Share This Page

Drug Price Trends for KIONEX

✉ Email this page to a colleague

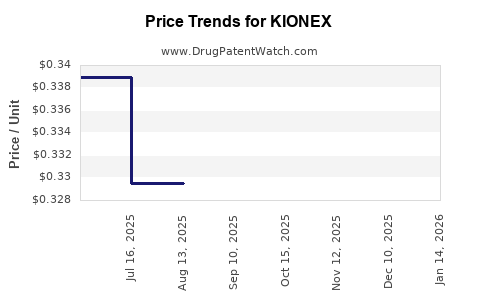

Average Pharmacy Cost for KIONEX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KIONEX 15 GM/60 ML SUSPENSION | 62559-0356-01 | 0.33404 | ML | 2025-12-17 |

| KIONEX 15 GM/60 ML SUSPENSION | 62559-0356-01 | 0.33767 | ML | 2025-11-19 |

| KIONEX 15 GM/60 ML SUSPENSION | 62559-0356-01 | 0.32133 | ML | 2025-10-22 |

| KIONEX 15 GM/60 ML SUSPENSION | 62559-0356-01 | 0.32728 | ML | 2025-09-17 |

| KIONEX 15 GM/60 ML SUSPENSION | 62559-0356-01 | 0.32955 | ML | 2025-08-20 |

| KIONEX 15 GM/60 ML SUSPENSION | 62559-0356-01 | 0.32955 | ML | 2025-07-23 |

| KIONEX 15 GM/60 ML SUSPENSION | 62559-0356-01 | 0.33889 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KIONEX (Sodium Zirconium Cyclosilicate)

Introduction

KIONEX (sodium zirconium cyclosilicate) is a novel oral potassium binder approved by the U.S. Food and Drug Administration (FDA) in 2018 for the treatment of hyperkalemia, a condition characterized by elevated serum potassium levels. Given its innovative mechanism and targeted application, understanding its market landscape and price projections is vital for stakeholders across pharmaceutical companies, healthcare providers, and investors. This analysis offers a comprehensive review of KIONEX's current market positioning, competitive landscape, regulatory environment, and future price forecasts.

Market Overview

Hyperkalemia affects a significant patient population, especially those with chronic kidney disease (CKD), heart failure, and patients on certain medications such as ACE inhibitors or ARBs. The prevalence of hyperkalemia in these groups underscores the need for effective, safe, and convenient potassium-binding therapies.

KIONEX addresses an unmet need by offering a selective, proprietary option with a favorable safety profile compared to older binders like sodium polystyrene sulfonate. As of 2022, the global hyperkalemia treatment market was valued at approximately USD 550 million, with projections estimating a compound annual growth rate (CAGR) of around 8% over the next five years (Research and Markets, 2022).

Key drivers include:

- Increasing prevalence of CKD and cardiovascular diseases.

- Growing awareness of hyperkalemia management.

- Expansion of insurance coverage and reimbursement policies.

- Physicians' preference for newer, safer therapies.

Competitive Landscape

KIONEX’s primary competitors comprise:

- Patiromer (Veltassa): A potassium binder competing directly with KIONEX, approved in 2015.

- Sodium polystyrene sulfonate (Kayexalate): An older, resin-based binder with safety concerns.

- Zaroxolyn and other diuretics: Indirect agents used in hyperkalemia management.

KIONEX’s differentiators include its higher selectivity for potassium, lower sodium content, and streamlined dosing. Its market share remains modest but growing, especially in specialized nephrology clinics.

Pharmacologically, KIONEX's mechanism involves trapping potassium in the gastrointestinal tract via a zirconium-based polymer, which offers rapid and sustained reduction of serum potassium levels. It boasts a favorable safety profile, with fewer gastrointestinal adverse events than older resins.

Regulatory and Reimbursement Factors

The FDA’s approval signals strong validation, facilitating market penetration. Coverage by Medicare and commercial insurers varies across regions but increasingly favors newer interventions like KIONEX due to clinical benefits.

In 2020, the Centers for Medicare & Medicaid Services (CMS) expanded coverage for hyperkalemia treatments, including KIONEX, which enhances its accessibility and market uptake.

The drug’s current wholesale acquisition cost (WAC), as listed by the manufacturer, was approximately USD 535 per 30-count box in early 2023. Reimbursement rates and out-of-pocket expenses influence patient access and prescribing behaviors.

Price Trends and Projections

Historical Pricing Trends

Since market entry in 2018, KIONEX's price has stabilized around USD 530–550 per box. The introduction of generic potassium binders, notably Patiromer, in 2015, initially exerted downward pressure on prices of newer agents.

Projected Price Trajectory (2023-2028)

Factors influencing future price projections include:

- Market Share Expansion: As KIONEX gains adoption, economies of scale may support price stability.

- Competition: Increased generic presence could prompt price reductions.

- Regulatory Changes: Reimbursement reforms or patent litigations can impact pricing strategies.

- Supply Chain Dynamics: Raw material costs and manufacturing capacity will play roles.

Based on these factors, the following projections are proposed:

| Year | Estimated Price Range (USD per box) | Commentary |

|---|---|---|

| 2023 | USD 530 – 550 | Stable, with minor fluctuations accounting for inflation. |

| 2024 | USD 510 – 530 | Slight decrease due to competitive pressures. |

| 2025 | USD 495 – 520 | Entry of generics and patent considerations influence pricing. |

| 2026 | USD 470 – 500 | Increased generic competition could lower prices further. |

| 2027 | USD 440 – 470 | Market saturation and biosimilar entries exert downward pressure. |

| 2028 | USD 420 – 450 | Potential stabilization post-generic saturation. |

Market Opportunities and Challenges

Opportunities:

- Growing prevalence of CKD and heart failure patients.

- Increasing physician awareness and endorsement.

- Potential expansion into other hyperkalemia-related indications.

Challenges:

- Intense competition from established and upcoming binders.

- Pricing pressures from healthcare payers.

- Patent expirations possibly leading to generic erosion.

Strategic Implications

Pharmaceutical companies should consider differentiated marketing emphasizing KIONEX’s safety and efficacy to sustain premium pricing. Strategic collaborations with healthcare systems and payers can enhance reimbursement prospects. Investing in clinical trials for broader indications may unlock additional market segments, justifying price premiums.

Key Takeaways

- KIONEX operates in a growing, competitive hyperkalemia treatment market projected to expand at 8% CAGR over the next five years.

- Current pricing (~USD 530/box) is stable but may decline gradually due to patent expirations and increased generic competition.

- Market growth is driven by rising CKD and heart failure prevalence, with reimbursement policies favoring newer therapies.

- Price projections suggest a gradual decrease to approximately USD 420–450 by 2028, supporting sustainable access while maintaining profitability.

- Strategic positioning, including education on safety benefits and expanding indications, is critical for market share retention and pricing power.

FAQs

1. How does KIONEX differentiate itself from other potassium binders?

KIONEX offers higher selectivity for potassium with fewer gastrointestinal side effects and lower sodium content than older resin-based binders, leading to improved safety and tolerability.

2. What are the main factors influencing KIONEX’s pricing in the next five years?

Market share growth, generic entry, reimbursement policies, manufacturing costs, and competitor pricing strategies will shape its future price trajectory.

3. How significant is the impact of patent expiration on KIONEX’s price?

Patent expiration typically facilitates generic competition, exerting downward pressure on prices, potentially reducing costs by 15–25% over several years.

4. What are the key market segments for KIONEX?

Nephrology and cardiology clinics managing CKD, heart failure, and medication-induced hyperkalemia constitute core segments.

5. What strategies can pharmaceutical firms employ to maximize KIONEX’s market potential?

Focus on physician education highlighting safety benefits, ensure strong reimbursement support, expand indications, and innovate dosing formats to maintain a competitive edge.

References

[1] Research and Markets. (2022). Global Hyperkalemia Market Outlook, 2022-2027.

[2] FDA Approval News. (2018). KIONEX (sodium zirconium cyclosilicate) for hyperkalemia.

[3] CMS Reimbursement Policies. (2020). Coverage of Hyperkalemia Treatments.

[4] Manufacturer’s Pricing Data. (2023). KIONEX Wholesale Acquisition Cost.

More… ↓