INGREZZA Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Ingrezza, and when can generic versions of Ingrezza launch?

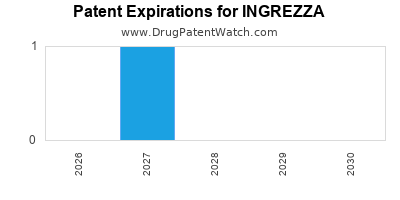

Ingrezza is a drug marketed by Neurocrine and is included in two NDAs. There are twenty-two patents protecting this drug and two Paragraph IV challenges.

This drug has two hundred and seventy-two patent family members in thirty-six countries.

The generic ingredient in INGREZZA is valbenazine tosylate. One supplier is listed for this compound. Additional details are available on the valbenazine tosylate profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Ingrezza

A generic version of INGREZZA was approved as valbenazine tosylate by LUPIN LTD on April 5th, 2024.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for INGREZZA?

- What are the global sales for INGREZZA?

- What is Average Wholesale Price for INGREZZA?

Summary for INGREZZA

| International Patents: | 272 |

| US Patents: | 22 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 50 |

| Clinical Trials: | 7 |

| Patent Applications: | 297 |

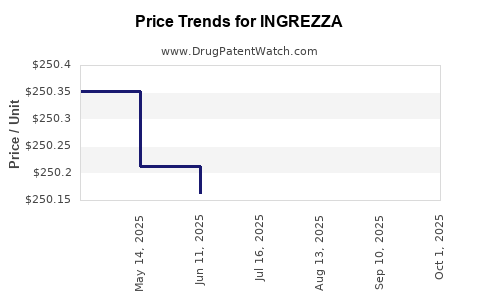

| Drug Prices: | Drug price information for INGREZZA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for INGREZZA |

| What excipients (inactive ingredients) are in INGREZZA? | INGREZZA excipients list |

| DailyMed Link: | INGREZZA at DailyMed |

Recent Clinical Trials for INGREZZA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Stephen Ruedrich | Phase 4 |

| Neurocrine Biosciences | Phase 4 |

| Michael Bloch | Phase 2 |

Pharmacology for INGREZZA

| Drug Class | Vesicular Monoamine Transporter 2 Inhibitor |

| Mechanism of Action | Vesicular Monoamine Transporter 2 Inhibitors |

Paragraph IV (Patent) Challenges for INGREZZA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| INGREZZA | Capsules | valbenazine tosylate | 60 mg | 209241 | 1 | 2022-02-14 |

| INGREZZA | Capsules | valbenazine tosylate | 40 mg and 80 mg | 209241 | 4 | 2021-04-12 |

US Patents and Regulatory Information for INGREZZA

INGREZZA is protected by thirty-three US patents and two FDA Regulatory Exclusivities.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Neurocrine | INGREZZA | valbenazine tosylate | CAPSULE;ORAL | 209241-002 | Oct 4, 2017 | AB | RX | Yes | Yes | 8,357,697 | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Neurocrine | INGREZZA | valbenazine tosylate | CAPSULE;ORAL | 209241-002 | Oct 4, 2017 | AB | RX | Yes | Yes | 10,906,903 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| Neurocrine | INGREZZA | valbenazine tosylate | CAPSULE;ORAL | 209241-003 | Apr 23, 2021 | RX | Yes | No | 10,912,771 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Neurocrine | INGREZZA | valbenazine tosylate | CAPSULE;ORAL | 209241-001 | Apr 11, 2017 | AB | RX | Yes | No | 10,919,892 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| Neurocrine | INGREZZA SPRINKLE | valbenazine tosylate | CAPSULE;ORAL | 218390-002 | Apr 30, 2024 | RX | Yes | No | 10,857,137 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for INGREZZA

When does loss-of-exclusivity occur for INGREZZA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 2819

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 18335259

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2020005373

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 76000

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1372567

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0250561

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 84333

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 2090809

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 84333

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 84333

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 71873

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 3300

Patent: פורמולציית ולבנאזין במינון גבוה ותכשירים, שיטות וערכות קשורות להן (High dosage valbenazine formulation and compositions, methods, and kits related thereto)

Estimated Expiration: ⤷ Get Started Free

Patent: 1770

Patent: פורמולציית ולבנאזין במינון גבוה ותכשירים, שיטות וערכות קשורות להן (High dosage valbenazine formulation and compositions, methods, and kits related thereto)

Estimated Expiration: ⤷ Get Started Free

Patent: 9802

Patent: פורמולציית ולבנאזין במינון גבוה ותכשירים, שיטות וערכות קשורות להן (High dosage valbenazine formulation and compositions, methods, and kits related thereto)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 50006

Estimated Expiration: ⤷ Get Started Free

Patent: 20534305

Patent: 高投与量バルベナジン製剤ならびにそれに関連する組成物、方法およびキット

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 84333

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 20002841

Patent: FORMULACION DE VALBENAZINA DE ALTA DOSIS Y COMPOSICIONES, METODOS Y KITS RELACIONADOS CON LA MISMA. (HIGH DOSAGE VALBENAZINE FORMULATION AND COMPOSITIONS, METHODS, AND KITS RELATED THERETO.)

Estimated Expiration: ⤷ Get Started Free

Moldova, Republic of

Patent: 84333

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 175

Patent: FORMULATION DE VALBENAZINE À DOSAGE ÉLEVÉ ET COMPOSITIONS, PROCÉDÉS ET KITS ASSOCIÉS

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 84333

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 84333

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 02500305

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 714

Patent: FORMULACIJA VISOKE DOZE VALBENAZINA I SASTAVI, POSTUPCI I KOMPLETI POVEZANI SA NJIM (HIGH DOSAGE VALBENAZINE FORMULATION AND COMPOSITIONS, METHODS, AND KITS RELATED THERETO)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 84333

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 24958

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 75681

Estimated Expiration: ⤷ Get Started Free

Patent: 1919622

Patent: High dosage VALBENAZINE formulation and compositions, methods, and kits related thereto

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering INGREZZA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Jordan | P20200336 | ⤷ Get Started Free | |

| South Korea | 20200066661 | 특정 VMAT2 억제제의 투여 방법 | ⤷ Get Started Free |

| Spain | 2911351 | ⤷ Get Started Free | |

| Japan | 2022040408 | ⤷ Get Started Free | |

| Slovenia | 3394057 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for INGREZZA (Valbenazine)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.