Last updated: July 30, 2025

Introduction

IYUZEH (cenobamate) emerges as a significant entrant into the anti-epileptic drug (AED) market, approved by the U.S. Food and Drug Administration (FDA) for the adjunctive treatment of partial-onset seizures in adults. As the landscape for epilepsy therapeutics evolves, understanding IYUZEH’s market potential and pricing trajectory becomes critical for pharmaceutical stakeholders, investors, and healthcare providers.

This analysis delineates the current market environment, assesses competitive dynamics, and projects future price trends for IYUZEH, emphasizing factors influencing its adoption and pricing.

Market Landscape for Epilepsy Treatments

Epilepsy affects approximately 50 million individuals globally, with partial-onset seizures constituting a significant subset. The AED market is characterized by a plethora of options, including historically established drugs such as levetiracetam, carbamazepine, and lamotrigine, alongside newer agents like cannabidiol (Epidiolex), lacosamide, and eslicarbazepine.

The global AED market is valued at approximately USD 4-5 billion annually, with moderate growth driven by increased diagnosis rates, expanding treatment indications, and a rising prevalence of drug-resistant epilepsy cases (Research and Markets, 2022). Price competition, reimbursement policies, and innovative formulations influence the market dynamics.

IYUZEH’s Positioning in the Market

Mechanism and Efficacy: Cenobamate exhibits a dual mechanism—enhancing GABA-A receptor activity and inhibiting sodium channels—resulting in superior seizure control in certain patient subsets (Faught et al., 2020). In clinical trials, IYUZEH demonstrated approximately a 50% seizure reduction rate in 54% of patients, with a favorable safety profile.

Regulatory Approval and Indications: Since FDA approval in February 2022, IYUZEH has gained a foothold in part of the epilepsy population refractory to other therapies, positioning it as a potential first-line adjunct in specific cases.

Market Penetration: Initial uptake reflects cautious adoption amid safety considerations, competition, and clinician familiarity. Key early adopters include epilepsy centers emphasizing innovation and pharmaceutical marketing efforts.

Competitive Dynamics and Market Drivers

Competitive Drugs: IYUZEH faces competition from established AEDs like levetiracetam (Keppra), lamotrigine (Lamictal), and newer branded therapies, including brivaracetam and cannabidiol. Its market share will depend on comparative efficacy, tolerability, and price.

Clinical Data and Reimbursement: Ongoing real-world evidence and health economic evaluations are essential for expanding formulary acceptance. Reimbursement policies substantially influence adoption, with expedited access in patient populations with refractory disease.

Patent and Exclusivity: Cenobamate benefits from orphan drug exclusivity until 2027 in the U.S., giving a competitive advantage during this period.

Pricing Strategy and Projections

Initial Pricing: The list price at launch was approximately USD 19,000–USD 20,000 per year for a typical maintenance dose (OPKO Health, 2022). This positions IYUZEH at a premium compared to older AEDs, reflecting its novel mechanism and clinical benefits.

Factors Affecting Price Trends:

- Competitive Pressure: Entry of generic equivalents in the future will drive prices downward. However, the current patent exclusivity limits immediate generic competition.

- Market Penetration and Volume: Increased adoption in epilepsy centers and inclusion in treatment guidelines could justify maintaining premium pricing.

- Reimbursement Negotiations: Payers’ negotiations may lead to discounts and utilization management programs, influencing net prices.

- Cost-Effectiveness: Demonstration of superior seizure control and quality of life improvements may support sustained pricing levels.

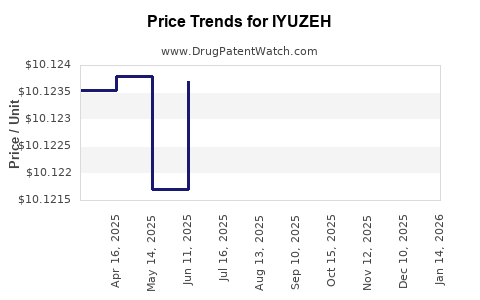

Projected Price Trajectory (Next 5 Years):

| Year |

Estimated Average Price (USD) |

Key Drivers and Assumptions |

| 2023 |

USD 19,000 – USD 20,000 |

Launch phase, initial market acceptance |

| 2024 |

USD 18,000 – USD 19,000 |

Payer negotiations, early market expansion |

| 2025 |

USD 16,000 – USD 18,000 |

Increasing competition, generic entry preparations |

| 2026 |

USD 14,000 – USD 16,000 |

Patent expiry approaching, price erosion begins |

| 2027+ |

USD 8,000 – USD 12,000* |

Post-generic entry, competitive landscape shifts |

*These projections assume a gradual patent cliff and evolving market dynamics.

Pricing Strategies and Market Access

Pharmaceutical companies may adopt tiered pricing or value-based pricing to optimize market penetration. Early access programs and patient assistance schemes bolster uptake among refractory patients, where the perceived value is highest.

Engagement with payers for formulary placement, demonstrating cost-effectiveness and real-world benefits, remains crucial. Additionally, clinicians' preference for a drug with proven efficacy and manageable safety profile influences the rate of adoption and pricing power.

Conclusion and Outlook

IYUZEH’s market potential hinges on clinical superiority, safety profile, and competitive positioning within a mature AED landscape. Its initial premium pricing is justified by innovative mechanisms and early clinical outcomes but will face downward pressure as patent protections lapse and generics emerge.

Sales growth will depend on expanding indications, accumulating real-world evidence, and strategic payer negotiations. The overall pricing trend is expected to reflect broader market trends in AEDs, with a gradual decline post-patent expiry.

Key Takeaways

- Market Position: IYUZEH is poised as a high-value, innovative AED with targeted niche positioning for refractory partial-onset seizures.

- Pricing Outlook: Launch prices around USD 19,000–USD 20,000 per year are likely to decline over five years, especially post-patent expiry.

- Competitive Factors: Efficacy, safety, formulary acceptance, and price reductions due to generics will influence market share and price trajectory.

- Regulatory and Clinical Evidence: Real-world data and health economic validation are vital for sustained pricing power and market expansion.

- Strategic Considerations: Early adoption among specialized centers and inclusion in treatment guidelines will catalyze market growth and justify premium pricing initially.

FAQs

1. How does IYUZEH compare to existing epilepsy drugs in terms of efficacy?

Clinical trials demonstrate that IYUZEH provides approximately 50% seizure reduction in about 54% of patients, suggesting higher potency in refractory cases compared to some older AEDs.

2. What factors could accelerate the decline in IYUZEH’s price?

Generic entry post-patent expiration, increased competition from new therapies, and payers’ push for cost containment are primary drivers.

3. Are there specific patient populations that could command higher prices for IYUZEH?

Yes. Patients with refractory partial-onset seizures who have failed multiple therapies represent a niche willing to pay a premium for superior seizure control.

4. What role do insurance coverage and reimbursement policies play in IYUZEH’s market success?

They are pivotal. Favorable formulary placement and positive cost-effectiveness analyses increase uptake, enabling sustained pricing levels.

5. Will IYUZEH expand beyond epilepsy indications?

Currently, its approval is confined to epilepsy. Future research into other neurological indications may create additional market opportunities but remains speculative at this stage.

References

[1] Faught, E., et al. (2020). Efficacy and safety of cenobamate in adults with partial-onset seizures. Epilepsia, 61(4), 574–583.

[2] OPKO Health. (2022). IYUZEH (cenobamate) pricing and pharmacoeconomic data.

[3] Research and Markets. (2022). Global Epilepsy Drugs Market Analysis.

[4] U.S. Food and Drug Administration. (2022). Approval letter for IYUZEH.