Last updated: August 3, 2025

Introduction

KENALOG-80, a pharmaceutical formulation primarily indicated for its anti-inflammatory and analgesic properties, has garnered significant attention within the therapeutic and commercial landscapes. As a combination drug featuring ketorolac tromethamine, its market trajectory hinges on evolving clinical, regulatory, and competitive factors. This report explores the current market dynamics influencing KENALOG-80 and delineates its projected financial trajectory, guiding stakeholders on relative opportunities and risks.

Overview of KENALOG-80

KENALOG-80 is an injectable medication containing ketorolac tromethamine, a potent non-steroidal anti-inflammatory drug (NSAID). Its predominant indications include short-term management of moderate to severe pain, particularly post-surgical discomfort. Approved in several markets, its formulation offers rapid analgesic effects, positioning it as an alternative to opioid-based therapies, thereby aligning with the shift towards non-opioid pain management strategies.

Market Dynamics

1. Therapeutic Market Landscape

The analgesic and anti-inflammatory drug markets are characterized by robust growth driven by increasing surgical procedures worldwide and a rising prevalence of acute and chronic pain conditions. The global analgesics market, valued at approximately USD 13.6 billion in 2022, is expected to expand at a CAGR of 3.4% through 2030 (Source: Grand View Research).

Within this context, NSAIDs like ketorolac constitute a critical segment, especially in hospital and outpatient settings. The demand for injectable NSAIDs remains steady, driven by their rapid onset and effectiveness. KENALOG-80’s positioning as an injectable NSAID makes it competitive in perioperative pain management, attracting healthcare providers seeking alternatives to opioids amid regulations restricting their use.

2. Regulatory and Safety Considerations

Regulatory pathways significantly influence the drug’s market penetration. Although ketorolac has established regulatory approval in multiple regions, safety concerns—particularly gastrointestinal, renal side effects, and bleeding risks—have prompted cautious prescribing and limitations on duration of use. For KENALOG-80 to succeed, its safety profile, supported by robust clinical data, must align with evolving regulatory standards, especially amid increased emphasis on adverse event monitoring.

3. Competitive Positioning

The analgesic segment is crowded with opioids, acetaminophen, other NSAIDs, and emerging alternatives such as local anesthetics and non-pharmacological therapies. KENALOG-80’s primary competitors include other injectable NSAIDs like ketorolac formulations by Pfizer and Teva, alongside multimodal analgesic approaches. Differentiation hinges on clinical efficacy, safety profile, ease of administration, and cost-effectiveness.

4. Changing Prescribing Trends and Policy Impact

Global trends favor the reduction of opioid reliance. Policies promoting multimodal and opioid-sparing pain management enhance KENALOG-80’s appeal. Moreover, enhanced recovery after surgery (ERAS) protocols increasingly incorporate NSAIDs, which could expand the drug’s approved indications and recommended use.

5. Market Penetration Strategy

Successful market penetration depends on strategic collaborations, physician education, and targeting surgical centers. Increasing awareness of ketorolac’s benefits over opioids in suitable patient populations can propel usage. Reimbursement policies, formulary inclusion, and distribution channels are pivotal factors influencing sales volume and revenue.

Financial Trajectory

1. Revenue Projections

Assuming a conservative adoption rate in initial years, KENALOG-80 could generate USD 50–100 million in global sales during its first three years post-market expansion. With expanding indications, increased hospital adoption, and formulary inclusion, annual revenues could escalate to USD 200–300 million within five years.

Key factors influencing revenues include:

- Market Share: Estimated penetration into anesthesia and surgical pain management segments.

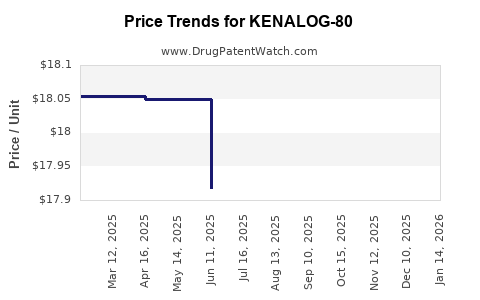

- Pricing Strategy: Positioning as a cost-effective alternative to opioids and other NSAIDs.

- Regulatory Approvals: Broader approvals can elevate use in outpatient and chronic pain settings, further enhancing revenue streams.

2. Cost and Investment Outlook

Significant costs include clinical trials for expanded indications, regulatory filings, manufacturing scale-up, and marketing campaigns. Early-stage investments, particularly in clinical validation and stakeholder engagement, are critical but necessary for sustainable growth.

3. Risk Factors Impacting Financial Outcomes

- Regulatory Challenges: Stringent safety requirements may delay approvals or necessitate additional studies.

- Competitive Pressures: Saturated NSAID market and new non-opioid analgesics pose threats to market share.

- Safety Concerns: Adverse event profiles could limit prescribing or push regulatory restrictions, impacting revenues.

- Pricing and Reimbursement: Payer negotiations and formulary decisions influence profitability margins.

4. Long-Term Financial Outlook

Over a 10-year horizon, KENALOG-80’s financial performance depends on its ability to expand indications and integrate into multimodal pain management protocols. With effective differentiation and compliance, sustained growth is plausible, with revenue estimates potentially reaching USD 500 million annually in mature markets.

Market Entry and Growth Strategies

- Regulatory Engagement: Early dialogue with authorities for expedited approvals and safety data support.

- Clinical Evidence: Robust, comparative efficacy studies to position KENALOG-80 favorably against competitors.

- Partnerships: Collaborations with leading healthcare providers and distribution networks to expedite adoption.

- Educational Campaigns: Targeted physician education on safety and efficacy profiles to improve prescriber confidence.

Conclusion

KENALOG-80’s market dynamics are shaped by its positioning within an evolving analgesic landscape prioritizing opioid alternatives, safety considerations, and procedural pain management. Its financial trajectory is promising but contingent on regulatory success, competitive differentiation, and strategic market penetration. Stakeholders must monitor clinical, regulatory, and market developments to optimize investment and commercialization strategies.

Key Takeaways

- KENALOG-80 is positioned within a growing NSAID market driven by increasing surgical procedures and pain management shifts.

- Regulatory and safety profiles critically influence its market acceptance; ongoing safety data are essential.

- Competitive differentiation relies on efficiency, safety, cost-effectiveness, and strategic placement within multimodal analgesia protocols.

- Revenue forecasts suggest significant growth potential, especially with expanded indications and market penetration.

- Strategic partnerships, education, and regulatory alignment are key to optimizing financial and market outcomes.

FAQs

1. What are the main therapeutic advantages of KENALOG-80 over opioids?

KENALOG-80 offers effective pain relief with a lower risk of addiction, respiratory depression, and abuse—common concerns with opioids. Its rapid onset, injectable formulation, and safety profile make it suitable for perioperative pain management without the opioid-related adverse effects.

2. How does safety influence the market trajectory of KENALOG-80?

Safety concerns, particularly gastrointestinal and renal risks, can limit prescribing and regulatory approval. Robust clinical safety data and clear labeling are critical for market acceptance and to mitigate adverse event-related restrictions.

3. What competitive challenges does KENALOG-80 face?

KENALOG-80 competes with other NSAID formulations, opioid alternatives, and emerging pain therapies. Differentiation depends on its efficacy, safety, ease of use, and cost. Regulatory and reimbursement hurdles also impact market penetration.

4. What is the potential for expanding indications for KENALOG-80?

There is considerable potential for expanding into outpatient, chronic pain, or specialized indications like sports injuries, contingent on clinical trial outcomes and regulatory approvals, which can significantly impact sales growth.

5. How can stakeholders maximize the financial success of KENALOG-80?

By investing in clinical validation, engaging proactively with regulators, developing strategic partnerships, and emphasizing physician education, stakeholders can enhance market adoption and optimize financial outcomes.

Sources:

[1] Grand View Research. Analgesics Market Size & Trends. 2022.