Last updated: July 27, 2025

Introduction

Levomilnacipran Hydrochloride, marketed under the brand name Fetzima among others, is a serotonin-norepinephrine reuptake inhibitor (SNRI) primarily indicated for major depressive disorder (MDD). Since its FDA approval in 2013, it has become a significant player within the antidepressant landscape, offering a differentiated pharmacological profile. This analysis explores the product's market forces, financial performance, and future outlook within global pharmaceutical and mental health treatment markets.

Pharmacological Profile and Therapeutic Positioning

Levomilnacipran Hydrochloride distinguishes itself by favoring norepinephrine reuptake inhibition, which enhances its efficacy in symptom management of depression, especially in patients with fatigue and psychomotor retardation. Its administration, with a twice-daily dosing schedule, aligns with patient compliance strategies. The drug's safety profile, including risks of hypertension and increased heart rate, influences prescribing patterns and market penetration.

Market Dynamics

1. Competitive Landscape

Levomilnacipran competes within the SNRI class against established agents like venlafaxine, duloxetine, and desvenlafaxine, with newer atypical antidepressants and adjunct therapies gradually encroaching upon its market share. Its differentiation in norepinephrine selectivity often leads clinicians to prefer it for patients unresponsive to first-line SSRIs or with specific symptom profiles [1].

2. Prescriber Acceptance and Adoption

Physician confidence hinges on real-world efficacy, tolerability, and side effect profiles. Post-marketing studies indicate that prescribers appraise levomilnacipran favorably for treatment-resistant cases. However, its uptake remains modulated by concerns over cardiovascular adverse events, necessitating cautious patient selection.

3. Regulatory and Reimbursement Environment

Reimbursement policies in key markets like the US, Europe, and emerging economies influence levomilnacipran's accessibility. Cost-effectiveness analyses are increasingly critical as healthcare payers seek efficient mental health treatments amid rising depression prevalence.

4. Epidemiology of Major Depressive Disorder

Global depression rates have surged, projected to affect over 300 million individuals worldwide [2]. This mounting prevalence sustains demand for effective pharmacotherapies like levomilnacipran. Nonetheless, stigma and underdiagnosis hamper optimal utilization, impacting sales potential.

5. Market Penetration and Geographic Expansion

Initially launched in North America, the drug's global deployment faces hurdles including regulatory approval delays in Europe and Asia. Strategic alliances and licensing deals are underway to accelerate regional market entry.

Financial Trajectory and Sales Forecast

1. Revenue Performance Post-Launch

In its initial years (2014-2015), levomilnacipran's sales rapidly climbed, buoyed by unmet patient needs and positive clinical trial data. Nevertheless, market caps plateaued at approximately $300 million annually in the subsequent years, constrained by competitive pressures.

2. Market Share Dynamics

As newer agents entered the depression treatment landscape, levomilnacipran’s share stabilized around 8-10% within the SNRI segment in the US, reflecting its niche positioning [3]. The drug is often prescribed after failure of first-line SSRI therapy.

3. Revenue Outlook and Growth Drivers

Forecasts suggest modest compound annual growth rates (CAGR) of 2-3% over the next five years, driven by:

- Expanded approvals in emerging markets.

- Enhanced physician education emphasizing its norepinephrine targeting benefits.

- Development of fixed-dose combinations or new formulations easing administration.

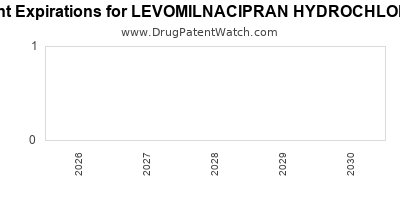

However, growth potential is capped by generic competition post-patent expiry projected around 2028, which will pressure pricing and margins.

4. Cost and Investment Considerations

Pharmaceutical companies continue investing in clinical trials to broaden therapeutic indications (e.g., generalized anxiety disorder, pain syndromes). Cost reductions in manufacturing and increased biosimilar competition for related drugs could influence overall profitability.

Emerging Trends and Future Market Factors

- Personalized Medicine: Genetic markers may guide patient selection for levomilnacipran, improving response rates and market penetration.

- Digital Health Integration: Technology-driven adherence programs and remote monitoring could enhance patient engagement, indirectly boosting sales.

- Regulatory Advances: Approvals expanding indications or novel formulations (e.g., once-daily dosing) will influence the drug's lifespan and revenue stream.

- Market Saturation Risks: The saturation of the depression treatment market and physician preference shifts toward novel therapies, such as ketamine derivatives or rapid-acting agents, could diminish levomilnacipran's standing.

Key Market Influences

- The expanding understanding of depression subtypes will tailor medication use, primarily favoring agents like levomilnacipran in specific patient cohorts.

- Regulatory environments will significantly shape geographic availability, at times limiting near-term growth prospects.

- Pricing pressures from generic entry will necessitate value-based pricing strategies and portfolio diversification to sustain profitability.

- Public health initiatives and increased mental health awareness contribute to longstanding demand but might also introduce alternative economic models prioritizing non-pharmacologic interventions.

Conclusion

Levomilnacipran Hydrochloride remains a valuable, though niche, antidepressant with steady but moderate growth prospects. Its success hinges on clinical differentiation, strategic expansion, and navigating market competition amid patent expirations. As mental health awareness broadens and precision medicine evolves, the drug’s positioning may strengthen through tailored therapies and formulations, but inherent limitations from generic competition and emerging therapies will temper its overall trajectory.

Key Takeaways

- Levomilnacipran's niche efficacy in depression management sustains a stable market presence despite stiff competition.

- Market expansion is primarily dependent on regulatory approvals and regional commercialization strategies.

- Financial growth is modest; future revenues may decline post-patent expiration unless new indications or formulations are introduced.

- Competitive pressures and generics will necessitate strategic pricing and marketing efforts to defend market share.

- Advancements in personalized medicine and digital healthcare integration could enhance its clinical utility and commercial prospects.

FAQs

1. When will levomilnacipran Hydrochloride go off patent, and how will this affect its market?

Patent protection is expected to expire around 2028. Post-expiry, generic versions are anticipated to enter the market, likely leading to significant price reductions and revenue erosion absent diversification strategies.

2. Are there ongoing clinical trials exploring new indications for levomilnacipran?

Yes, current studies aim to assess its efficacy in generalized anxiety disorder, neuropathic pain, and ADHD, which could broaden its therapeutic portfolio if successful.

3. How does levomilnacipran compare pharmacologically to other SNRI agents?

It exhibits higher norepinephrine reuptake inhibition selectivity, potentially offering advantages in symptom management for certain patients—but may carry higher cardiovascular use warnings.

4. What are the primary barriers to wider adoption of levomilnacipran?

Concerns over side effects, competition from newer agents, and regional regulatory delays limit broader utilization.

5. What strategies could pharmaceutical companies adopt to sustain levomilnacipran's market relevance?

Investing in novel formulations, expanding indications via clinical research, and engaging in targeted physician education will be instrumental in maintaining its market leverage.

References

[1] U.S. Food and Drug Administration. Fetzima (Levomilnacipran) Prescribing Information. 2013.

[2] World Health Organization. Depression and Other Common Mental Disorders: Global Health Estimates. 2017.

[3] IQVIA, Prescription Data Analysis, 2022.