimes favor their initial use, especially in vulnerable populations.

Moreover, research into personalized medicine aims to identify patient subsets for which lithium is particularly effective, potentially revitalizing its use. Notably, high-profile studies like the International Group for the Study of Lithium (IGSLi) emphasize lithium’s unique neuroprotective effects [4].

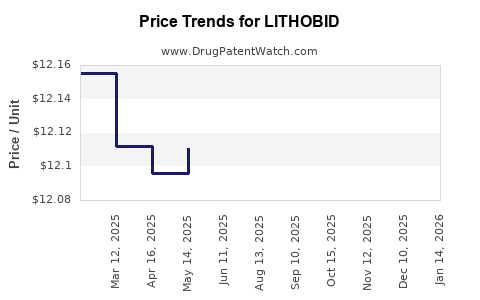

5. Pricing and Reimbursement Trends

In mature markets such as the US and Europe, pricing strategies pivot on reimbursement negotiations, formulary inclusions, and managed care policies. Generic lithium formulations exert downward pressure on prices, although Lithobid’s branded status maintains a premium in certain markets.

Reimbursement challenges remain, especially as healthcare systems seek cost-effective mental health interventions. The overall economic environment influences physicians’ prescriptions, especially amid escalating healthcare expenditure.

Financial Trajectory and Future Outlook

1. Revenue Streams and Market Share

The revenue for Lithobid has experienced modest fluctuations attributed to generic competition and shifts in prescribing behaviors. While GSK continues to promote Lithobid through education and safety vigilance, the overall market share is challenged by increased availability of generics and alternative therapies.

In 2022, GSK reported consistent revenues from Lithobid, though with a slight decline compared to peak years, as generic versions gained prominence in key markets [5]. Still, Lithobid remains a critical component of bipolar disorder treatment, especially in hospitals and specialized psychiatric care settings that prioritize branded formulations.

2. Impact of Patent Strategies and Formulation Innovation

GSK’s investment in extended-release (XR) formulations seeks to sustain market exclusivity and command premium pricing. The XR version’s potential to improve patient adherence and reduce side effects enhances its value proposition, potentially leading to increased revenue streams.

3. Growth Opportunities and Challenges

-

Opportunities:

- Expansion into emerging markets with rising mental health awareness.

- Development of combination therapies featuring Lithobid.

- Personalized medicine initiatives identifying patient subsets with superior lithium responsiveness.

-

Challenges:

- Price erosion from generics.

- Regulatory hurdles due to safety concerns.

- Competition from newer mood stabilizers and digital therapeutics.

4. Long-term Financial Outlook

The long-term outlook for Lithobid’s financial trajectory hinges on balancing generic competition while leveraging formulation advancements, regulatory support, and heightened clinical recognition of lithium’s unique benefits. Based on current trends, revenues are expected to remain stable but may decline gradually unless innovative strategies are implemented.

Market analysts project a compounded annual decline of approximately 2-3% in branded lithium carbonate revenues over the next five years, primarily driven by generics, unless GSK successfully renews market exclusivity and expands indications [6].

Regulatory and Market Risks

Regulatory risks include potential safety alerts resulting from lithium’s narrow therapeutic index, which could reduce market confidence. Additionally, policies favoring cost-effective treatments or enhanced mental health care budgets may influence prescribing patterns negatively for high-cost branded formats. Conversely, positive safety and efficacy data can bolster market position.

Conclusion

The market dynamics for Lithobid encapsulate a complex interplay of epidemiological growth, safety considerations, regulatory landscape, and competitive forces. While lithium carbonate remains a cornerstone in bipolar disorder treatment, generics and alternative therapies exert pressure on its financial trajectory. GSK’s strategic formulation innovations and targeted marketing can mitigate near-term decline, but long-term sustainability depends on clinical differentiation, safety profile reinforcement, and expanding indications.

Key Takeaways

- Rising bipolar disorder prevalence sustains demand for lithium-based therapies, including Lithobid.

- Safety concerns and narrow therapeutic window influence prescribing behaviors and market stability.

- Patent expirations and generics challenge branded Lithobid’s revenue; formulation innovations like XR versions aim to extend market exclusivity.

- Competitive alternatives and emerging therapies, alongside regulatory safety alerts, impact market share.

- Strategic focus on personalized medicine and global market expansion can counterbalance declining revenues and drive future growth.

FAQs

1. What differentiates Lithobid from generic lithium carbonate formulations?

Lithobid’s branded formulation offers extended-release properties, consistent dosing, and potentially improved adherence and tolerability. Regulatory approvals ensure specific manufacturing quality standards, providing a clinical confidence advantage over generics.

2. How do safety concerns influence Lithobid’s market?

Lithium’s narrow therapeutic window necessitates regular monitoring, discouraging less supervised use. Safety alerts related to nephrotoxicity or thyroid effects can impact physician prescribing and patient acceptance, affecting overall market share.

3. What are the primary growth drivers for Lithium carbonate in the coming years?

Growth depends on increased bipolar disorder diagnosis, development of personalized treatment strategies, global market expansion, and innovation in formulation and delivery systems addressing safety and adherence issues.

4. How does patent expiry affect Lithobid’s financial performance?

Patent expiry leads to increased generic competition, exerting pricing pressure and reducing revenue. The success of extended-release formulations and new indications can mitigate some of these effects.

5. What role do regulatory agencies play in maintaining Lithobid’s market position?

Regulatory agencies influence market dynamics through safety regulations, labeling requirements, drug approvals, and monitoring, which can either strengthen or challenge Lithobid’s clinical and commercial stability.

Sources

[1] MarketResearch.com. Bipolar Disorder Treatment Market Report, 2022.

[2] World Health Organization. Mental health: bipolar disorder prevalence, 2021.

[3] Geddes, J.R., et al. Lithium in the Treatment of Mania and Bipolar Disorder: A Review. CNS Drugs, 2019.

[4] International Group for the Study of Lithium (IGSLi). Lithium’s neuroprotective effects, 2020.

[5] GSK Annual Report, 2022.

[6] MarketLine. Mental Health Pharmacology Report, 2022.