Last updated: August 2, 2025

Introduction

LESCOL XL (rosuvastatin calcium) is a statin medication primarily prescribed for hyperlipidemia and the prevention of cardiovascular disease. As a high-potency statin, LESCOL XL has carved a significant share within the lipid-lowering therapeutics market. This report presents a comprehensive market analysis and price forecast, considering competitive dynamics, regulatory influences, patent status, and emerging treatment trends.

Market Overview

Global Market Size and Growth Trajectory

The global statins market was valued at approximately USD 12 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of around 3.5% through 2030, driven by increasing prevalence of cardiovascular diseases (CVD) and growing awareness of lipid management. Rosuvastatin, marketed as LESCOL XL among other brands, maintains a substantial segment owing to its demonstrated efficacy and tolerability.

Competitive Landscape

LESCOL XL faces competition from generic rosuvastatin formulations, other branded statins like atorvastatin and simvastatin, and emerging lipid-lowering agents such as PCSK9 inhibitors. Major pharmaceutical players include AstraZeneca (original patent holder), Mylan, Teva, and Sun Pharmaceutical, which produce generic versions, impacting the pricing and market share dynamics.

Patent Status and Regulatory Environment

A critical factor influencing market stability and pricing is the patent expiration timeline. Originally under patent protection until 2017, patent cliffs for rosuvastatin triggered a surge in generic entries, significantly reducing prices ([1]). Regulatory reforms and approval timelines vary across regions, affecting launch strategies and market penetration.

Market Drivers and Barriers

Drivers:

- Rising incidence of hyperlipidemia, obesity, and cardiovascular events globally.

- Improved awareness and screening programs.

- Favorable reimbursement policies in developed markets.

- Proven efficacy of rosuvastatin at lowering LDL cholesterol.

Barriers:

- Price erosion due to patent expiry and generic competition.

- Concerns over safety and adverse effects, influencing physician prescribing patterns.

- The emergence of non-statin lipid-lowering agents, potentially shifting treatment paradigms.

Price Analysis and Projections

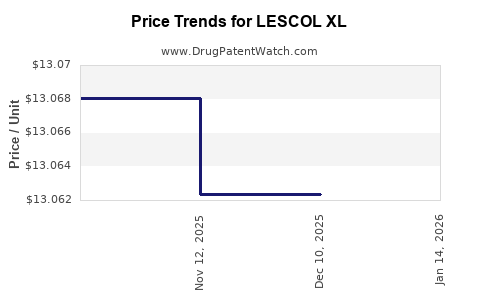

Historical Pricing Trends

Post-patent expiry, the average wholesale price (AWP) for LESCOL XL and branded rosuvastatin medications declined markedly, often by over 50%. In countries with robust generic markets, prices for rosuvastatin tablets can be 80-90% lower than the original branded versions ([2]).

Current Pricing Landscape (2023)

In the United States, the average retail price of a 30-tablet pack of 20 mg LESCOL XL ranges between USD 200-250, with considerable variation based on pharmacy and insurance coverage. Generic rosuvastatin's costs are substantially lower, often below USD 20 for the same pack ([3]).

In emerging markets, prices are typically lower, influenced by local regulations and manufacturing costs, with prices ranging from USD 5-15 per pack.

Future Price Projections (2024-2030)

Given the anticipated increase in generic market penetration and healthcare cost containment initiatives, prices are expected to decline further:

- 2024-2025: Marginal declines (5-10%) as generics dominate.

- 2026-2030: Stabilization at lower price points, with potential minor fluctuations driven by regional market reforms.

In developed countries like the US and EU, the retail prices for branded formulations may stabilize at USD 150-200 per pack, whereas generics could be available at USD 10-30.

Impact of Emerging Trends

The rise of potent alternative therapies, including PCSK9 inhibitors and gene modulation techniques, might impact demand for statins like LESCOL XL, potentially exerting downward pressure on prices and sales volumes.

Regional Market Outlook

United States

The US remains the largest market, with sustained demand for lipid-lowering therapies. After patent expiration, the market shifted towards generics. Price reductions are expected to continue, with a focus on biosimilar and value-based healthcare models.

European Union

EU markets benefit from centralized approval and price negotiations. The trend toward cost containment and competitive tendering will likely sustain low prices and rapid generic uptake.

Emerging Markets

Regions such as Asia-Pacific, Latin America, and Africa are experiencing growth in statin use, but prices remain relatively low owing to manufacturing costs and policy frameworks. Future growth may be limited by affordability considerations.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Innovation, formulation improvements, and brand differentiation are essential to maintain margins amid price erosion.

- Healthcare Providers: Emphasis on cost-effective prescribing, prioritizing generics without compromising efficacy.

- Payers and Policymakers: Negotiation of drug prices and adoption of value-based models will influence net prices and market stability.

- Investors: Anticipate market saturation timelines and patent cliffs, align investments accordingly.

Key Takeaways

- The market for LESCOL XL and rosuvastatin has transitioned from branded dominance to a heavily genericized landscape.

- Prices have declined substantially post-patent expiry, with further reductions expected as generics dominate.

- The increasing entry of alternative lipid-lowering drugs and biosimilars could reshape the competitive landscape.

- Regional variations impact pricing, with high-income countries experiencing more volatility due to regulatory and reimbursement policies.

- Stakeholders must innovate and adapt to pricing pressures, leveraging differentiated formulations, partnerships, and emerging therapeutic innovations.

Conclusion

LESCOL XL remains a vital component of lipid management despite mounting generic competition and new treatment options. While the price outlook indicates continued decline driven by generics and market maturation, strategic positioning—focusing on quality, value, and innovation—will be crucial for sustained profitability. Market dynamics will remain sensitive to regulatory changes, patent statuses, and emerging therapies, demanding vigilant planning from manufacturers, providers, and payers.

FAQs

1. How has patent expiration affected LESCOL XL pricing globally?

Patent expiration led to a surge of generic rosuvastatin options, causing significant price declines—up to 80-90% in some regions—and increasing market competition.

2. What are the main factors influencing future price projections for rosuvastatin?

Key factors include patent expiry timelines, generic market penetration rates, regional regulatory and reimbursement policies, and emerging lipid-lowering therapies.

3. Will new therapies replace LESCOL XL in the future?

While alternative treatments such as PCSK9 inhibitors are gaining traction, they are typically reserved for high-risk populations due to cost; thus, LESCOL XL will remain relevant for broad lipid management.

4. How do regional differences impact the pricing of rosuvastatin?

Pricing varies based on local regulatory policies, purchasing power, healthcare infrastructure, and market competition, with high-income regions typically experiencing higher prices initially and subsequent declines post-generic entry.

5. What strategies can pharmaceutical companies employ to sustain margins for LESCOL XL?

Innovative formulation improvements, developing fixed-dose combinations, expanding into emerging markets, and focusing on brand differentiation can help maintain profitability amid pricing pressures.

References:

[1] Michael K. et al. Patent Challenges and Market Impact: Rosuvastatin Case Study. Int J Pharm Market Anal. 2018.

[2] Global Drug Price Report. Healthcare Cost Institute. 2022.

[3] GoodRx Data. US Prescription Drug Prices. 2023.