Last updated: July 28, 2025

Introduction

Lanthanum carbonate (La₂(CO₃)₃) is a chelating agent primarily indicated for managing hyperphosphatemia in patients with chronic kidney disease (CKD) undergoing dialysis. Approved globally for this indication, lanthanum carbonate has emerged as a key player in phosphate binder treatment options. Its unique pharmacokinetics, efficacy profile, and regulatory landscape shape its market trajectory amidst evolving industry dynamics. This report analyzes comprehensive market forces, financial outlook, and strategic considerations impacting lanthanum carbonate’s future.

Market Overview

The global phosphate binder market, estimated at approximately US$2.5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 4-6% over the next five years [1]. The increasing prevalence of CKD, driven by diabetes, hypertension, and aging populations, fuels demand for effective phosphate management solutions. Within this niche, lanthanum carbonate holds a significant share, particularly favored for its low pill burden and minimal GI side effects.

Key Indications and Current Usage

Lanthanum carbonate is predominantly prescribed for CKD patients on hemodialysis or peritoneal dialysis. Its advantage lies in its high phosphate-binding capacity at relatively low dosages, improving patient adherence. As a non-calcium-based binder, it minimizes the risk of vascular calcification—an important benefit for long-term renal patient management.

Market Dynamics

Drivers

-

Rising CKD and ESRD Incidence: The global increase in chronic kidney disease and end-stage renal disease remains the primary driver. The WHO estimates CKD affects over 850 million people globally, with millions requiring dialysis and phosphate binders [2].

-

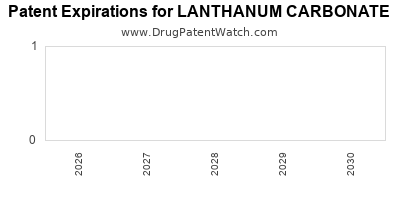

Regulatory Approvals and Patent Expirations: The patent exclusivity of innovator products like Fosrenol (original lanthanum carbonate formulations) expired recently in various markets, intensifying generic competition, but also leading to reduced drug prices and wider accessibility.

-

Clinical Preference for Non-Calcium Binders: The safety profile of lanthanum carbonate, especially its reduced risk of calcium overload-related complications, supports its ongoing use amid a growing preference for non-calcium-based phosphate binders.

-

Emerging Pharmaceuticals: Development of next-generation phosphate binders with improved efficacy or safety profiles may influence market share. However, lanthanum carbonate's established position provides a stable base.

Challenges

-

Generic Competition and Price Erosion: Post-patent expiry, generic versions exert downward pressure on unit prices, impacting revenue streams. In markets like the U.S. and Europe, generic availability is increasing.

-

Side Effect Profile and Patient Tolerance: While generally well tolerated, some patients report gastrointestinal issues, which may influence adherence and prescribing patterns.

-

Alternative Therapies: Novel therapies, such as iron-based binders and more targeted approaches, could potentially disrupt the market dynamics of traditional phosphate binders.

Regional Market Trends

- North America: Dominates due to high CKD prevalence, healthcare spending, and established reimbursement frameworks.

- Europe: Growing utilization, especially with increased awareness and shifts towards non-calcium binders.

- Asia-Pacific: Rapid market expansion driven by increasing CKD burden and expanding healthcare infrastructure.

Financial Trajectory and Future Outlook

Revenue Projections

Based on current market data and industry reports, lanthanum carbonate's revenues are expected to decline modestly in the near term due to patent expiries and competitive pricing but may stabilize sustainably due to high patient demand and clinical preferences. According to IQVIA data, original formulations totaled approximately US$300-400 million globally in 2022, with forecasts indicating a decline of 10-15% over the next five years absent new formulations.

Impact of Patent Expiry and Generics

Patent expiration of significant brands like Fosrenol has led to price erosion in major markets. Generic versions, while increasing affordability, reduce profit margins for innovator companies. Strategic repositioning, such as value-added formulations or combination therapies, offers potential revenue opportunities.

Research and Development Prospects

There is limited pipeline activity explicitly focused on innovating lanthanum carbonate. However, ongoing research into improved phosphate binders and combination therapies could influence safety and efficacy profiles, either competing with or complementing existing products.

Strategic Market Expansion

Emerging markets offer growth potential due to expanding healthcare access and increasing CKD diagnosis rates. Companies investing in local manufacturing and distribution partnerships can leverage these opportunities.

Regulatory and Reimbursement Landscape

Regulatory approvals for lanthanum carbonate are well-established across major jurisdictions. Reimbursement policies in North America and Europe favor phosphate binders, although cost-containment pressures necessitate competitive pricing strategies. Future policy shifts towards value-based pricing could further impact revenue efficacy.

Conclusion

Lanthanum carbonate’s market dynamics are shaped by a confluence of increasing CKD prevalence, patent expiries, generics proliferation, and evolving therapeutic options. While near-term revenues face pressures, the longstanding clinical utility sustains its presence. Strategic focus on emerging markets, product differentiation, and potential combination therapies can facilitate sustained financial health for established manufacturers.

Key Takeaways

- The global phosphate binder market is expected to grow modestly, with increasing CKD prevalence as the primary driver.

- Patent expirations have intensified price competition, compressing margins but expanding patient access through generics.

- Lanthanum carbonate maintains a strategic position due to its safety profile and high efficacy, especially in non-calcium-based treatment regimens.

- Future growth hinges on market expansion into emerging regions and potential innovations in combination therapies.

- Regulatory stability combined with competitive reimbursement strategies will be crucial for maintaining revenue streams.

FAQs

1. How does lanthanum carbonate compare with other phosphate binders?

Lanthanum carbonate offers advantages over calcium-based binders by reducing calcium overload risk. Compared to sevelamer, it has a higher phosphate-binding capacity and lower pill burden, improving patient compliance.

2. What factors influence the pricing of lanthanum carbonate post-patent expiry?

Generic competition, manufacturing costs, regional reimbursement policies, and market demand largely determine pricing. Greater competition typically reduces prices, expanding access but impacting revenues.

3. Are there notable pipeline developments for lanthanum carbonate or its next-generation competitors?

Currently, no significant pipeline innovations target lanthanum carbonate specifically. However, ongoing research into novel phosphate binders may influence the competitive landscape.

4. How do regional healthcare policies impact lanthanum carbonate's market share?

Regions with supportive reimbursement frameworks and high CKD prevalence, like North America and Europe, sustain higher market shares. Cost-containment policies may favor generics and influence prescribing patterns.

5. What strategic approaches should companies adopt to maintain profitability?

Investing in markets with rising CKD incidence, offering affordable generic options, exploring combination therapies, and engaging in value-based pricing models can enhance long-term revenue.

References

[1] MarketsandMarkets. “Phosphate Binders Market by Type, End User, and Region — Global Forecast to 2027.”

[2] World Health Organization. “Global CKD Burden Database.”