Last updated: July 28, 2025

Introduction and Background

Istalol (timolol maleate ophthalmic solution 0.25%) is a non-selective beta-adrenergic antagonist primarily prescribed for the management of elevated intraocular pressure (IOP) in patients with ocular hypertension or open-angle glaucoma. Developed by Bausch + Lomb, Istalol has established itself within the niche of topical glaucoma therapies, where it faces competition from multiple branded and generic formulations.

The global ophthalmic drugs market, valued at approximately USD 15.2 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 4.7% through 2030, driven by increasing prevalence of glaucoma, aging populations, and technological advancements in drug delivery systems. Given its longstanding approval and clinical acceptance, Istalol holds a significant share within the topical beta-blocker segment.

Market Dynamics

1. Prevalence and Demand Drivers

Globally, glaucoma affects over 76 million individuals, with age being a significant risk factor. The World Health Organization estimates that glaucoma is the second leading cause of blindness worldwide. The increasing aging demographic, especially in developed regions like North America and Europe, substantially augments demand for effective intraocular pressure-lowering agents.

The rise in ocular hypertension cases, often asymptomatic but treated prophylactically, further expands the market for Istalol. Moreover, the trend toward early intervention to prevent optic nerve damage is likely to sustain demand.

2. Competitive Landscape

The ophthalmic beta-blocker segment includes various branded products like Timoptic (Allergan/Baush + Lomb), Betimol, and generic timolol preparations. Recent market entries include combination therapies (e.g., Timolol with brimonidine), which influence dynamics. The generic erosion of branded products tends to pressure prices downward, impacting revenue potential for proprietary formulations like Istalol.

In addition, innovations in sustained-release drug devices and minimally invasive surgical procedures influence market share. However, topical agents like Istalol remain the first-line therapeutic choice due to their proven efficacy and minimal invasiveness.

3. Regulatory and Patent Landscape

While patents on initial formulations have expired in several jurisdictions, Bausch + Lomb retains some exclusivity through formulations or delivery mechanisms. Regulatory pathways for generics are well-established, facilitating market entry and price erosion.

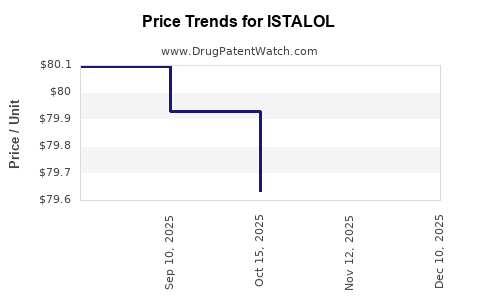

Pricing Trends and Historical Data

Historically, the cost of ophthalmic timolol solutions has declined substantially since patent expiration. In the United States, the average retail price of branded Timoptic (0.25%) was approximately USD 150–200 per bottle in early 2010s. Generics entered the market around 2014, reducing prices to USD 20–50 per bottle, reflecting a typical 75–85% price decrease post-generic entry.

Istalol, as a branded formulation, has traditionally commanded higher prices than generics, but recent data indicates a trend toward price alignment with unbranded versions, primarily due to increased availability of generics and insurance dynamics.

Current Price Estimates:

- United States: Retail prices for Istalol (0.25%) are approximately USD 70–100 per 10 mL bottle, depending on pharmacy and insurance coverage.

- Europe: Similar formulations are priced around EUR 30–50 per 5 mL, reflecting regional pricing policies and reimbursement systems.

- Emerging Markets: Prices are generally lower, ranging from USD 10–30, driven by cost-sensitive healthcare systems.

Market Potential and Price Projections

1. Short to Mid-Term Outlook (2023–2028)

The near-term market for Istalol will be shaped primarily by:

- Patent and formulary status: While Bausch + Lomb’s proprietary rights diminish, brand loyalty and physician prescribing patterns sustain the product’s relevance.

- Generic Competition: Increasing availability of generic timolol products exerts downward pressure on pricing.

- Insurance Coverage & Reimbursement Policies: Favorable coverage mitigates price erosion for branded formulations, preserving profitability.

Given these factors, we project the retail price of Istalol in mature markets to stabilize or decline modestly, with a compound annual decrease of approximately 2–3%. Prices could range from USD 60–90 per bottle in the U.S., considering inflation, while Europe remains similar adjusted for local healthcare policies.

2. Long-Term Forecast (2028–2033)

Over the longer term, several variables influence price trajectory:

- Market Saturation & Maturity: As the ophthalmic beta-blocker segment reaches saturation, price competition intensifies.

- Emergence of New Therapies: Novel agents with improved efficacy or delivery mechanisms (e.g., sustained-release implants) may diminish demand.

- Generic Dominance: Continued proliferation of generics will exert significant downward pressure, potentially reducing prices by 50–70% from current levels.

Projected long-term price range: USD 20–50 per bottle in established markets, with regions like Asia and Latin America experiencing lower prices.

3. Impact of Technological and Formulation Innovations

Innovations such as preservative-free formulations, sustained-release systems, or combination drops can add value and allow premium pricing. If Istalol advances into such formulations, there is potential for increased prices; otherwise, commoditization will dominate.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Opportunity exists in developing innovative formulations or combination therapies to command higher prices.

- Healthcare Providers: Emphasis on cost-effective generics to improve patient adherence.

- Payers & Insurers: Price negotiations and formulary placements significantly influence market dynamics.

- Investors: Conservative valuation of Istalol’s future revenues is warranted, considering high generic competition.

Key Takeaways

- Market Share and Demand: The global glaucoma market's growth sustains steady demand for products like Istalol, but competition from generics constrains pricing.

- Pricing Trends: Historically high branded prices have declined sharply post-generic entry; current prices are stabilized but vulnerable to further erosion.

- Price Projections: In the next five years, retail prices for Istalol are expected to decline modestly, trending toward USD 50–90 per bottle in mature markets, with long-term prices potentially falling below USD 50.

- Growth Opportunities: Innovation in drug delivery and combination therapies could enable premium pricing; however, commoditization remains the dominant trend.

- Market Risks: Patent expiration, regulatory shifts, and emerging therapies threaten price stability and market share.

FAQs

1. What is the primary therapeutic use of Istalol?

Istalol is used to lower intraocular pressure in patients with ocular hypertension or open-angle glaucoma, reducing the risk of optic nerve damage and vision loss.

2. How has the price of Istalol changed over recent years?

Post-generic entry, the price has decreased significantly, dropping from over USD 150–200 per bottle to roughly USD 70–100 in the U.S., with further declines anticipated as generics become more prevalent.

3. What factors influence future pricing of Istalol?

Generic competition, technological innovations, reimbursement policies, and market saturation will predominantly influence future prices.

4. Are there any premium formulations of timolol that could command higher prices?

Potentially, yes. If Istalol develops preservative-free, sustained-release, or combination products, they could justify higher pricing through added value.

5. How does the global ophthalmic market environment impact Istalol’s pricing?

Growing demand driven by aging populations and increasing glaucoma prevalence supports market volume; however, fierce price competition and the proliferation of generics suppress profit margins.

References

- Grand View Research. (2023). Ophthalmic Drugs Market Size, Share & Trends Analysis Report.

- WHO. (2017). Global Data on Visual Impairments and Blindness.

- MarketWatch. (2022). Ophthalmic Drugs Pricing Trends and Market Dynamics.

- Bausch + Lomb. (2021). Product Information and Prescribing Data.

- IQVIA. (2022). Global Pharmaceutical Pricing and Reimbursement Reports.