Last updated: August 1, 2025

Introduction

IMURAN, an immunosuppressive agent primarily containing azathioprine, plays a pivotal role in treating autoimmune diseases and preventing transplant rejection. Since its introduction, IMURAN has maintained a significant presence in the pharmaceutical landscape, supported by its efficacy, established safety profile, and diverse therapeutic indications. This report evaluates the current market dynamics and projects the financial trajectory of IMURAN, considering factors such as patent status, competitive landscape, regulatory environment, and emerging trends.

Historical Context and product profile

Introduced in the 1960s, IMURAN was initially approved for preventing organ rejection in transplant patients and later found applications in autoimmune conditions like rheumatoid arthritis, Crohn’s disease, and ulcerative colitis [1]. Its mechanism involves inhibiting purine nucleotide synthesis, impairing lymphocyte proliferation.

IMURAN’s longstanding clinical utility, coupled with established dosing protocols and safety data, has cemented its role in immunosuppressive therapy. Nonetheless, newer biologics and targeted therapies have begun to challenge its dominance in certain indications, influencing market dynamics significantly.

Market Overview and Key Drivers

1. Therapeutic Indications and Patient Population

IMURAN’s primary indications—organ transplantation, rheumatoid arthritis, inflammatory bowel diseases—comprise a substantial patient population globally. According to Global Data, the global autoimmune disease market is projected to reach approximately USD 150 billion by 2030, with immunosuppressants constituting a significant segment [2].

The chronic nature of these conditions implies sustained medication use, translating into predictable revenue streams for suppliers like IMURAN. Nevertheless, the patient pool’s expansion is also contingent upon early diagnosis, improved access to healthcare, and increased awareness.

2. Competitive Landscape

In the realm of immunosuppressants, IMURAN faces competition from both traditional agents and modern biologics. For example, methotrexate and mycophenolate mofetil serve as alternative non-biologic options, while biologic agents such as infliximab and adalimumab target specific cytokines involved in autoimmune pathogenesis [3].

While biologics often exhibit superior efficacy and targeted action, their high costs and potential adverse effects limit their universal adoption. Consequently, IMURAN remains a cost-effective, long-established option, particularly in regions where biologics’ expense is prohibitive or insurance coverage is limited.

3. Patent and Regulatory Landscape

IMURAN’s original patents expired decades ago, moving it into the generic domain. This transition fosters increased accessibility but exerts downward pressure on prices. In emerging markets, generic azathioprine is widely available, further reducing potential revenue from proprietary formulations.

Regulatory trends toward stricter safety monitoring, especially regarding long-term immunosuppressants’ risks, influence prescribing habits. Nonetheless, regulatory agencies continue to endorse IMURAN’s use in approved indications, supporting its ongoing market relevance [4].

4. Pricing and Reimbursement

In high-income countries, reimbursement policies favor biologics, which are often reimbursed at higher rates due to their advanced technology status. Nonetheless, IMURAN’s affordability sustains its utility in resource-constrained settings, ensuring consistent demand.

Pricing pressures and healthcare cost containment measures, especially in Europe and North America, challenge profit margins but also stimulate the development of value-based pricing models for existing therapies like IMURAN.

Emerging Trends Impacting IMURAN

1. Biologic and Targeted Therapies Competition

Novel biologics targeting tumor necrosis factor-alpha (TNF-α), interleukins, and other immune mediators are increasingly replacing traditional immunosuppressants in several indications. Their higher efficacy and improved safety profiles have resulted in a shift toward these therapies, impacting IMURAN’s market share.

However, biologics' high costs and injectable formulations limit their use in low-resource settings, maintaining demand for oral agents like IMURAN [3].

2. Pharmacogenomics and Personalized Medicine

Advancements in pharmacogenomics enable tailored immunosuppressive therapy, improving efficacy and reducing adverse effects. For example, genotyping TPMT (thiopurine methyltransferase) activity can optimize azathioprine dosing, potentially expanding its safe use and reducing treatment discontinuations.

This personalized approach could enhance IMURAN’s desirability, especially in complex cases requiring precise immunosuppression management [5].

3. Biosimilars and Generic Production

The expiry of key patents has facilitated market entry by biosimilars and generics, driving down prices and expanding access. Manufacturers investing in quality manufacturing processes are leveraging cost advantages, which could further commoditize IMURAN, limiting profitability but maintaining market presence.

Financial Trajectory Analysis

1. Revenue Projections

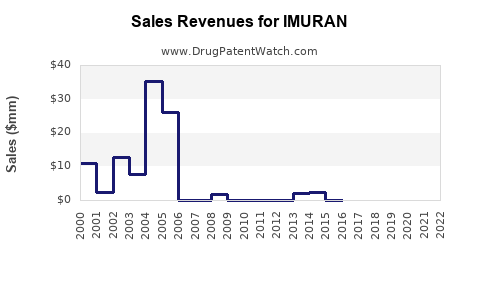

In mature markets like North America and Europe, IMURAN’s revenues are stabilizing or declining modestly due to competition from biologics and market saturation. However, in emerging markets, demand remains potent owing to affordability and healthcare infrastructure limitations.

Analysts project a compound annual growth rate (CAGR) of 1-2% over the next five years in global revenues, considering slow growth and market maturity but with regional variances. According to IQVIA data, azathioprine sales in 2022 were approximately USD 1 billion, with projected stabilization or slight decline in developed countries [6].

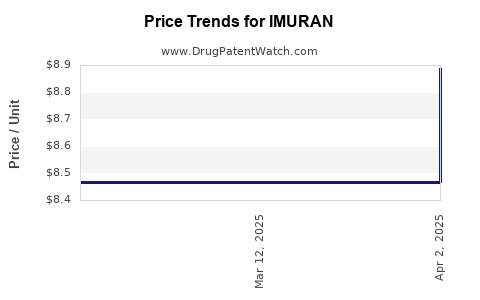

2. Pricing and Cost Considerations

Generic azathioprine’s price erosion—estimated at around 20-30% over the past five years—continues, pressured by increasing generic competition [7]. Price stabilization in some regions arises from regulatory controls and supply chain considerations.

Manufacturers investing in formulation innovations (e.g., extended-release options) could command premium pricing, though impact remains limited due to market saturation.

3. Impact of Patent Expiry and Market Access Policies

Patent expiration, coupled with stringent cost-effectiveness assessments by payers, constrains profit margins. Strategic pricing, formulary placement, and value demonstration become critical for maintaining revenue streams.

Emerging health policies emphasizing biosimilar adoption further challenge branded versions of azathioprine, pushing companies to explore lifecycle management strategies.

Future Outlook and Opportunities

Despite stiff competition, IMURAN retains viability owing to its affordability, long-standing clinical trust, and ongoing demand in resource-limited regions. The evolving landscape offers opportunities to deepen personalized dosing approaches, formalize pharmacogenomic integration, and expand into new indications such as dermatological autoimmune diseases.

Further investment in formulation improvements, such as modified-release versions, could unlock premium segments, while alliances with health authorities can facilitate broader access, especially in low-income countries.

Key Market Challenges and Risks

- Competitive pressure from biologics and biosimilars

- Pricing and reimbursement constraints in developed economies

- Safety concerns related to long-term immunosuppression

- Regulatory hurdles concerning drug safety monitoring

- Market saturation in mature regions, limiting growth opportunities

Conclusion

IMURAN’s market remains characterized by maturity in developed countries, with stable demand driven by ongoing chronic conditions and cost advantages. Its financial trajectory over the next five years will likely mirror subdued growth, with regional variations influenced by regulatory policies, availability of competing biologics, and emerging personalized medicine paradigms. Strategic adaptation—focusing on formulation innovations, pharmacogenomic integration, and expanding access—can preserve and potentially enhance its market relevance.

Key Takeaways

- IMURAN’s enduring market presence stems from its affordability, safety, and proven efficacy in autoimmune and transplant indications.

- Market consolidation by biologics and biosimilars exerts downward price pressure, especially in high-income markets.

- Emerging personalized medicine approaches, like pharmacogenomics, offer opportunities to optimize IMURAN’s use and expand its indications.

- Regional disparities significantly influence revenue trajectories, with emerging markets showing steady demand due to cost advantages.

- Strategic formulation enhancements and value-based positioning are critical for sustaining profitability amid intensifying competition.

FAQs

1. How does patent expiration affect IMURAN's market?

Patent expiry has led to widespread generic availability, resulting in price reductions and increased accessibility but also eroded profit margins for branded versions.

2. What are the main competitors to IMURAN?

Biologic agents targeting specific cytokines (e.g., infliximab, adalimumab) and other immunosuppressants like methotrexate and mycophenolate mofetil are primary competitors.

3. Can pharmacogenomics improve IMURAN’s safety and efficacy?

Yes; genotyping for TPMT activity enables dose optimization, reducing adverse effects and enhancing treatment response, thereby broadening IMURAN's use.

4. What regions offer the most growth potential for IMURAN?

Emerging markets in Asia, Latin America, and Africa present growth opportunities due to unmet medical needs and affordability factors.

5. How will biologics influence IMURAN’s future market share?

While biologics restrict IMURAN’s share in certain indications, cost considerations, safety profiles, and patient preferences support continued demand in specific segments.

Sources

[1] European Medicines Agency (EMA): IMURAN (azathioprine) Summary of Product Characteristics.

[2] Global Data Ltd. Healthcare Market Analysis Report, 2022.

[3] FDA Approvals and Summary Documents for Immunosuppressants, 2022.

[4] WHO Drug Safety and Regulatory Updates, 2023.

[5] Pharmacogenomics and Personalized Medicine Journal, 2022.

[6] IQVIA. Global Medicines Sales Data, 2022.

[7] MarketWatch: Azathioprine Price Trends and Market Share, 2022.