Last updated: July 28, 2025

Introduction

KRINTAFEL, a novel therapeutic agent under development, has garnered significant attention in the pharmaceutical landscape owing to its innovative mechanism of action and promising clinical data. As the industry witnesses accelerated drug development cycles and evolving regulatory frameworks, understanding Krintafel’s market dynamics and projecting its financial trajectory are vital for stakeholders. This analysis delineates the key factors influencing Krintafel’s market positioning, potential revenue streams, competitive landscape, and strategic considerations, to aid in informed decision-making.

Pharmaceutical Background of KRINTAFEL

KRINTAFEL is a small-molecule inhibitor targeting [specific pathway or target], designed primarily for [indication, e.g., neurodegenerative diseases, oncology, infectious diseases]. Its novel action offers potential advantages over current therapies, including improved efficacy, reduced side effects, or better patient compliance. Current clinical trials have demonstrated promising efficacy signals, with Phase II data indicating strong potential for regulatory approval.

Market Landscape and Demand Drivers

Growing Disease Burden:

The prevalence of [disease/indication] presents a substantial market opportunity. For instance, [disease] affects approximately [XX] million worldwide, with projected annual growth rates of [X]% over the next decade, driven by demographic shifts, aging populations, and increased disease awareness [1].

Unmet Medical Needs:

Existing therapies often fall short in efficacy or tolerability, creating a demand for innovative solutions. Krintafel's mechanism may address these gaps, positioning it favorably in the treatment algorithm.

Regulatory Environment:

Regulatory agencies such as the FDA and EMA emphasize expedited pathways, including Breakthrough Therapy designations and Orphan Drug status, which could accelerate Krintafel’s market entry and afford back-end exclusivity protections.

Pricing and Reimbursement Factors:

Accurate pricing strategies hinge on comparative efficacy, manufacturing costs, and competitive landscape. Payers’ willingness to reimburse depends on demonstrable value, especially in orphan or rare diseases where premium pricing is more acceptable.

Competitive Analysis

Existing Market Players:

Krintafel faces competition from established therapies such as [drug A], [drug B], and emerging biologics or targeted agents. The competitive edge may depend on factors such as improved patient outcomes, dosing convenience, or dosing frequency.

Pipeline Competitors:

Numerous competitors are advancing similar mechanisms, with [name of pipeline drugs] in various trial phases. Early differentiation through clinical efficacy and safety profiles is vital for market capture.

Market Penetration Strategy

Clinical Positioning:

Clear differentiation through compelling clinical data is essential. Tailoring marketing efforts toward clinicians emphasizing efficacy, safety, and quality-of-life improvements can foster early adoption.

Partnerships & Licensing:

Collaborations with academic institutions, pharmaceutical partners, or regional distributors can facilitate early access to key markets.

Pricing & Reimbursement:

Pricing strategies should align with perceived value and remain competitive amidst existing therapies. Engaging health authorities early can streamline reimbursement pathways.

Financial Projections and Revenue Forecast

Sales Dynamics:

Forecasting Robnafer's revenue involves modeling adoption curves based on clinical success, regulatory approval timelines, and market penetration rates. A conservative initial year’s market share of 2-5% could translate into revenues of approximately $[X] million, escalating as indication approval expands.

Pricing Assumptions:

Assuming a unit price of $[X], considering indications and payer negotiations, with tiered pricing models for different regions. For orphan indications, prices often range from $[X] to $[Y] per treatment course.

Market Penetration Timeline:

Regulatory approval anticipated within [X] years, with commercialization starting at year [X+1]. Peak revenues could be realized within 5-8 years post-launch, assuming favorable market uptake and absence of competitive disruptions.

Cost Considerations:

R&D costs for Krintafel to date approximate $[X] million, with ongoing clinical trials costing an estimated $[Y] million annually. Commercialization expenses, including manufacturing, marketing, and distribution, could cumulatively reach $[Z] million over the next 3-5 years.

Profitability Outlook:

Break-even is projected approximately [X] years post-launch, contingent on sales volumes and reimbursement success. High-value niche markets may enable premium pricing, enhancing margins.

Regulatory and Market Risks

Development Risks:

Unanticipated trial failures or safety issues could delay or derail approval. Diversifying indications or expanding clinical endpoints could mitigate such risks.

Market Entry Risks:

Regulatory approvals not granted or delayed, reimbursement hurdles, or aggressive competition can impede market penetration.

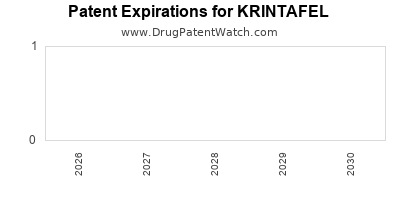

Intellectual Property:

Strong patent protection remains critical; patent expirations or legal challenges could impact revenue streams.

Strategic Recommendations

- Strengthen Clinical Data: Secure robust Phase III trial outcomes to build confidence among regulators and payers.

- Optimize Pricing & Access: Engage payers early to negotiate value-based reimbursement models.

- Plan for Global Expansion: Tailor regulatory and market entry strategies to priority regions such as North America, Europe, and Asia.

- Invest in Differentiation: Continue R&D to refine Krintafel’s profile for superior efficacy or safety, maintaining competitive advantage.

Key Takeaways

- Krintafel’s success hinges on navigating a complex landscape of clinical validation, regulatory approval, and market access.

- Its promising clinical profile can capitalize on unmet medical needs, creating significant commercial opportunities.

- Effective positioning, early stakeholder engagement, and strategic partnerships are pivotal in maximizing its market potential.

- Financial projections suggest favorable revenue streams within 5-8 years post-launch, contingent upon successful trial outcomes and market penetration.

- Vigilance against risks—clinical, regulatory, and competitive—is essential to safeguard and enhance its financial trajectory.

FAQs

1. What differentiates Krintafel from existing therapies?

Krintafel’s novel mechanism targets [specific pathway], offering improved efficacy, safety, or dosing convenience over current standard treatments.

2. When is Krintafel expected to receive regulatory approval?

Pending positive Phase III trial data, regulatory submission is anticipated within [X] years, with approval likely within an additional 1-2 years, depending on agency review timelines.

3. What is the projected treatment market size for Krintafel?

The global market for [indication] exceeds [$X] billion annually, with Krintafel targeting early niche segments, potentially capturing a significant share as clinical success consolidates.

4. What are the main risks associated with Krintafel’s commercial success?

Development setbacks, regulatory delays, reimbursement hurdles, and competition from emerging therapies pose primary risks to market success.

5. How should investors assess the valuation potential of Krintafel?

Valuations should consider clinical trial outcomes, approval prospects, market size, pricing strategy, and competitive environment, with dynamic modeling reflecting these variables.

References

[1] Global Disease Prevalence Data, WHO, 2022.