KENGREAL Drug Patent Profile

✉ Email this page to a colleague

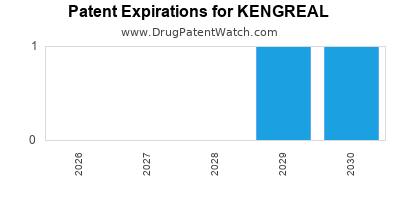

When do Kengreal patents expire, and when can generic versions of Kengreal launch?

Kengreal is a drug marketed by Chiesi and is included in one NDA. There are seven patents protecting this drug and one Paragraph IV challenge.

This drug has seventy-four patent family members in twenty-four countries.

The generic ingredient in KENGREAL is cangrelor. There are three drug master file entries for this compound. Two suppliers are listed for this compound. Additional details are available on the cangrelor profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Kengreal

A generic version of KENGREAL was approved as cangrelor by GLAND on August 11th, 2025.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for KENGREAL?

- What are the global sales for KENGREAL?

- What is Average Wholesale Price for KENGREAL?

Summary for KENGREAL

| International Patents: | 74 |

| US Patents: | 7 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 37 |

| Clinical Trials: | 6 |

| Patent Applications: | 748 |

| Drug Prices: | Drug price information for KENGREAL |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for KENGREAL |

| What excipients (inactive ingredients) are in KENGREAL? | KENGREAL excipients list |

| DailyMed Link: | KENGREAL at DailyMed |

Recent Clinical Trials for KENGREAL

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Florida | Phase 4 |

| Scott R. MacKenzie Foundation | Phase 4 |

| Scott R MacKenzie Foundation | Phase 4 |

Pharmacology for KENGREAL

| Drug Class | P2Y12 Platelet Inhibitor |

| Mechanism of Action | P2Y12 Receptor Antagonists |

| Physiological Effect | Decreased Platelet Aggregation |

US Patents and Regulatory Information for KENGREAL

KENGREAL is protected by seven US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Chiesi | KENGREAL | cangrelor | POWDER;INTRAVENOUS | 204958-001 | Jun 22, 2015 | AP | RX | Yes | Yes | 10,039,780 | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Chiesi | KENGREAL | cangrelor | POWDER;INTRAVENOUS | 204958-001 | Jun 22, 2015 | AP | RX | Yes | Yes | 9,295,687 | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| Chiesi | KENGREAL | cangrelor | POWDER;INTRAVENOUS | 204958-001 | Jun 22, 2015 | AP | RX | Yes | Yes | 8,680,052 | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Chiesi | KENGREAL | cangrelor | POWDER;INTRAVENOUS | 204958-001 | Jun 22, 2015 | AP | RX | Yes | Yes | 9,925,265 | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Chiesi | KENGREAL | cangrelor | POWDER;INTRAVENOUS | 204958-001 | Jun 22, 2015 | AP | RX | Yes | Yes | 9,427,448 | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for KENGREAL

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Chiesi | KENGREAL | cangrelor | POWDER;INTRAVENOUS | 204958-001 | Jun 22, 2015 | 6,114,313 | ⤷ Get Started Free |

| Chiesi | KENGREAL | cangrelor | POWDER;INTRAVENOUS | 204958-001 | Jun 22, 2015 | 6,130,208 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for KENGREAL

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Chiesi Farmaceutici S.p.A. | Kengrexal | cangrelor | EMEA/H/C/003773Kengrexal, co-administered with acetylsalicylic acid (ASA), is indicated for the reduction of thrombotic cardiovascular events in adult patients with coronary artery disease undergoing percutaneous coronary intervention (PCI) who have not received an oral P2Y12 inhibitor prior to the PCI procedure and in whom oral therapy with P2Y12 inhibitors is not feasible or desirable. | Authorised | no | no | no | 2015-03-23 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for KENGREAL

When does loss-of-exclusivity occur for KENGREAL?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Brazil

Patent: 2017014996

Patent: formulações farmacêuticas e recipientes selados

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 71868

Patent: FORMULATIONS PHARMACEUTIQUES COMPRENANT DU CANGRELOR DE HAUTE PURETE ET LEURS PROCEDES DE PREPARATION ET D'UTILISATION (PHARMACEUTICAL FORMULATIONS COMPRISING HIGH PURITY CANGRELOR AND METHODS FOR PREPARING AND USING THE SAME)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 17001840

Patent: Formulaciones farmacéuticas que comprenden cangrelor de alta pureza y métodos para preparar y usar las mismas.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 7206014

Patent: 包含高纯度坎格雷洛的药物制剂以及制备和使用它们的方法 (Pharmaceutical formulations comprising high purity cangrelor and methods for preparing and using the same)

Estimated Expiration: ⤷ Get Started Free

Patent: 5990138

Patent: 包含高纯度坎格雷洛的药物制剂以及制备和使用它们的方法 (Pharmaceutical formulations comprising high purity cangrelor and methods of making and using same)

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 17006958

Patent: Formulaciones farmacéuticas que comprenden cangrelor de alta pureza y métodos para la preparación y uso de los mismos

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 44900

Patent: FORMULATIONS PHARMACEUTIQUES COMPRENANT DU CANGRELOR DE HAUTE PURETÉ ET LEURS PROCÉDÉS DE PRÉPARATION ET D'UTILISATION (PHARMACEUTICAL FORMULATIONS COMPRISING HIGH PURITY CANGRELOR AND METHODS FOR PREPARING AND USING THE SAME)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 1152

Patent: FORMULACIONES FARMACEUTICAS QUE COMPRENDEN CANGRELOR DE ALTA PUREZA Y METODOS PARA PREPARAR Y UTILIZAR LAS MISMAS. (PHARMACEUTICAL FORMULATIONS COMPRISING HIGH PURITY CANGRELOR AND METHODS FOR PREPARING AND USING THE SAME)

Estimated Expiration: ⤷ Get Started Free

Patent: 17009289

Patent: FORMULACIONES FARMACEUTICAS QUE COMPRENDEN CANGRELOR DE ALTA PUREZA Y METODOS PARA PREPARAR Y UTILIZAR LAS MISMAS. (PHARMACEUTICAL FORMULATIONS COMPRISING HIGH PURITY CANGRELOR AND METHODS FOR PREPARING AND USING THE SAME.)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 326

Patent: FORMULATIONS PHARMACEUTIQUES COMPRENANT DU CANGRELOR DE HAUTE PURETÉ ET LEURS PROCÉDÉS DE PRÉPARATION ET D'UTILISATION

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 171246

Patent: FORMULACIONES FARMACEUTICAS QUE COMPRENDEN CANGRELOR DE ALTA PUREZA Y METODOS PARA LA PREPARACION Y USO DE LOS MISMOS

Estimated Expiration: ⤷ Get Started Free

Patent: 221170

Patent: FORMULACIONES FARMACEUTICAS QUE COMPRENDEN CANGRELOR DE ALTA PUREZA Y METODOS PARA LA PREPARACION Y USO DE LOS MISMOS

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 33409

Patent: ФАРМАЦЕВТИЧЕСКИЕ СОСТАВЫ, ВКЛЮЧАЮЩИЕ КАНГРЕЛОР ВЫСОКОЙ ЧИСТОТЫ, И СПОСОБЫ ИХ ПОЛУЧЕНИЯ И ПРИМЕНЕНИЯ (PHARMACEUTICAL COMPOSITIONS CONTAINING HIGH-PURITY CANGRELOR, AND METHODS FOR PRODUCTION AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 17127531

Patent: ФАРМАЦЕВТИЧЕСКИЕ СОСТАВЫ, ВКЛЮЧАЮЩИЕ КАНГРЕЛОР ВЫСОКОЙ ЧИСТОТЫ, И СПОСОБЫ ИХ ПОЛУЧЕНИЯ И ПРИМЕНЕНИЯ

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2440847

Estimated Expiration: ⤷ Get Started Free

Patent: 170103848

Patent: 고순도의 칸그렐러를 포함하는 약제학적 제제, 및 이들의 제조 및 사용 방법

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering KENGREAL around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Argentina | 010377 | COMPOSICIONES FARMACEUTICAS PARA SECAR POR CONGELACION QUE CONTIENEN COMPUESTOS DE NUCLEOSIDOS, PROCEDIMIENTO PARA SU PREPARACION Y USO DE DICHAS COMPOSICIONES PARA FABRICAR MEDICAMENTOS. | ⤷ Get Started Free |

| Japan | 2011520899 | ⤷ Get Started Free | |

| World Intellectual Property Organization (WIPO) | 2016114818 | ⤷ Get Started Free | |

| Hungary | 226616 | PHARMACEUTICAL COMPOSITIONS SUITABLE FER FREEZE DRYING COMPRISING NUCLEOTIDE ANALOGS AND PROCESS FOR PREPARING THEM | ⤷ Get Started Free |

| Hungary | 226489 | STABILISED PHARMACEUTICAL COMPOSITIONS CONTAINING NUCLEOTIDE ANALOGS | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for KENGREAL

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1007094 | 15C0060 | France | ⤷ Get Started Free | PRODUCT NAME: CANGRELOR OU UN SEL PHARMACEUTIQUEMENT ACCEPTABLE,NOTAMMENT UN SEL TETRASODIQUE; REGISTRATION NO/DATE: EU/1/15/994/001 20150323 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for KENGREAL (Reteplase)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.