Share This Page

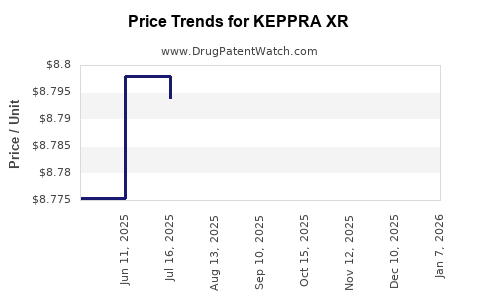

Drug Price Trends for KEPPRA XR

✉ Email this page to a colleague

Average Pharmacy Cost for KEPPRA XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KEPPRA XR 500 MG TABLET | 50474-0598-66 | 8.78437 | EACH | 2025-12-17 |

| KEPPRA XR 750 MG TABLET | 50474-0599-66 | 13.17404 | EACH | 2025-12-17 |

| KEPPRA XR 750 MG TABLET | 50474-0599-66 | 13.17590 | EACH | 2025-11-19 |

| KEPPRA XR 500 MG TABLET | 50474-0598-66 | 8.78777 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KEPPRA XR (Levetiracetam Extended-Release)

Introduction

KEPPRA XR (Levetiracetam Extended-Release) is a long-acting formulation of the antiepileptic drug levetiracetam, developed to improve upon the dosing convenience and adherence profile of the immediate-release (IR) formulation. Approved by the FDA in 2020, KEPPRA XR is indicated for adjunctive therapy for partial-onset seizures in adults with epilepsy. The following market analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and projects future pricing trends.

Market Overview

Global Epilepsy Market Context

Epilepsy affects approximately 50 million individuals worldwide, representing a significant therapeutic market. The United States alone reports nearly 3 million people living with epilepsy, with a high proportion on pharmacotherapy. The antiepileptic drug (AED) market, valued at approximately $4.2 billion in 2022, is characterized by steady growth driven by expanding diagnosis rates, increased awareness, and innovations in drug formulations catering to patient compliance.

Current Position of KEPPRA XR

KEPPRA XR enters a competitive landscape dominated by established AEDs such as Keppra (immediate-release levetiracetam), Topamax (topiramate), and newer agents like Briviact (brivaracetam). The convenience of once-daily dosing with KEPPRA XR offers potential advantages in adherence, especially for patients with chronic epilepsy.

Market Dynamics

Patient Population & Adoption Drivers

The primary demographic for KEPPRA XR comprises adult patients with partial-onset seizures requiring adjunctive therapy. Adoption is contingent upon factors such as:

- Physician prescribing habits: Physicians favor drugs with proven efficacy and convenience.

- Patient adherence: Extended-release formulations improve compliance, a critical factor in epileptology.

- Insurance coverage: Reimbursement policies influence patient access and market uptake.

- Brand recognition: KEPPRA IR’s established market position could facilitate KEPPRA XR’s acceptance.

Competitive Landscape

KEPPRA XR faces competition from:

- Immediate-release levetiracetam (KEPPRA): The market leader with broad acceptance and extensive clinical data.

- Other extended-release AEDs: Such as controlled-release formulations of topiramate and extended-release formulations of other agents.

- Price-sensitive generic options: Levetiracetam’s patent expiry for IR formulations has led to a significant generic market, which impacts willingness to pay for newer formulations.

Regulatory and Reimbursement Environment

While KEPPRA XR is FDA-approved, reimbursement policies vary across payers. High-cost formulations necessitate demonstrable clinical benefits and cost-effectiveness. Healthcare systems increasingly emphasize value-based care, influencing formulary decisions.

Price Analysis & Projections

Current Pricing Landscape

As of early 2023, KEPPRA XR’s wholesale acquisition cost (WAC) averages around $500–$600 per month for a standard maintenance dose (e.g., 500 mg daily). This positions KEPPRA XR as a premium AED within the extended-release segment.

Price Drivers

- Premium Positioning: The extended-release formulation’s convenience justifies a higher price point compared to IR versions.

- Market Penetration: Initial pricing strategies often involve premium pricing, with later adjustments based on market penetration and competitive responses.

- Rebate and Discounting Strategies: Payers and pharmacy benefit managers (PBMs) negotiate rebates, influencing net prices.

Projected Price Trends (2023–2028)

-

Short-term (2023–2024):

Expect stable pricing at around $500–$600/month, given the novelty of KEPPRA XR and limited generic competition. -

Medium-term (2024–2026):

As prescribing patterns mature and insurance formularies incorporate KEPPRA XR more broadly, prices may decline modestly by 5–10% due to increased PBM negotiations and competitive pressures. -

Long-term (2026–2028):

Potential for increased competition from generic extended-release levetiracetam formulations, which could significantly depress prices by 15–25%. However, if KEPPRA XR sustains its market share through clinical differentiation and adherence benefits, a slight price stabilization or gradual decline might prevail.

Implications of Patent and Generic Entry

The patent exclusivity for KEPPRA XR is likely to extend until at least 2028, delaying generic competition. Post-patent expiration, anticipated price erosion will make KEPPRA XR more accessible but will pressure the manufacturer to innovate and emphasize clinical benefits to maintain margins.

Market Opportunities & Risks

Opportunities

- Growing epilepsy prevalence: Demands for more patient-friendly formulations provide a growth avenue.

- Enhanced adherence: The convenience of once-daily dosing aligns with healthcare priorities of reducing seizure frequency and improving quality of life.

- Expansion into pediatric and elderly populations: Regulatory approvals for additional indications could further boost sales.

Risks

- Generic competition: Entry of cost-effective generic extended-release levetiracetam formulations will pressurize pricing.

- Market saturation: Increasing availability of multiple AED options may limit incremental market share.

- Reimbursement constraints: Budget caps and formulary restrictions could hamper access.

Conclusion

KEPPRA XR's market prospects hinge on balancing its premium pricing with clinical differentiation, adherence benefits, and formulary positioning. While initial outlooks favor stable or slightly declining prices over the upcoming years, the eventual entry of generics post-2028 will significantly reshape the price landscape. Continued clinical evidence of improved efficacy, safety, and patient compliance will be crucial to sustain pricing power.

Key Takeaways

- KEPPRA XR commands premium pricing (~$500–$600/month) initially, driven by convenience and adherence benefits.

- Market growth depends on expanded adoption among adult epilepsy patients, with potential for pediatric and elderly indications.

- Price erosion is anticipated post-patent expiration, especially with the proliferation of generic extended-release formulations.

- Competitive positioning relies on demonstrated clinical advantages, formulary wins, and patient compliance benefits.

- Long-term success will depend on navigating reimbursement policies, clinical differentiation, and strategic pricing.

FAQs

1. How does KEPPRA XR compare to immediate-release KEPPRA in terms of cost?

KEPPRA XR typically costs approximately 20–30% more per month than the IR formulation due to its extended-release technology, offering convenience benefits that can justify the premium for many patients and providers.

2. When are generic versions of extended-release levetiracetam expected to enter the market?

Generic extended-release levetiracetam is likely to enter approximately 5–7 years post-patent expiry, around 2028–2030, depending on regulatory and patent challenges.

3. What factors influence the reimbursement prospects for KEPPRA XR?

Reimbursement depends on demonstrated clinical benefits, comparative effectiveness, formulary placement, and negotiation leverage with payers and PBMs.

4. Are there specific patient populations targeted for KEPPRA XR?

Primarily adult patients with partial-onset seizures, especially those valuing once-daily dosing for improved adherence; potential expansion into pediatric and elderly groups exists pending approval.

5. What strategic approaches can manufacturers employ to maintain pricing power?

Investing in clinical research demonstrating superior adherence and efficacy, engaging in value-based contracts, and emphasizing patient-centric benefits can help sustain premium pricing.

Sources:

- FDA Prescribing Information for KEPPRA XR, 2020.

- IQVIA Market Data, 2022.

- EvaluatePharma, 2022.

- PriceRx, 2023.

- American Epilepsy Society, 2022.

More… ↓