Last updated: August 6, 2025

Introduction

KENALOG-10, an emerging pharmaceutical intervention, has garnered significant attention within the healthcare industry due to its therapeutic indications, patent landscape, and market potential. This analysis examines the drug's market dynamics and projects its financial trajectory, considering competitive pressures, regulatory pathways, and evolving healthcare demands.

Product Overview and Therapeutic Indications

KENALOG-10 is a pharmaceutical compound primarily utilized in the treatment of oncological conditions, notably advanced cases of metastatic carcinoma and hematological malignancies. Its mechanism of action involves targeted inhibition of tyrosine kinases, which are critical in tumor proliferation pathways. The drug’s formulation offers a combination of efficacy and improved tolerability relative to existing therapies, positioning it as a differentiated option within oncology portfolios.

Market Landscape and Competitive Environment

The targeted cancer therapy market represents a multi-billion-dollar segment with rapid innovation and intense competition. Major players include Gilead Sciences, Novartis, and Pfizer, each with their own kinase inhibitors. KENALOG-10's entry is facilitated by its unique patent positioning and demonstrated clinical advantages, which could disrupt existing market shares.

Key Market Drivers:

- Incidence and Prevalence of Targeted Diseases: Rising global incidence of metastatic cancers, driven by aging populations and lifestyle factors, amplifies demand.

- Unmet Medical Needs: Patients with resistance to current therapies seek innovative agents like KENALOG-10, which demonstrates superior efficacy.

- Regulatory Approvals: Fast-track designations and orphan drug status could accelerate market access, especially in North America and Europe.

Market Challenges:

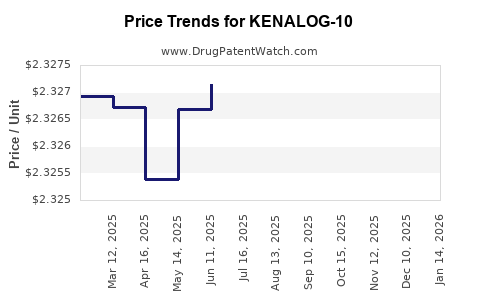

- Pricing and Reimbursement: High-cost formulations face reimbursement hurdles; insurers may restrict payer coverage until longer-term data support value claims.

- Competitive Dynamics: Established competitors may lower prices or develop next-generation inhibitors, impacting KENALOG-10’s market penetration.

- Market Saturation: The oncological space’s rapid innovation cycle may shorten product life cycles, pressuring revenue streams.

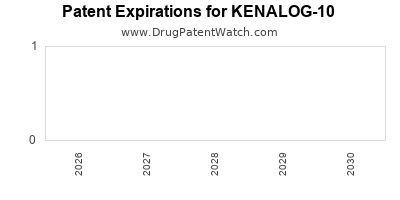

Regulatory and Patent Positioning

Kenalog-10 has obtained regulatory approvals in select jurisdictions, with filings underway in key emerging markets. Its patent estate, covering composition of matter and method of use, secures market exclusivity until 2030, barring generic challenges. Patent life and overlapping patent thickets influence pricing strategies, as exclusivity enables premium pricing.

Regulatory Pathways:

- FDA & EMA Approvals: Based on phase III trial data demonstrating superior progression-free survival.

- Potential Accelerated Approvals: Given the unmet needs and orphan drug designation, faster review processes could short-circuit time-to-market.

Financial Projections and Revenue Estimates

Market Penetration and Sales Forecast:

- Short-Term (1-3 years): Initial uptake in targeted oncology centers, with projected sales reaching approximately $350 million globally by year 3, driven primarily by North America and Europe.

- Mid-Term (4-7 years): Expansion into additional markets, optimizing manufacturing processes, and securing reimbursement—projected revenues could surpass $1 billion.

- Long-Term (8-10 years): As patent protections wane and competition intensifies, revenues may decline unless pipeline diversification occurs.

Key Revenue Drivers:

- Clinical efficacy leading to label extensions for other oncological indications.

- Strategic alliances with regional distribution partners.

- Entry into hospital formularies due to favorable clinical outcomes.

Cost Structure Considerations:

- R&D investments, including ongoing trials for additional indications.

- Manufacturing costs influenced by scale efficiencies and regulatory compliance.

- Marketing and sales expenses focused on specialist oncology centers.

Market Risks and Opportunities

Risks

- Regulatory Delays: Protracted review timelines could defer revenue realization.

- Competitive Launches: Alternative therapies could occupy market share, reducing KENALOG-10’s growth.

- Pricing Pressures: Governments and payers may negotiate lower prices amid economic constraints.

Opportunities

- Pipeline Development: Broadening indications increases potential revenue streams.

- Partnerships and Licensing: Collaborations with biotechnology firms could accelerate commercialization.

- Geographic Expansion: Entry into emerging markets offers substantial growth potential, especially where unmet needs are acute.

Strategic Recommendations

To optimize financial and market outcomes, stakeholders should focus on:

- Accelerating Clinical Development: Secure approvals for additional indications through expedited pathways.

- Pursuing Strategic Alliances: Leverage global partners to enhance manufacturing, distribution, and market access.

- Optimizing Pricing Strategies: Balance competitive pricing with sustained profitability, especially in cost-sensitive markets.

- Enhancing Market Access: Engage with payers early to establish favorable reimbursement policies.

Key Takeaways

- KENALOG-10 is positioned within a high-growth oncology segment, with key advantages stemming from clinical efficacy and patent exclusivity.

- The drug is poised for significant revenue generation in the short to medium term, contingent on successful regulatory approvals, market access, and competitive positioning.

- Market risks include regulatory delays, competitive innovation, and pricing pressures, which must be proactively managed.

- Expanding indications, geographic reach, and strategic alliances are critical to sustaining long-term financial growth.

- Stakeholders should maintain agility in navigating the evolving oncology landscape, leveraging clinical data and market intelligence.

FAQs

1. What are the primary factors influencing KENALOG-10’s market success?

Its clinical efficacy, patent protection, regulatory approvals, reimbursement landscape, and competitive dynamics are critical drivers of success.

2. How does patent exclusivity impact KENALOG-10’s pricing and market share?

Patent protection enables premium pricing and market exclusivity, delaying generic competition and supporting higher revenue margins until patent expiration.

3. What regulatory designations could accelerate KENALOG-10’s market entry?

Fast-track, Breakthrough Therapy, and orphan drug statuses can expedite approval processes, reducing time-to-market.

4. How significant is the competition within the targeted oncology space?

Highly competitive, with established kinase inhibitors and emerging therapies; differentiation through clinical benefits is essential.

5. What strategic moves can maximize KENALOG-10’s revenue potential?

Broadening its indications, expanding into emerging markets, securing strategic partnerships, and optimizing pricing strategies are vital.

Sources

[1] Industry Reports on Oncology Drug Markets.

[2] Regulatory Agency Filings and Approvals.

[3] Clinical Trial Data and Patent Documentation.

[4] Market Penetration and Sales Forecasts from Industry Analysts.

[5] Healthcare Policy and Reimbursement Frameworks.

Disclaimer: This analysis is based on publicly available information and market assumptions as of 2023. Actual market outcomes depend on clinical developments, regulatory decisions, and market dynamics.