ISTURISA Drug Patent Profile

✉ Email this page to a colleague

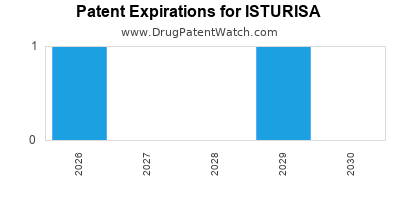

Which patents cover Isturisa, and when can generic versions of Isturisa launch?

Isturisa is a drug marketed by Recordati Rare and is included in one NDA. There are six patents protecting this drug.

This drug has one hundred and thirty-six patent family members in forty-three countries.

The generic ingredient in ISTURISA is osilodrostat phosphate. One supplier is listed for this compound. Additional details are available on the osilodrostat phosphate profile page.

DrugPatentWatch® Generic Entry Outlook for Isturisa

Isturisa was eligible for patent challenges on March 6, 2024.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be July 6, 2035. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ISTURISA?

- What are the global sales for ISTURISA?

- What is Average Wholesale Price for ISTURISA?

Summary for ISTURISA

| International Patents: | 136 |

| US Patents: | 6 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 50 |

| Clinical Trials: | 1 |

| Drug Prices: | Drug price information for ISTURISA |

| What excipients (inactive ingredients) are in ISTURISA? | ISTURISA excipients list |

| DailyMed Link: | ISTURISA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for ISTURISA

Generic Entry Date for ISTURISA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for ISTURISA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Johns Hopkins University | PHASE4 |

Pharmacology for ISTURISA

US Patents and Regulatory Information for ISTURISA

ISTURISA is protected by eight US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of ISTURISA is ⤷ Get Started Free.

This potential generic entry date is based on patent 10,143,680.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

International Patents for ISTURISA

When does loss-of-exclusivity occur for ISTURISA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 1116

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 15287336

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2016030243

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 54393

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 17000026

Estimated Expiration: ⤷ Get Started Free

China

Patent: 6470704

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0181406

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 20749

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 66596

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 17008187

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 3685

Estimated Expiration: ⤷ Get Started Free

Patent: 1790140

Estimated Expiration: ⤷ Get Started Free

Patent: 1991359

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 66596

Estimated Expiration: ⤷ Get Started Free

Patent: 12278

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 39037

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 9374

Patent: צורות מתן רוקחיות המכילה מיקרוקרסטליין צלולוז (Pharmaceutical dosage forms comprising microcrystalline cellulose)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 31136

Estimated Expiration: ⤷ Get Started Free

Patent: 17520590

Patent: 医薬製剤

Estimated Expiration: ⤷ Get Started Free

Patent: 19194221

Patent: 医薬製剤 (PHARMACEUTICAL DOSAGE FORMS)

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 66596

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 16017315

Patent: FORMAS DE DOSIFICACION FARMACEUTICA. (PHARMACEUTICAL DOSAGE FORMS.)

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 170201

Patent: FORMAS DE DOSIFICACION FARMACEUTICA

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 016502540

Patent: PHARMACEUTICAL DOSAGE FORMS

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 66596

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 66596

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201610227T

Patent: PHARMACEUTICAL DOSAGE FORMS

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 66596

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2468610

Estimated Expiration: ⤷ Get Started Free

Patent: 170029491

Patent: 제약 투여 형태 (PHARMACEUTICAL DOSAGE FORMS)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 86704

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 07682

Estimated Expiration: ⤷ Get Started Free

Patent: 1613586

Patent: Pharmaceutical dosage forms

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 16000557

Patent: PHARMACEUTICAL DOSAGE FORMS

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ISTURISA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Croatia | P20181406 | ⤷ Get Started Free | |

| Japan | 2017002063 | ⤷ Get Started Free | |

| Spain | 2686704 | ⤷ Get Started Free | |

| Canada | 2619660 | DERIVES IMIDAZOLO CONDENSES UTILISES POUR INHIBER L'ALDOSTERONE SYNTHASE ET L'AROMATASE (CONDENSED IMIDAZOLO DERIVATIVES FOR THE INHIBITION OF ALDOSTERONE SYNTHASE AND AROMATASE) | ⤷ Get Started Free |

| European Patent Office | 3412278 | FORMES PHARMACEUTIQUES (PHARMACEUTICAL DOSAGE FORMS) | ⤷ Get Started Free |

| European Patent Office | 2523731 | ⤷ Get Started Free | |

| South Korea | 20130018985 | CONDENSED IMIDAZOLO DERIVATIVES FOR THE INHIBITION OF ALDOSTERONE SYNTHASE AND AROMATASE | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ISTURISA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2523731 | SPC/GB20/034 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: OSILODROSTAT, OR OSILODROSTAT PHOSPHATE; REGISTERED: UK EU/1/19/1407/001(NI) 20200113; UK EU/1/19/1407/002(NI) 20200113; UK EU/1/19/1407/003(NI) 20200113; UK PLGB 15266/0029-0001 20200113; UK PLGB 15266/0030-0001 20200113; UK PLGB 15266/0031-0001 20200113 |

| 2523731 | 2090024-7 | Sweden | ⤷ Get Started Free | PRODUCT NAME: OSILODROSTAT OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF, INCLUDING OSILODROSTAT DIHYDROGEN PHOSPHATE; REG. NO/DATE: EU/1/19/1407 20200113 |

| 2523731 | 2020/020 | Ireland | ⤷ Get Started Free | PRODUCT NAME: OSILODROSTAT OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF, INCLUDING OSILODROSTAT DIHYDROGEN PHOSPHATE.; REGISTRATION NO/DATE: EU/1/19/1407 20200113 |

| 2523731 | 122020000026 | Germany | ⤷ Get Started Free | PRODUCT NAME: OSILODROSTAT ODER EIN PHARMAZEUTISCH AKZEPTABLES SALZ DAVON, EINSCHLIESSLICH OSILODROSTATDIHYDROGENPHOSPHAT; REGISTRATION NO/DATE: EU/1/19/1407 20200109 |

| 2523731 | C202030030 | Spain | ⤷ Get Started Free | PRODUCT NAME: OSILODROSTAT O UNA SAL FARMACEUTICAMENTE ACEPTABLE DEL MISMO, INCLUIDO EL OSILODROSTAT DIHIDROGENO FOSFATO.; NATIONAL AUTHORISATION NUMBER: EU/1/19/1407; DATE OF AUTHORISATION: 20200109; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/19/1407; DATE OF FIRST AUTHORISATION IN EEA: 20200109 |

| 2523731 | 301043 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: OSILODROSTAT, DESGEWENST IN DE VORM VAN EEN FARMACEUTISCH AANVAARDBAAR ZOUT, MET INBEGRIP VAN OSILODROSTATDIWATERSTOFFOSFAAT; REGISTRATION NO/DATE: EU/1/19/1407 20200113 |

| 2523731 | 2020012 | Norway | ⤷ Get Started Free | PRODUCT NAME: OSILODROSTAT ELLER ET FARMASOEYTISK AKSEPTABELT SALT DERAV, INKLUDERT OSILODROSTAT DIHYDROGENFOSFAT; REG. NO/DATE: EU/1/19/1407 20200203 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for ISTURISA (Rivastigmine Transdermal System)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.