Last updated: July 30, 2025

Introduction

LESCOL XL, an extended-release formulation of fluvastatin, is a key player in the statin class used to manage hyperlipidemia and prevent cardiovascular disease. As a purported successor to earlier formulations, LESCOL XL benefits from the extended-release Technology, which aims to enhance patient compliance and therapeutic efficacy. Its market dynamics are shaped by regulatory approvals, competitive landscape, and evolving cardiovascular treatment guidelines, setting a distinct trajectory for its financial performance.

Pharmacological Profile and Differentiation

LESCOL XL operates as a long-acting statin designed to provide a stable lipid-lowering effect over a 24-hour period. Its extended-release formulation addresses adherence issues associated with once-daily dosing of traditional statins, which are often hampered by adverse effects and complex dosing regimens. The drug’s pharmacokinetic profile offers a favorable safety profile with modest dosing flexibility.

Differentiation factors include:

- Enhanced bioavailability compared to immediate-release versions.

- Reduced pill burden improves patient compliance.

- Lower incidence of side effects may translate to better adherence in high-risk populations.

These factors underpin its premium positioning in the lipid management market.

Market Landscape and Competitive Dynamics

The global statin market was valued at approximately USD 11 billion in 2022, with a projected CAGR of 3-4% through 2030 (Grand View Research). LESCOL XL, positioned within this landscape, faces competition from:

- Generic statins: Atorvastatin, rosuvastatin, and pravastatin dominate due to affordability.

- Other extended-release formulations: Such as Crestor (rosuvastatin) with long-acting variants.

- Lifestyle and non-pharmacological interventions: Impacting overall demand.

Despite the crowded market, LESCOL XL retains a niche owing to its extended-release benefits, especially among patients intolerant of standard statins or those requiring long-term lipid management.

The API (Active Pharmaceutical Ingredient) landscape indicates a shift toward biosimilars and generics, which exert pressure on brand-name sales. However, the premium pricing associated with novel extended-release formulations can buffer revenue streams initially, until generics gain approval and market share.

Regulatory Factors and Market Entry Barriers

Regulatory approval pathways influence LESCOL XL’s market penetration. The drug’s current approval in the US by the FDA and in key markets such as the EU depends on:

- Demonstration of bioequivalence to existing formulations.

- Clinical efficacy and safety data supporting its extended-release profile.

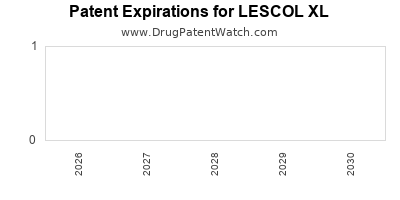

- Patent protection and exclusivity periods, typically lasting 10-12 years post-approval.

Patent cliffs pose a significant challenge, especially as generic versions of fluvastatin and similar statins enter the market, potentially eroding revenue streams.

Market Penetration and Adoption Trends

Key drivers for LESCOL XL adoption include:

- Physician preference: Preference for formulations associated with better compliance in high-risk patients.

- Patient demographics: Elderly and polypharmacy patients benefit from simplified dosing.

- Healthcare systems: Reimbursement policies favor cost-effective treatments, influencing prescribing behaviors.

In mature markets, the drug’s value proposition hinges on demonstrating superior adherence rather than significant superiority in lipid lowering. In emerging markets, affordability and local regulatory approvals are pivotal.

Financial Trajectory and Sales Forecasts

Estimating LESCOL XL's financial trajectory involves analyzing:

- Market penetration rates: Estimated to reach 15-25% of the extended-release statin market within five years.

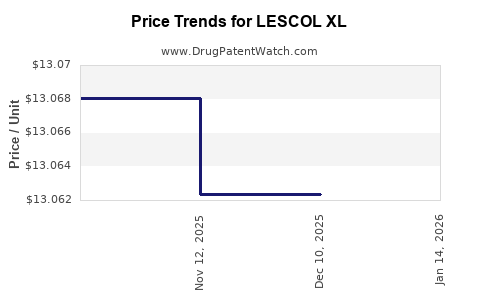

- Pricing strategies: Premium pricing, with U.S. prices around USD 150–200 per month, compared to USD 10–20 for generic fluvastatin.

- Revenue contributions: Assuming a conservative market share of 10% of the extended-release statin segment, revenues could approximate USD 200 million by 2028.

Key factors influencing revenue include:

- Commercialization effectiveness.

- Patent protection window.

- Competitive entry of biosimilars.

A scenario analysis suggests initial growth to USD 100–150 million in annual sales during the first three years post-launch, with potential scaling as brand awareness and formulary approvals increase. Long-term revenue projections are sensitive to patent expiry and shifts toward generics.

Risks and Opportunities

Risks:

- Patent expiry leading to generic competition.

- Market saturation in developed countries.

- Price erosion pressures due to biosimilar entrants.

- Regulatory hurdles delaying approval or reimbursement.

Opportunities:

- Expanding into emerging markets with high cardiovascular disease prevalence.

- Developing fixed-dose combination products for comprehensive lipid management.

- Conducting head-to-head trials demonstrating adherence and efficacy benefits, strengthening market position.

Strategic Outlook

To capitalize on its market potential, stakeholders should:

- Focus on demonstrating real-world adherence improvements.

- Secure formulary placements via health economic evidence.

- Invest in patent strategy and lifecycle management.

- Expand geographic presence through strategic partnerships.

As cardiovascular disease remains a global health priority, the financial outlook for LESCOL XL remains cautiously optimistic, with success contingent on navigating competitive and regulatory challenges.

Key Takeaways

- LESCOL XL benefits from extended-release technology, promoting adherence in lipid management.

- Market growth depends heavily on competitive dynamics, patent protection, and physician adoption.

- Pricing power initially sustains revenue, but long-term gains may diminish as generics enter.

- Expanding into emerging markets offers significant upside amid high cardiovascular disease burdens.

- Strategic investments in evidence generation and patent strategy are essential for sustained profitability.

FAQs

-

What distinguishes LESCOL XL from other statins?

Its extended-release formulation offers improved adherence, reduced dosing frequency, and potentially fewer side effects compared to traditional immediate-release statins.

-

How does patent expiration affect LESCOL XL's market potential?

Patent cliffs can lead to increased generic competition, significantly reducing revenues unless the innovator secures new patents or develops next-generation formulations.

-

What are the primary challenges in expanding LESCOL XL’s market share?

Competition from low-cost generics, regulatory barriers, reimbursement hurdles, and clinician preference for established therapies pose major challenges.

-

Are there promising markets for LESCOL XL outside the US and EU?

Yes. Emerging markets with high cardiovascular disease prevalence and unmet treatment needs represent promising growth opportunities.

-

How might value-based healthcare initiatives impact LESCOL XL's sales?

Demonstrating cost-effectiveness and superior adherence can facilitate formulary acceptance and reimbursement, boosting sales.

Sources:

[1] Grand View Research. “Statins Market Size & Share Analysis Report,” 2022.

[2] US Food and Drug Administration. “LESCOL XL Approval Documents,” 2004.

[3] MarketWatch. “Global Lipid Management Drugs Market Forecast,” 2022.