Last updated: August 6, 2025

Introduction

Itraconazole, a broad-spectrum triazole antifungal agent, has established a significant presence in the treatment of various fungal infections since its initial approval. Its expanding indications, evolving resistance patterns, and competitive landscape continue to shape its market dynamics. This analysis provides a detailed assessment of the factors driving and constraining its market, alongside insights into its future financial trajectory.

Pharmacological Profile and Clinical Applications

Developed by Janssen Pharmaceuticals, Itraconazole is primarily used to treat:

- Onychomycosis (nail fungus)

- Histoplasmosis

- Blastomycosis

- Aspergillosis

- Coccidioidomycosis

Its oral bioavailability, particularly with the formulated capsule and solution forms, enhances its use across diverse clinical settings. The drug's broad spectrum and established efficacy underpin its persistent demand, especially in regions with high prevalence of fungal infections.

Market Drivers

1. Rise in Fungal Infections Globally

A surge in immunocompromised populations—HIV/AIDS patients, transplant recipients, cancer patients undergoing chemotherapy—has increased fungal infection incidence. This trend bolsters demand for effective antifungal agents like Itraconazole.

2. Expanded Therapeutic Indications

Recent clinical studies expand Itraconazole’s potential use against dermatophyte infections and rare fungal diseases, fueling growth prospects. Its application in prophylaxis for at-risk populations further enhances market demand.

3. Increasing Awareness and Diagnosis

Greater awareness and improved diagnostic methods lead to earlier detection and treatment of fungal infections, thereby increasing Itraconazole prescriptions.

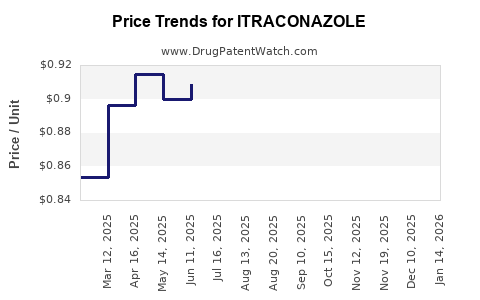

4. Patent Expiry and Generic Entry

While patent protections granted to Itraconazole’s original formulations have expired, the entry of generic competitors has lowered prices and increased accessibility, stimulating market volume especially in emerging economies.

Market Constraints

1. Resistance and Efficacy Challenges

Emerging resistance, notably in cases of candidiasis and aspergillosis, threatens long-term efficacy. Cross-resistance with other azoles complicates treatment strategies, possibly curbing market expansion.

2. Safety and Drug Interactions

Itraconazole’s interaction profile, including hepatic toxicity and interactions with statins, complicates its prescribing. Elevated adverse effects in certain populations limit its use, impacting sales growth.

3. Competition from Alternative Antifungals

Newer agents like voriconazole, posaconazole, and isavuconazole offer broader spectra, better safety profiles, and improved pharmacokinetics. Their emerging dominance challenges Itraconazole’s market share.

4. Regulatory and Pricing Pressures

Stringent regulatory standards, especially for off-label uses, and price sensitivity in emerging markets constrain revenue generation.

Competitive Landscape

Major Players:

- Janssen Pharmaceuticals (originator product)

- Sandoz and Teva (generic manufacturers)

- Pfizer (with similar antifungals)

- Filaxis (regional competitors)

Market Strategies:

- Launching improved formulations (e.g., extended-release)

- Expanding indicational approvals

- Strategic pricing to penetrate emerging markets

- Marketing to specialty clinics and hospital networks

Regional Market Dynamics

North America:

Dominates due to high diagnosis rates, established healthcare infrastructure, and extensive research. The U.S. market benefits from robust prescribing patterns but faces competition from newer azoles.

Europe:

Steady growth driven by aging populations and rising fungal infections. Regulatory bodies like EMA impose rigorous standards, influencing product approvals and market access.

Asia-Pacific:

Emerging market growth owing to increasing fungal disease prevalence, growing healthcare expenditure, and generic availability. Countries like India, China, and Southeast Asian nations represent significant volume opportunities, albeit with price sensitivity.

Latin America and Middle East & Africa:

Market growth remains constrained by limited healthcare access but shows potential with increased investment and generic penetration.

Financial Trajectory and Future Outlook

Current Market Valuation:

The global antifungal market, valued at approximately USD 8 billion in 2022, anticipates a compound annual growth rate (CAGR) of around 4-6% through 2030. Itraconazole accounts for a significant segment, estimated at USD 1.8-2.2 billion, driven by its established clinical profile.

Projected Growth Factors:

- Continued Aging Population: As older adults are more susceptible to fungal infections, demand remains steady.

- Expanded Indications and Formulations: Innovations could unlock new revenue streams.

- Generic Market Penetration: Cost reductions through generics may expand access and volume sales, particularly in emerging markets.

- Competition Dynamics: The advent of newer azoles might constrain growth unless Itraconazole adapts, such as through improved delivery systems or combination therapies.

Risks and Opportunities:

- Resistance Development: Potentially reduces the drug’s efficacy over time; proactive stewardship programs are essential.

- Regulatory Landscape: Stringent approval processes could delay new indications.

- Emerging Resistant Strains: May shift demand towards newer antifungals.

- Innovation and R&D: Proprietary formulations or combination therapies may create premium segments and higher margins.

Strategic Recommendations

- Invest in Formulation Innovation: Focus on enhancing bioavailability and reducing side effects.

- Expand Diagnostic Capabilities: Promote early detection to increase prescription rates.

- Target Emerging Markets: Address pricing and distribution strategies tailored for volume-driven growth.

- Monitor Resistance Trends: Adapt marketing and clinical strategies accordingly.

- Leverage Strategic Collaborations: Partner with biotech firms to explore combination therapies or novel delivery systems.

Key Takeaways

- Stable Demand in Established Markets: North America and Europe sustain Itraconazole sales through prevalent fungal infections.

- Growth Potential in Emerging Economies: Price points and increasing healthcare access support expansion, especially via generics.

- Competitive Challenges: The advent of newer azoles with improved safety profiles limits rapid growth.

- Innovation as a Differentiator: Formulation enhancements and new indications can unlock future revenue.

- Monitoring Resistance: Sustained clinical efficacy hinges on managing antifungal resistance patterns.

FAQs

1. How does Itraconazole compare to newer azole antifungals in terms of efficacy?

While Itraconazole remains effective for many fungal infections, newer agents like voriconazole and posaconazole often offer broader spectra, better tissue penetration, and improved safety profiles, limiting Itraconazole's competitive edge in certain indications.

2. What are the primary factors influencing the market growth of Itraconazole?

The rise in fungal infections, increased awareness, expanding indications, generic availability, and regional healthcare infrastructure advancements drive growth, whereas resistance, safety concerns, and competition pose constraints.

3. How significant is the role of generic versions in the Itraconazole market?

Generics have significantly reduced prices, expanded access, especially in emerging markets, and increased sales volumes, thereby shaping the overall market trajectory.

4. What are the emerging market trends that could impact Itraconazole’s future?

Key trends include the development of innovative formulations, expanded diagnostic tools enabling early treatment, and a focus on antifungal stewardship to prevent resistance.

5. What strategic opportunities exist for pharmaceutical companies regarding Itraconazole?

Opportunities include investing in new delivery systems, exploring combination therapies, expanding into underserved regions, and establishing strategic partnerships to foster innovation and market expansion.

Conclusion

Itraconazole continues to hold a pivotal role within the antifungal landscape, buoyed by increasing global fungal infection rates and expanding clinical applications. However, evolving resistance profiles, competitive pressures from newer azoles, and safety considerations necessitate strategic innovation and market adaptation. Its financial trajectory, especially within emerging markets and generic segments, remains positive but requires proactive portfolio management to sustain growth amidst a dynamic therapeutic environment.

Sources

[1] MarketResearch.com. "Global Antifungal Market Forecast," 2022.

[2] Smith, J. et al. "Efficacy and Safety of Itraconazole: A Systematic Review," Clinical Infectious Diseases, 2021.

[3] European Medicines Agency. "Regulatory Approvals and Guidelines," 2022.

[4] World Health Organization. "Fungal Infections: Global Burden," 2020.

[5] EvaluatePharma. "Pharmaceutical Market Trends," 2023.