Last updated: July 28, 2025

Introduction

Indapamide, a thiazide-like diuretic, has been a staple in hypertension and edema management since its approval, with manufacturing approved by leading regulatory authorities like the FDA (United States Food and Drug Administration) and EMA (European Medicines Agency). Its cost-effectiveness, favorable efficacy profile, and well-characterized safety make it crucial within antihypertensive therapy. Understanding the market dynamics and financial trajectory of Indapamide involves analyzing factors such as patent status, competition landscape, regulatory trends, and global demand.

Market Overview

Global Pharmaceutical Market for Antihypertensive Agents

The antihypertensive drugs market is projected to reach USD 32 billion by 2027, growing at a CAGR of roughly 2-4% [1]. The segment includes various classes: ACE inhibitors, ARBs, beta-blockers, calcium channel blockers, and diuretics like Indapamide. Diuretics historically represent one of the most affordable and widely prescribed classes, accounting for approximately 15% of antihypertensive prescriptions globally.

Position of Indapamide in the Market

Indapamide's popularity stems from its efficacy in reducing blood pressure and its favorable side effect profile—lower incidences of electrolyte imbalance compared to other diuretics. It is frequently included in combination therapies, amplifying its usage. Major pharmaceutical companies, such as Servier and other generic manufacturers, produce and distribute formulations worldwide.

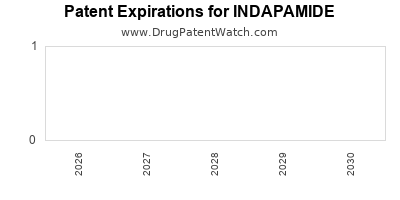

Patent and Regulatory Status

Indapamide's patent expired decades ago, transitioning into the generic market, which significantly impacts pricing and market competitiveness. As a result, the drug enjoys widespread availability, especially in high-growth emerging markets such as India, China, and Brazil, where the demand for affordable antihypertensive agents is climbing due to rising hypertension prevalence [2].

Market Drivers

Epidemiological Trends

Hypertension affects over 1.3 billion people globally, a figure expected to rise driven by aging populations and sedentary lifestyles. The WHO estimates that high blood pressure contributes significantly to cardiovascular morbidity and mortality [3]. As a first-line treatment, diuretics like Indapamide are critical, especially in low- and middle-income countries where affordability influences prescribing patterns.

Cost-Effectiveness

Indapamide's low cost—particularly as a generic—positions it as an attractive option for health systems with constrained budgets. Its efficacy substantiates its continued recommendation in guidelines such as the JNC 8 and ESC/ESH hypertension guidelines [4][5].

Combination Therapy Integration

Combination formulations (e.g., Indapamide with ACE inhibitors or calcium channel blockers) enhance adherence by simplifying regimens. Marketed fixed-dose combinations have proven successful, further bolstering demand.

Regulatory Environment

Regulatory approvals and inclusion in clinical guidelines bolster its market position. The drug’s longstanding positive safety profile simplifies regulatory pathways, encouraging generic manufacturing.

Market Barriers and Challenges

Emerging Competition

Newer agents such as ARNIs and vasodilators, along with advancements in personalized medicine, influence prescribing behaviors. Additionally, the rise of brand-name combination therapies may marginalize traditional monotherapies [6].

Brand Loyalty and Physician Preferences

Despite affordability, physician prescribing trends tend to favor newer drugs with perceived superior efficacy or fewer side effects, potentially impacting market share.

Supply Chain Disruptions

Global manufacturing reliance and raw material shortages can threaten consistent availability, especially in resource-limited settings.

Regulatory and Policy Changes

Pricing reforms, patent law evolutions, and healthcare reimbursement policies influence market accessibility and profitability.

Financial Trajectory Analysis

Historical Revenue Trends

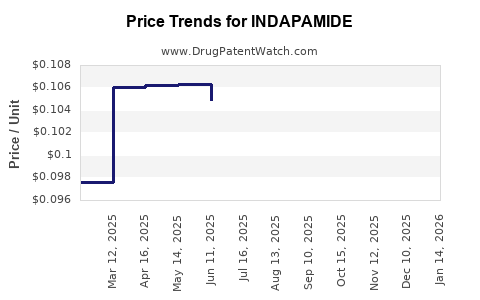

While specific revenue figures for Indapamide are scarce due to the prevalence of generics, global antihypertensive diuretics category revenue has remained resilient, driven by sustained demand across markets. Large pharma companies report important contributions from generic sales, with revenues stabilized through high-volume sales rather than premium pricing.

Forecasted Growth and Revenue

The global antihypertensive drug market is projected to grow modestly at 2-4% annually. Given Indapamide's role as a cost-effective monotherapy and partner in fixed-dose combinations, its share is expected to remain stable or slightly increase, especially in underserved markets. The growth in hypertension prevalence and increased healthcare access supports this trajectory.

- Emerging markets present substantial upside potential, with increasing adoption of affordable generic diuretics.

- Developed markets may see stagnation owing to saturation and competition from newer agents but will still contribute through prescriptions in combination therapies.

Potential for Revenue Expansion

Key avenues for revenue growth include:

- First-line treatment recommendations in updated guidelines.

- Expansion of authorized generic formulations.

- Strategic partnerships to develop proprietary combination products.

- Penetration in growing markets with expanding healthcare access.

Impact of Patent and Regulatory Dynamics

Given the expired patent status, profitability hinges on manufacturing efficiencies, branding strategies, and market penetration. Regulatory hurdles for new formulations could influence revenue streams but are unlikely to significantly alter the generic market landscape.

Future Outlook and Strategic Implications

Although the pharmaceutical market for Indapamide is characterized by mature, low-margin generics, strategic considerations include:

- Enhancing manufacturing efficiencies to sustain low-cost offerings.

- Leveraging regional distribution networks to capture emerging markets.

- Formulating fixed-dose combinations to broaden therapeutic utility.

- Collaborating with health authorities to include Indapamide in essential medicines lists, boosting demand.

Forecasts indicate a steady, resilient financial trajectory driven by global hypertension trends, cost-effective prescriptions, and expanding access in developing economies. However, innovation in hypertension therapy and evolving regulatory environments may influence long-term market dynamics.

Key Takeaways

-

Stable Role in the Market: Indapamide remains a cornerstone in antihypertensive therapy due to its efficacy, safety, and affordability, particularly in emerging markets.

-

Generics and Competition: Patent expiration has led to a highly competitive landscape with low-priced generics, limiting profit margins but ensuring widespread availability.

-

Market Growth Drivers: Rising global hypertension prevalence and health system preferences for cost-effective medications underpin steady demand.

-

Challenges Ahead: Increasing use of newer therapeutic agents, evolving regulatory policies, and supply chain vulnerabilities could impact revenue stability.

-

Strategic Focus: Manufacturers should prioritize formulary inclusion, develop fixed-dose combinations, and expand market reach to capitalize on growth opportunities.

FAQs

1. How does the patent expiration of Indapamide affect its market?

Patent expiration has transitioned Indapamide into the generic market, leading to increased competition and significantly lower prices. This promotes widespread accessibility but constrains profit margins for manufacturers.

2. What are the key advantages of Indapamide over other diuretics?

Indapamide offers comparable efficacy with fewer electrolyte imbalances, better tolerability, and cost advantages over older thiazide diuretics like hydrochlorothiazide.

3. Which markets offer the highest growth potential for Indapamide?

Emerging markets in Asia, Africa, and Latin America show significant growth potential due to increasing hypertension prevalence and demand for affordable therapies.

4. Are there any upcoming formulations or innovations involving Indapamide?

Currently, most innovations focus on fixed-dose combination products that include Indapamide. Patent activity for new formulations remains limited, given the drug’s generic status.

5. How might regulatory changes impact the future profitability of Indapamide?

Healthcare reforms favoring cost-effective treatments could enhance demand, while policies aimed at controlling drug prices or promoting newer therapies may exert downward pressure on revenues.

Sources:

[1] MarketResearch.com, "Global Antihypertensive Drugs Market Forecast," 2022.

[2] WHO, "Global Hypertension Prevalence and Impact," 2021.

[3] JNC 8 Guidelines, 2014.

[4] European Society of Cardiology (ESC) Guidelines, 2018.

[5] Deloitte, "Pharmaceutical Industry Outlook," 2022.