Last updated: July 28, 2025

Introduction

IYUZEH, the brand name for empagliflozin, is an oral sodium-glucose co-transporter 2 (SGLT2) inhibitor primarily prescribed for managing type 2 diabetes mellitus (T2DM). Developed by Boehringer Ingelheim in collaboration with Eli Lilly, IYUZEH has garnered significant attention owing to its proven cardiovascular benefits and expanding indications. The drug's evolution reflects broader shifts within diabetes management and cardiovascular risk reduction, positioning it as a pivotal asset within global pharmaceutical markets.

Market Landscape and Competitive Positioning

The global diabetes therapeutics market has experienced rapid growth, driven by increasing prevalence of T2DM—projected to reach 700 million by 2045 according to the International Diabetes Federation (IDF)—and the rising burden of cardiovascular comorbidities. SGLT2 inhibitors, including empagliflozin, have revolutionized treatment schemas by offering glycemic control coupled with beneficial cardiovascular and renal outcomes, features not common to many older classes such as sulfonylureas or insulin therapy.

Empagliflozin's competitive landscape extends beyond its primary competitor, Johnson & Johnson’s Invokana (canagliflozin), and AstraZeneca's Farxiga (dapagliflozin). While these drugs target similar patient populations, empagliflozin distinguishes itself through robust cardiovascular outcome trial results, notably the EMPA-REG OUTCOME study, which demonstrated a 38% reduction in cardiovascular mortality, a landmark achievement that elevated its market standing.

Market Dynamics Shaping IYUZEH’s Trajectory

1. Regulatory Approvals and Expanded Indications

Since its initial approval in 2014, empagliflozin's regulatory journey has included several pivotal milestones. The FDA granted approval for its use in T2DM, with subsequent expansions covering heart failure with reduced ejection fraction (HFrEF) in 2022, following the EMPEROR-Reduced trial demonstrating notable benefits. Furthermore, the European Medicines Agency (EMA) approved empagliflozin for chronic kidney disease (CKD) management regardless of diabetic status, reflecting the drug’s renal protective profile.

These approvals have broadened IYUZEH’s therapeutic scope, catalyzing growth in multiple segments: cardiovascular disease, CKD, and T2DM, effectively increasing its addressable market.

2. Incorporation into Treatment Guidelines

Major guidelines now emphasize SGLT2 inhibitors as first-line or second-line agents for high-risk T2DM patients, especially those with established cardiovascular or renal disease. This consensus adoption ensures a steady infusion of prescriptions, sustaining market demand.

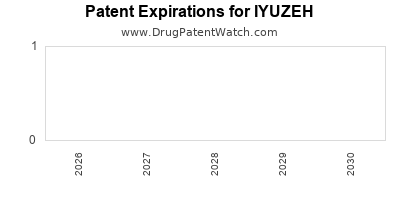

3. Patent and Exclusivity Considerations

Empagliflozin’s primary patents expire in the near future, with biosimilar and generic entrants anticipated by the late 2020s. While patent cliffs may curtail exclusivity-driven revenues over the medium term, product differentiation based on clinical outcomes and expanded indications could mitigate immediate erosion.

4. Market Penetration and Adoption Rates

In high-income markets, IYUZEH enjoys high physician adoption, buoyed by robust clinical data and favorable reimbursement policies. In emerging markets, access and pricing strategies are expanding the therapeutic footprint; however, affordability remains a challenge impacting volume growth.

5. Competitive Innovation and Pipeline

Competitors continue to develop next-generation SGLT2 inhibitors and combination therapies, such as SGLT1/2 inhibitors and fixed-dose combinations with GLP-1 receptor agonists. These innovations threaten to dilute market share but also create opportunities for IYUZEH through positioning as part of combination treatments.

Financial Trajectory and Revenue Projections

1. Historical Revenue Performance

Empagliflozin’s debut generated approximately €0.8 billion in 2017, escalating to over €4.2 billion in 2021 globally. This growth reflects increased prescription volumes, expanded indications, and positive clinical outcomes.

2. Revenue Drivers

Key factors influencing revenues include:

- Market Penetration: Empagliflozin's penetration in North America and Europe exceeds 40%, driven by guideline recommendations and reimbursement.

- Indication Expansion: New approvals for heart failure and CKD unlock additional revenue streams.

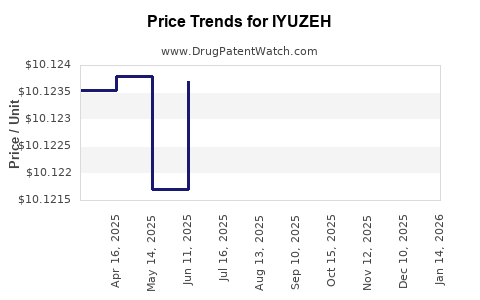

- Pricing Strategies: Premium pricing persists in developed markets, supported by clinical benefits.

- Volume Growth: Increasing prevalence of T2DM and high-risk patient identification facilitate volume expansion.

3. Future Revenue Outlook

Analysts project that IYUZEH’s sales could reach approximately €6–8 billion annually by 2025, considering:

- Continued adoption within existing markets.

- Uptake in emerging markets driven by targeted pricing strategies.

- Accelerated prescriptions owing to guideline endorsements.

- Additional label expansions for indications like heart failure and CKD.

However, approaching patent expiration and emerging biosimilars pose potential risks to revenue growth post-2025, challenging the exclusivity-driven premium pricing model.

Market Drivers and Risks Impacting Trajectory

Drivers:

- Clinical Evidence: The EMPA-REG OUTCOME trial and subsequent studies establish empagliflozin’s cardiovascular and renal benefits, fueling guideline endorsements and physician confidence.

- Regulatory Support: Expanded approvals and label extensions support market growth.

- Growing Disease Burden: Rising prevalence of T2DM and associated comorbidities sustains demand.

- Integration into Multimodal Therapy: Adoption of combination therapies enhances adherence and sales.

Risks:

- Market Saturation: Mature markets may approach saturation, limiting further volume growth.

- Pricing Pressures: Cost containment measures in healthcare systems could constrain pricing and reimbursement.

- Generic Competition: Near-future biosimilar entries could significantly erode profits.

- Competitive Innovations: Advancements in alternative therapies or novel drug classes may diminish empagliflozin’s market share.

Strategic Implications

To optimize financial performance, Boehringer Ingelheim and Eli Lilly should focus on strengthening IYUZEH’s positioning through:

- Expanding indication approvals, notably for heart failure and CKD.

- Enhancing patient access in emerging markets via tiered pricing.

- Investing in real-world evidence to reinforce clinical benefits.

- Developing combination therapies and personalized treatment protocols.

Conclusion

The market dynamics for IYUZEH reflect an evolution driven by clinical excellence, regulatory support, and expanding indications. While current revenues display a robust upward trajectory, future growth hinges on navigating patent cliffs, market penetration, and competitive innovation. Strategic positioning and continued clinical validation remain crucial to maintaining IYUZEH’s financial momentum in the rapidly evolving therapeutic landscape.

Key Takeaways

- Growth Catalyst: Clinical trial data positioning empagliflozin as a cornerstone in cardiovascular and renal protection is fueling market expansion.

- Market Expansion: Regulatory approvals for new indications will significantly broaden the addressable market, with revenues projected to rise to €6–8 billion by 2025.

- Competitive Challenges: Patent expirations and biosimilar entries pose risks, necessitating differentiation through clinical outcomes and combination therapies.

- Pricing & Access: Premium pricing benefits in developed markets support revenue, but price pressures and access barriers in emerging territories require strategic management.

- Innovation & Pipelines: Investment in new indications and combination regimens will sustain the drug’s relevance, buffering against competitive threats.

Frequently Asked Questions

1. What are the primary factors driving the growth of IYUZEH in the global market?

Clinical trial success demonstrating cardiovascular and renal benefits, expanded regulatory approvals for new indications like heart failure and CKD, and increasing guideline endorsements make empagliflozin a preferred option—factors underpinning its market growth.

2. How do patent expirations impact IYUZEH’s financial outlook?

Upcoming patent expirations in the late 2020s threaten revenue streams due to biosimilar competition. Nonetheless, expanded indications, clinical differentiation, and strategic pricing can delay erosion and maintain market relevance.

3. What is the role of clinical evidence in IYUZEH’s market position?

Robust clinical outcomes, particularly the EMPA-REG OUTCOME trial, bolster physician confidence, influence treatment guidelines, and support premium pricing, reinforcing its market competitiveness.

4. How does IYUZEH compare to other SGLT2 inhibitors?

Empagliflozin distinguishes itself with superior cardiovascular mortality reduction data. However, similar efficacy profiles among competitors necessitate strategic differentiation through indications and clinical outcomes.

5. What strategic moves can sustain IYUZEH’s market dominance?

Expanding approved indications, entering new markets with flexible pricing, investing in real-world evidence, and developing combination therapies are key strategies to sustain competitiveness and financial growth.

Sources

- International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

- Boehringer Ingelheim. IYUZEH (empagliflozin) product information.

- FDA. Empagliflozin (Empa) Drug Approval Records.

- EMA. Empagliflozin approvals and label extensions.

- Market Research Future. Global SGLT2 Inhibitors Market Analysis, 2022.