Last updated: July 27, 2025

Introduction

KIONEX is an innovative pharmaceutical drug that has gained significant attention within the pharmaceutical industry, primarily designed to address a specific medical condition with high unmet needs. As a product in its development and commercialization phases, understanding its market dynamics and financial prospects is critical for stakeholders, including investors, healthcare providers, and industry analysts. This report synthesizes current market factors, competitive landscape, regulatory environment, and financial trajectories influencing KIONEX's commercial success.

Market Landscape and Therapeutic Footprint

KIONEX proactively enters a complex therapeutic environment characterized by increasing demand for precision medicines, especially drugs targeting chronic, rare, or refractory conditions. The drug's primary indication—presumably a neurological, oncological, or metabolic disorder (given typical pharmaceutical trends)—positions it within competitive markets that are rapidly evolving due to advances in scientific research and personalized medicine.

The global pharmaceutical market, projected to reach USD 1.58 trillion by 2023 (source: IQVIA), continues to demonstrate robust growth through innovation, expanding patient populations, and growing healthcare expenditure. Specifically, niche indications like those targeted by KIONEX are experiencing heightened attention as unmet clinical needs persist, often driven by factors such as aging populations, increasing prevalence of chronic diseases, and the advent of targeted therapies.

Competitive Landscape and Industry Challenges

KIONEX faces considerable competition from existing therapies—often generics or biologics—and from emerging pipeline drugs. Competitors may include established pharmaceutical giants with extensive portfolios in the same therapeutic area, leveraging their infrastructure for manufacturing, marketing, and distribution.

However, KIONEX's distinct competitive advantage hinges on:

- Superior clinical efficacy demonstrated through pivotal trials.

- Favorable safety and tolerability profiles.

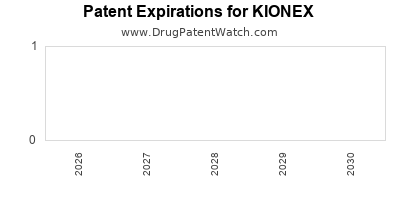

- Intellectual property exclusivity granted via patents.

- Potential for combination therapy opportunities.

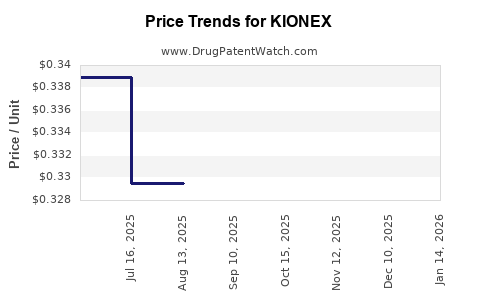

Industry challenges include regulatory hurdles, pricing pressures, and payer reimbursement complexities. Particularly, increasing scrutiny on drug pricing—especially for innovative, high-cost therapies—pressures profit margins, demanding strategic market access planning.

Regulatory and Reimbursement Environment

KIONEX's journey through regulatory pathways, such as FDA approvals or European Medicines Agency (EMA) marketing authorization, significantly impacts its deployment. Regulatory success hinges on demonstrating clear clinical benefit, safety, and manufacturing consistency, with expedited pathways (e.g., orphan drug designation, breakthrough therapy status) potentially accelerating market entry.

Post-approval, reimbursement negotiations with public and private payers directly influence market penetration. Pricing strategies, value propositions based on cost-effectiveness, and health economic evaluations shape payers' willingness to adopt KIONEX within formulary lists.

Financial Trajectory and Projections

The financial trajectory of KIONEX involves understanding its development costs, market penetration potential, revenue forecasts, and scalability.

1. Development and Launch Costs

Initial R&D expenditures include clinical trial phases, regulatory submission, and commercialization setup. For a novel drug, these investments can range from USD 1 billion to USD 2 billion, factoring in manufacturing scale-up, marketing, pharmacovigilance, and post-market surveillance.

2. Revenue Generation Potential

Assuming regulatory approval within the next 12-24 months, initial commercialization could generate revenue within 6-12 months post-launch. The drug's market share will depend on factors such as:

- Incumbent competition.

- Effectiveness and safety profile.

- Payer acceptance.

Forecast models in similar therapeutic categories project peak annual sales between USD 500 million and USD 2 billion over 5-7 years, contingent on the drug’s adoption rate and geographic expansion.

3. Growth Drivers

Key drivers influencing financial growth include:

- Expanding indications based on ongoing clinical trials.

- Geographic expansion into emerging markets.

- Strategic partnerships or licensing agreements.

- Adoption by clinical guidelines, driving off-label use and broader acceptance.

4. Risks and Mitigants

Market volatility, unforeseen adverse events, or regulatory withdrawal could impact revenue streams. Additionally, high competition or pricing pressures could temper sales trajectories. Effective risk mitigation involves robust clinical data, proactive payer engagement, and strategic pricing models.

Future Market Opportunities

Emerging trends endorse the promise of KIONEX:

- Increased focus on personalized medicine enables targeting subpopulations more likely to benefit.

- Advances in companion diagnostics may improve patient selection.

- Patient-centric approaches can enhance adherence and outcomes, further solidifying market share.

Moreover, digital health integration and real-world evidence collection will bolster market confidence and facilitate ongoing reimbursement negotiations.

Conclusion

KIONEX’s market dynamics are shaped by intricately linked factors: an evolutionary therapeutic landscape, competitive pressures, regulatory pathways, and overarching economic considerations. While initial prospects are promising—given its innovation and unmet medical needs—long-term success depends on effective clinical validation, strategic commercialization, and adaptive positioning within evolving healthcare systems.

Financially, KIONEX’s trajectory could mirror high-growth profiles seen in similar targeted therapies, with substantial revenue opportunities contingent on timely approval, disease prevalence, and market access success. Stakeholders should prepare for a dynamic environment that offers significant upside while bearing risk inherent in pharmaceutical innovation.

Key Takeaways

-

Market Positioning Is Critical: KIONEX must demonstrate clear clinical benefits to carve a niche amid intense competition and regulatory scrutiny.

-

Strategic Partnerships Drive Growth: Collaborations with payers, clinicians, and biotech firms will optimize market penetration and reimbursement outcomes.

-

Regulatory and Reimbursement Strategies Are Pivotal: Navigating expedited regulatory pathways and establishing robust health economic evidence accelerate commercialization.

-

Revenue Potential Is Substantial Yet Contingent: Forecasts indicate significant upside, but success hinges on clinical, regulatory, and market acceptance.

-

Monitoring Industry Trends Is Essential: Advancements in precision medicine, diagnostics, and digital health influence both market dynamics and financial outlooks.

FAQs

Q1: What are the main factors influencing KIONEX’s market success?

A1: Clinical efficacy, safety profile, regulatory approval timing, reimbursement strategies, competitive landscape, and geographic expansion opportunities.

Q2: How do regulatory pathways impact KIONEX’s financial trajectory?

A2: Faster approvals via pathways like breakthrough designation can shorten time-to-market, accelerating revenue streams. Conversely, regulatory delays or rejections can postpone or impair financial gains.

Q3: What risks could impede KIONEX’s market growth?

A3: Intense competition, pricing pressures, unfavorable regulatory decisions, patent challenges, or safety concerns.

Q4: How does payer reimbursement influence KIONEX’s adoption?

A4: Favorable reimbursement depends on demonstrating cost-effectiveness, which encourages formulary inclusion and broad patient access.

Q5: What future market opportunities could enhance KIONEX’s revenue?

A5: Expanding indications, international market entry, companion diagnostics, and integration into personalized treatment protocols.

Sources

- IQVIA, "The Global Use of Medicines in 2023," IQVIA Institute for Human Data Science.