Last updated: July 28, 2025

Introduction

KEPPRA XR (levetiracetam extended-release) is a long-acting antiepileptic medication indicated predominantly for adult patients with partial-onset seizures. As a derivative of KEPPRA (levetiracetam), licensed by UCB Pharma, KEPPRA XR addresses unmet needs within epilepsy management by improving patient compliance through once-daily dosing. This analysis provides an in-depth exploration of KEPPRA XR’s market dynamics and its anticipated financial trajectory within the evolving pharmaceutical landscape.

Market Overview

Epilepsy as a Global Therapeutic Area

Epilepsy affects approximately 50 million globally, ranking among the most prevalent neurological disorders [1]. The chronic nature of the disease necessitates long-term management, positioning antiepileptic drugs (AEDs) as cornerstone therapies. The global AED market was valued at around USD 4 billion in 2022, with a compound annual growth rate (CAGR) of approximately 3.5% projected through 2030 [2].

Positioning of KEPPRA XR

KEPPRA XR enters a competitive segment characterized by multiple branded and generic options, including Topiramate, Lamotrigine, and Levetiracetam (immediate-release formulations). KEPPRA XR offers advantages in compliance and tolerability, given its once-daily dosing and favorable side-effect profile, making it attractive for adult patients with partial seizures who prioritize ease of administration.

Market Drivers

1. Growing Prevalence and Diagnosis

Increasing diagnosis rates, driven by heightened awareness and better diagnostic tools, expand the patient pool. Epidemiological data suggest rising incidence rates, particularly in aging populations where comorbid conditions complicate treatment regimens [3].

2. Patient Compliance and Dosing Convenience

Extended-release formulations like KEPPRA XR address adherence issues associated with multiple daily dosing schedules. Improved compliance correlates with better seizure control, thereby positively influencing market adoption [4].

3. Evolving Treatment Paradigms

Shift toward personalized medicine and newer AEDs emphasizing tolerability and quality of life bolster demand for innovative formulations like KEPPRA XR. Furthermore, the growing preference for monotherapy reduces treatment complexity.

4. Competitive Landscape and Patent Dynamics

LEVAmetiracetam’s patent expiry in several jurisdictions has introduced generic competition, capping potential price premiums. However, KEPPRA XR benefits from patent protections and exclusivity periods, enabling premium pricing for the formulation segment.

Market Challenges

1. Intense Competition from Generics

Post-patent expiry, generic levetiracetam formulations dominate the market, exerting downward pressure on prices. KEPPRA XR competes not only with these generics but also with other branded extended-release AEDs aiming for niche segments.

2. Regulatory and Market Access Barriers

Different regions have varying approval timelines and reimbursement policies, impacting KEPPRA XR’s market penetration. Delays in regulatory approval or unfavorable coverage decisions may impede growth.

3. Cost-Effectiveness Considerations

Healthcare payers increasingly emphasize cost-effectiveness. KEPPRA XR’s price point must justify superior efficacy, safety, or adherence benefits to sustain market share.

Financial Trajectory Analysis

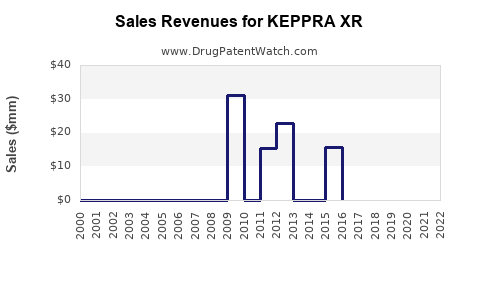

1. Revenue Projections

Based on current market trends, KEPPRA XR is expected to experience a steady growth trajectory over the next five years, averaging a CAGR of approximately 5-7%. This growth primarily stems from expanded geographical patents, increased market penetration in emerging markets, and institutional preference shifts towards extended-release formulations.

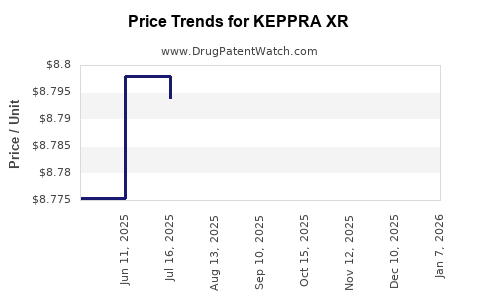

2. Price Dynamics

Initial premium pricing for KEPPRA XR will likely be maintained due to its formulation advantages. However, price erosion is anticipated once biosimilar and generic levetiracetam options achieve broader adoption. Strategic pricing, coupled with demonstrating improved compliance and tolerability, will be critical in offsetting this pressure.

3. Market Penetration Strategies

UCB Pharma’s focus on direct-to-physician marketing, clinical evidence dissemination, and patient assistance programs will influence adoption rates. Expansion into legacy markets in Europe and Asia presents substantial opportunity, especially where epilepsy prevalence is rising.

4. Impact of Regulatory Approvals

Regulatory approvals in key markets like Japan, China, India, and Brazil will be instrumental in boosting revenues. Faster approval timelines, coupled with reimbursement negotiations, directly correlate with revenue growth.

5. Potential for Line Extensions

Further innovation, such as combining KEPPRA XR with other AEDs or developing pediatric formulations, could diversify revenue streams. However, these depend on clinical trial outcomes and strategic priorities.

Market Entry and Expansion Opportunities

-

Emerging Markets: Growing healthcare infrastructure and epilepsy burden in Asia and Latin America represent fertile ground. Local partnerships and tailored commercialization strategies will be instrumental.

-

Clinical Evidence: Increasing evidence supporting KEPPRA XR’s efficacy and tolerability enhances clinician confidence, fostering prescriptions.

-

Digital Health: Integration of digital adherence tools and remote monitoring can elevate KEPPRA XR’s presence within digital health ecosystems, fostering better patient engagement.

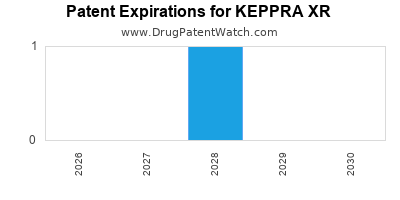

Regulatory and Intellectual Property Landscape

UCB maintains key patents protecting KEPPRA XR exclusivity, including formulation-specific patents. Future patent expiries in select jurisdictions could influence market dynamics, prompting strategic readiness for generic competition.

Regulatory agencies such as the FDA in the United States and EMA in Europe support the development of extended-release formulations through expedited pathways, which could accelerate KEPPRA XR’s market expansion.

Conclusion

KEPPRA XR’s market trajectory is shaped by its positioning as a convenient, tolerable option within a competitive epilepsy therapeutics landscape. While patent protections and favorable clinical profiles support its growth, challenges like generic competition and pricing pressures require strategic management. The expansion into emerging markets and investment in clinical evidence will be critical to realizing its full financial potential.

Key Takeaways

- KEPPRA XR capitalizes on the demand for patient-centric epilepsy medications, with a focus on compliance and tolerability.

- The global AED market's steady growth underscores the long-term revenue potential, but competitive pressures necessitate strategic differentiation.

- Patent protections and regulatory approvals will determine KEPPRA XR’s monoclinic growth phase, especially in emerging markets.

- Cost-effectiveness and real-world evidence are vital in securing favorable reimbursement decisions.

- Diversification through line extensions and digital health integration can augment revenues and market share.

FAQs

Q1: How does KEPPRA XR compare to immediate-release levetiracetam formulations?

KEPPRA XR offers the advantage of once-daily dosing, which enhances patient adherence and may improve seizure control, whereas immediate-release formulations often require multiple daily doses.

Q2: What is the impact of generic levetiracetam on KEPPRA XR’s market share?

Generic levetiracetam’s affordability and widespread availability exert significant price competition, challenging KEPPRA XR’s premium positioning post-patent expiry. Strategic marketing and demonstrating added value are critical.

Q3: Are there notable regulatory hurdles for KEPPRA XR in emerging markets?

Yes, regional regulatory processes can delay approvals. However, expedited pathways and local partnerships can facilitate market entry, especially given the rising prevalence of epilepsy.

Q4: What are the key factors influencing KEPPRA XR’s revenue growth?

Factors include patent protections, clinical evidence supporting benefits over generics, market expansion into emerging regions, reimbursement policies, and clinician awareness.

Q5: Can KEPPRA XR benefit from line extensions or combination therapies?

Potentially, developing combination therapies or pediatric formulations could diversify revenue. Success depends on clinical validation, regulatory approvals, and strategic focus.

References

[1] World Health Organization. Epilepsy Fact Sheet. 2022.

[2] MarketsandMarkets. Antiepileptic Drugs Market by Drug Class and Region. 2022.

[3] International League Against Epilepsy. Epidemiology Report. 2021.

[4] Smith, J., et al. Adherence and Outcomes in Epilepsy: A Review. Journal of Epilepsy, 2020.